Financial advisory fees are a huge controversy at present. After all, there is significant evidence that paying higher fees for asset management services is detrimental to your portfolio. And while the average fee for portfolio managers has fallen significantly the average financial advisory fee remains pretty much where it has been for the last decade at 1%. What explains this and will it persist? When I started in the world of financial services we were mostly commission based. You...

Read More »Having a Printing Press Doesn’t Mean Money is Infinite

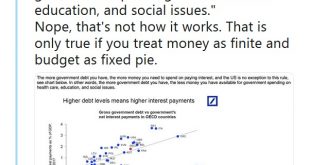

Deutsche Bank put out an imprecise piece of research saying that higher debt levels mean higher government interest payments. This isn’t really true because the government can technically set its interest rates at whatever it wants. For instance, there was nothing stopping the Fed from keeping rates at 0% forever.¹ What DB was really implying was that there is a direct connection between debt and inflation (which interest rates are primarily a function of). But this is not really a good...

Read More »Was the GFC a Once-in-a-Lifetime Event?

Someone emailed me with a very good question yesterday: “Did we really go through a once-in-a-lifetime Great Recession in 2008, or is the global economy overleveraged to an even greater extent, just in different ways?” My basic view of the Great Financial Crisis is that is was not unique in that it was a debt crisis, it was unique in that it was a debt crisis attached to such a significant household asset. Back in the old days we used to have regular panics or Depressions. The reason for...

Read More »Bringing Back the Pragcap Discussion Forum!

Due to high demand I am going to bring back the Pragmatic Capitalism discussion forum. Many of you know I’ve had problems with forums and comments sections in the past and I’ve tried to move commentary to Twitter mostly, but I have to be honest – Twitter has increasingly devolved into an anonymous argument spewing mess. While it has valuable features I feel like it’s hard to maintain a continuous and useful dialogue with people. So, let’s try this again. The new Asgaros Forum on WordPress...

Read More »Odd Lots Podcast – Talking MMT

I joined the great Joe Weisenthal and Tracy Alloway on Bloomberg’s Odd Lots Podcast to discuss MMT. We covered my journey learning MMT during the financial crisis, the good in MMT and why I’ve become more critical of it over the years. Overall I think it’s a really balanced and objective discussion. I hope you enjoy it.

Read More »Three Things I Think I Think – Yield Curves and Stuff

Here are some things I think I am thinking about: 1) Ahhhh, the yield curve inverted again! There have been lots of scary articles about how the yield curve is inverting and that that means recession because, well, yield curve inversions pretty much always lead recessions. I wrote about this a few years back and my conclusions were simple: An inverted curve usually leads by 18-24 months so you have quite a long time to be worried, or, um, not worry. According to the Cleveland Fed today’s...

Read More »An Open Letter to the US Sentate – Vote No on Stephen Moore

To The Senators of the United States of America: This letter will be a swift and thorough explanation for why voting NO on Stephen Moore should be one of the easiest decisions you have ever made. Mr. Moore is a well known TV pundit and political commentator. We should be clear – despite often being referred to as an “economist” Mr. Moore is not, in fact, a PhD holding economist. And his basic misunderstanding of economics has been on consistent display over the last 30+ years. His...

Read More »The Shortest (and Best) MMT Primer You’ll Ever Read

NB – About 10 years ago I wrote an MMT primer after first being introduced to the theory. I initially thought the theory was coherent and operationally sound, but it turns out that I was wrong. In fact, my primer wasn’t a complete primer because MMT is MUCH more complex than I initially thought (and also much more wrong than I initially thought). Over the course of those 10 years I still haven’t seen a succinct primer so there is still tons of confusion about the theory. In fact, almost...

Read More »Is Government Debt “Equity”?

I’ve noticed a trend in some economic circles that seems to stem from the Positive Money and MMT people – this idea that government “debt” is “equity”. While the taxonomy in mainstream macroeconomics can sometimes be messy I don’t think this is a case where we need to be trying to reinvent well established terms. Let me explain. First off, I understand the desire to create a more coherent taxonomy for terms that seem to have no meaning (for instance, the term “money” in mainstream macro),...

Read More »Reconciling Krugman vs Kelton

Warning – This is going to be another nerdy one. I apologize in advance. Paul Krugman and Stephanie Kelton are two very good economists. They’re also people I’ve had fights with over the years. Not physical fights. Make no mistake – I am a big wimp, but I could kick both of their asses at the same time with one arm tied behind my back. But as someone who leans somewhat towards Post-Keynesian economics and is critical of both MMT (Kelton’s camp) and New Keynesian economics (Krugman’s...

Read More » Heterodox

Heterodox