Share the post "Do Trump’s Taxes Matter?"The release of a 1995 Donald Trump tax return could become the turning point of the 2016 Presidential Election. But how much does this really matter? Let’s do some Q&A on the topic just for fun. I’ll pretend to be an unbiased observer and we’ll let an equally unbiased observer, say, Vladimir Putin, interview me. Here’s how it went:Vlad: Comrade Roche, thanks for joining me today (shakes my hand, nearly breaking it). I have some questions for...

Read More »Bull Markets are the Hardest Part

Share the post "Bull Markets are the Hardest Part"There are two difficult times to be an investor – when the market goes up and when it goes down.¹ We all know the difficulty of the bear market. It usually works something like this:We think markets will go up for some reason.Markets go down.Markets go down a lot more than we’re comfortable with.Soil shorts, reconsider how you’re allocating your assets and go change your pants.Well, not exactly like that, but probably not too far off. But the...

Read More »The Problem with Modern Banking

Share the post "The Problem with Modern Banking"When it comes to free markets and competition I am always more inclined to side with the idea that competition is a good thing that drives a more efficient outcome than bureaucratically managed markets. At the same time, we have to recognize that some degree of government is a good thing. There are, after all, many things that private competitive companies don’t want to engage in because they’re generally contradictory to a profit based...

Read More »21 Questions….

Share the post "21 Questions…."The good people over at Guru Focus did a nice Q&A covering 21 questions that you may or may not find interesting. It’s pretty short and painless so you won’t endure too much agony reading it if you choose to:How and why did you get started investing? What is your background?Like most people, I got into finance for a simple reason – it’s where the money is. Literally. But as I’ve gotten older I’ve realized that the fascinating part about investing isn’t so...

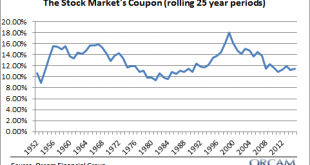

Read More »Why I Prefer to Think of Stocks as Bonds

Share the post "Why I Prefer to Think of Stocks as Bonds"Bonds have always struck me as fairly simple instruments. In general, you know what a (high quality) bond’s return will be and you know what its time horizon is. That makes investing in fixed income instruments much simpler than investing in stocks. After all, the most difficult part about the stock market is that you don’t know the future returns OR the time horizon. This uncertainty is what makes the stock market unnerving and...

Read More »Warren Buffett is (Actually) Losing His Hedge Fund Bet

Share the post "Warren Buffett is (Actually) Losing His Hedge Fund Bet"Back in 2008 Warren Buffett made a famous bet with a big hedge fund.¹ Buffett bet that the S&P 500 would outperform a fund of hedge funds over the next 10 year period. His basic thinking was that most investors are better off owning a low cost index fund rather than owning high cost stock picking funds. And so far, Buffett is winning the bet by a mile with a total return of 65.67% for the S&P 500 vs 21.87% for the...

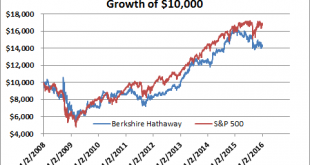

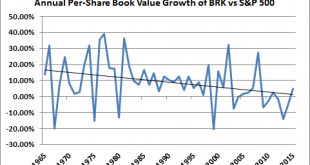

Read More »Make Berkshire Hathaway Great Again

Share the post "Make Berkshire Hathaway Great Again"Asset allocation is all about matching future expectations with your future needs. The problem with doing this is that our future needs are only loosely known and predicting the future of certain asset class returns is incredibly difficult. Still, there are some basic principles we can apply to this endeavor that increase our odds of success. For instance, we don’t really know what any single entity will return in the future, however, we...

Read More »A Cheat Sheet for Understanding Monetary Realism

Share the post "A Cheat Sheet for Understanding Monetary Realism"A few years back I started calling my economic views “Monetary Realism”. This was based on the popular paper I wrote called “Understanding the Modern Monetary System”. I wrote the paper to serve as an operating manual for the economy and when I recognized that many of its views were unique I realized that it was silly to align it with any specific “economic school” that might influence or unjustly bias the way people utilized...

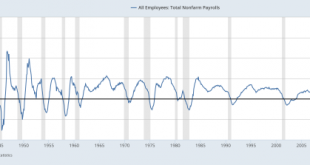

Read More »Three Things I Think I Think – Unrealistic Expectations Edition

Share the post "Three Things I Think I Think – Unrealistic Expectations Edition"Sorry to go AWOL over the last few days. Life got in the way. And yes, I have one of those life things despite claims that all I do is write and talk about economics and finance. Anyhow, here are some things I think I am thinking about:1 – Venture Capitalists are bad (not)! Here’s a piece in the WSJ about Marc Andreessen’s venture capital returns. Basically the article argues that the firm’s returns aren’t that...

Read More »Come to Stocktoberfest 2016

Share the post "Come to Stocktoberfest 2016"If you’re in the southern California area on the weekend of October 13-15 you should make your way down to one of the most beautiful parts of the world – Coronado for Stocktoberfest. Howard Lindzon and the StockTwits crew have arranged another great list of speakers and events for the weekend. I’ll be part of a panel on the passive investing myth on Friday the 14th speaking right after the awesome Mark Dow and Morgan Housel. I’ll be joined on the...

Read More » Heterodox

Heterodox