This is a long one and a C&P. Other than putting it up at Angry Bear, I can not take credit for this one. What I can say is . . . they are not the first ones to accuse Supply Chain for much of the inflationary issues we have had as a nation. In 2008, automotive cut production and did not maintain orders with the supply base. When it started back up, we were chasing semiconductors, etc. Lead-times doubled. We have just gone through similar....

Read More »Inflation is decelerating substantially towards the Fed target ADDENDUM: the huge impact of shelter

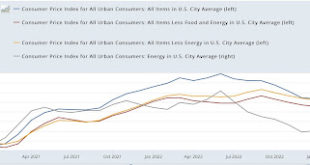

Measured by actual rather than fictitious prices, inflation is decelerating substantially towards the Fed target ADDENDUM: the huge impact of shelter – by New Deal democrat For the last year, consumer prices have mainly been about two things: (1) the huge rise, and then fall, in gas prices; and (2) the phantom menace of owner’s equivalent rent (OER) dragging shelter prices higher, even as actual house prices peaked, and new rental...

Read More »Price and Prejudice

Working paper on the Post Keynesian Economics Society website. From the abstract: The current debate on the causes of inflation is dominated by a particular view of what caused the inflationary acceleration in the 1970s, the so-called Great Inflation. In this view inflation is always and everywhere a demand phenomenon and requires contractionary monetary policy to be kept under control. The alternative view put forward by many heterodox authors emphasize what might be termed the...

Read More »How “FHFA-CPI” using house prices rather than OER shows a sharp deceleration in inflation

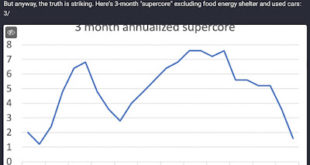

How “FHFA-CPI” using house prices rather than OER shows a sharp deceleration in inflation – by New Deal democrat Paul Krugman made another foray into the “inflation is mostly gone” genre over the weekend with a thread on Mastodon that largely relied on the following graph: concluding that “[A]t this point the burden of proof lies on anyone claiming that we had more than a, well, transitory inflation spike that’s mostly behind us.” I’m...

Read More »Understanding Inflation using Gasoline Prices

Seems that gas, fuel, gasoline is being used as a marker to understand just how horrible we have it as a result of the current inflation. It’s just sooooooooooo terrible. I’ll just say this. As a marker of inflation and our personal economic experience all it shows is how terrible we are at remembering. Unfortunately for us, such a bad memory leads us to terrible voting decisions. Though, it does allow for easy emotional manipulation of the citizenry...

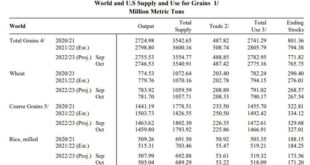

Read More »The WASDE Is Out, May the Kernels Fall Where They Will

USDA has now dropped the World Agricultural Supply and Demand Estimates in the much awaited October reporting. In a simple one liner, here is the gist of it – lower soy and corn yields this year (drought and lack of fertilizer – we saw this one coming), but wheat supply down, but higher than last year. Wheat is essentially a weed and has conditional consideration mostly to weather and also if the crop was planted, looks like we’re ok here. Here...

Read More »I am an extreme Inflation dove and complain that heads they win tails I lose

The point of this post is that I see an odd consensus about the conclusion based on opposite assumptions. The conclusion is the standard conclusion that US inflation is currently definitely too high and that it is necessary to reduce it even at the risk of a recession. First the US public considers current US inflation to be a very bad problem. It is easy to see why. Normal people use “inflation” to mean price inflation and assume given...

Read More »We Really Need to Talk Fertilizer

Six billion. I have written and rewritten the first line of this over and over and over again. Six billion. That is the amount of current US dollars American farmers have to come up with this year as fertilizer prices hit highs not seen since 2008, on top of higher prices last year. The difference is that in 2008 we had a financial meltdown, a run on energy markets, and global calamity. This year, we have supply crunches due to war, restrictions,...

Read More »Thinking about Inflation: A conversation with Marc Lavoie

[embedded content]The conversation on inflation with Marc Lavoie at the Fields Institute in Toronto. I think that there was an agreement, between us, and most people in the room that the oligopolistic view of inflation does not hold water. I tried to discuss the Argentinean case on the basis of a piece that I co-wrote with Fabián Amico and Franklin Serrano, published in the local version of Le Monde Diplomatique online. A longer version, also in Spanish, here. An English version is in the...

Read More »Lance Taylor (1940-2022) and his legacy

With Lance in Beijing (2001)I took Lance’s macro class in the Fall of 1995 at the New School for Social Research (NSSR), and then was his Teaching Assistant for two years. The book we formally used was Income Distribution, Inflation and Growth: Lectures on Structuralist Macroeconomic Theory, in which the terms (not the concepts) for wage-led and profit-led economies were first used (at least that's what I think; profit-led does not appear in the index, I must note). But classes were based on...

Read More » Heterodox

Heterodox