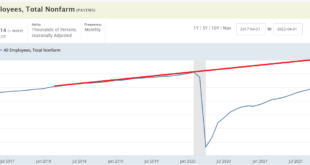

Employment generates income and spending. The gap vs the pre-covid path is closing at an ever slowing rate. And the cost of living is rising faster than wages, which exacts a toll as well. These are inflation-adjusted: This came out last week:

Read More »We Will Get It Planted

In Texas a large portion of Plant ’22 has already happened. Central Texas corn emergence is already knee high, green, and waiting for the rains to continue this week. Other parts of the country have struggled to get seed in the ground either due to low soil temps, too much precipitation or no rain to speak of. This past week or so as rains and storms, some wreaking tornado havoc, have doused the land in various agriculturally important regions....

Read More »Thinking Caps On – Grab a Coffee – Sales/Trading Commentary

From: JJ LANDOAt: May 14 2013 07:41:14 Consider the following thought experiment. These are the scenarios:A. The Treasury decides that it will fund itself 30% more in Overnight Bills and reduce issuance across the curve.B. The Fed announces it will increase QE by 30% (it will remit the net income of this activity back to the Treasury like taxes)C. Congress announces a new tax on all passive income from USTs, to holders both at home and abroad (ie Central Banks), for all...

Read More »We May Be on The Precipice of a Dust Bowl

We May Be on The Precipe of a Dust Bowl La Niña is showing her brutality as places that need to plant soon are snowed in and the places that have planted are dry, dry, dry, with the exception of the Mississippi floodplain. Here in central Texas, we are hit and miss with the official precip totals a little less than average, but we are not even at seven inches of measurable precipitation so far this year on my farm, which is less than an hour west...

Read More »Poultry Epidemic Causing Pandemic Prices

The avian influenza does not seem to be letting up with multiple states reporting cases, including Texas. Here is the current map of reported cases. The USDA and USGS have been doing a good job of tracking and confirming cases through APHIS, and the surprising news that has all of us in the poultry business worried is that this is a highly pathogenic virus that is transmitted through wild birds and domestic alike. Sparrows, crows, cardinals and...

Read More »1st Quarter 2022 Planted Report, a Strange Turn and More of the Same

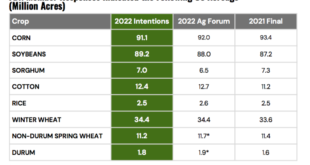

As we rounded out the month of March the USDA has been busy assessing the planted acres around the United States, reported the 31st of March. Much to my prior post, there are not really any surprises as the data has indicated that the planting is mirroring last year…with a few caveats, most namely the switch of 4% moving to soy from corn. Let’s take a look at the estimates from the FBN group and their phone survey they conducted a week or so ago...

Read More »Conventional Macroeconomics Rears Its Head

Conventional Macroeconomics Rears Its Head It is always annoying to have to admit one has been wrong. But I was among those who a year ago or so was going along with those who argued inflation was transitory and the rate would probably come down later in the year. The annoying Larry Summers, along with the somewhat less annoying Olivier Blanchard, prominently argued the contrary, hauling out old-fashioned conventional macroeconomic arguments...

Read More »Inflation, politics, and policy

Between the Russian invasion of Ukraine and COVID outbreaks in China, it certainly seems likely that supply shortfalls and upward pressure on prices will continue. This raises difficult questions about politics and economic policy. On the political side of the ledger, I think that President Biden’s strategy should be predicated on continued inflation; if inflation subsides people will be happy and he will benefit politically no matter what he...

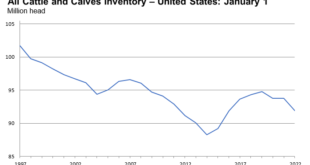

Read More »First Quarter ’22 Cattle & Ranch Report

Green grass is growing finally down south as some rainfalls are being received east of the Colorado River, not that Colorado River, the other one that moves through Austin, and has very little to do with it’s namesake. Grass growing in the spring brings on the grazing and let’s the ranchers get off the expensive feed. Now is also the time to sow sorghum for the herds to clear in the next few months. Net, net it’s still an expensive business to be...

Read More »Some thoughts on inflation and what not to do about it

I have written extensively over the years on inflation and some of that is here in the blog (see this or this, or this more recently on Volcker the inflation dragon slayer, if you believe in fairy tales; there's way more if you search the blog; I also highly recommend this paper by Perry and Cline in ROKE, which is open, btw). My more recent piece on inflation came out recently in Catalyst, just before the war in Ukraine (on the war see this by Palley, and this old piece by Gary Leupp after...

Read More » Heterodox

Heterodox