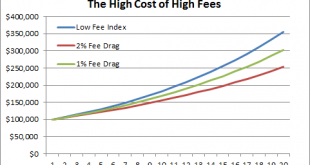

Here’s a clip from last night’s episode of Hard Knocks: Training Camp with America’s Worst Football Program.¹ In the clip Carl Nassib gives his teammates a lesson in investing: [embedded content] He gets a lot right here and a lot wrong. Let’s cover each point: 1) Nassib starts off exactly right by slamming high fee financial advisors who charge 1% or more. Yep, there are a billion financial advisors out there ready to charge you 1% per year. In my opinion, you should never ever pay 1% or...

Read More »Three Things I Think I Think – Tesla X 3

Oh yeah baby. This the post you have not been waiting for – all Tesla all the time. Here are three things about Tesla I think I am thinking about: 1) Tesla and short-termism. So, Tesla is talking about going private. The main reason for this is supposedly because the stock creates all sorts of short-term distractions that are not aligned with the long-term goals of the company. I always find this to be an odd view. If you want long-term shareholders who don’t get distracted by short-term...

Read More »The Internet is not a Public Park

Alex Jones got banned by YouTube, Facebook, Apple and Spotify yesterday. Strangely, this was a controversial topic in some circles. That’s right – a man who monetized a fake news conspiracy theory about MURDERED KINDERGARTENERS got banned and there are people who are willing to defend this monster in the name of free speech. I am at a loss for words. Look, I am all for free speech. If you want to go out and say stupid shit all over the place then have at it. But we have a real problem...

Read More »Why Are Banks Special?

The concept of endogenous money and banking is back in the spotlight these days with more and more prominent “mainstream” economists coming around to the idea that banks are special and that private debt levels are an important element in understanding the business cycle. In just the last few days David Andolfatto and several Harvard economists have published new work that considers the importance of banks and private debt. This is not surprising to any regular reader of my research as...

Read More »The Best Investment Writing – Volume 2

I am really excited to announce the latest volume of “The Best Investment Writing”. Meb Faber collected some of the best writing of the last year from an all-start team of investors. This one’s even better than the original. I wrote about…SURPRISE – bonds and the myth that bond prices must fall if interest rates rise…. Below is a preview – I hope you enjoy it:

Read More »Three Things I Think I Think – GDP, Housing and Bad Narratives

Here are some things I think I am thinking about: 1) Q2 GDP – More bleh than expected. For all the talk about how great the Q2 GDP was going to be I have to say that I wasn’t really that impressed. The year over year rate comes in at 2.8% which is not really that impressive. Prices were up some, but at 2.7% we’re pretty consistent with the core readings we’ve seen in recent CPI. Private residential fixed investment was up 7.5% year over year which is pretty consistent with what we’ve seen...

Read More »Thoughts on the Rise of “Democratic Socialism”, Part One

The surging popularity of Bernie Sanders in the 2016 Presidential election led to a substantial increase in the number of Democratic Socialists. The impact of this movement is real and we’re seeing it in recent elections with Alexandria Ocasio-Cortez winning a huge upset in New York. But what is Democratic Socialism and is this movement good for the country? Democratic Socialism is a political philosophy that advocates the social ownership of the means of production in a manner that is...

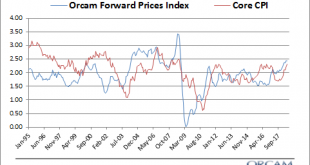

Read More »Inflation Update – Still Not Flatin’ Too Much

Back in February I provided a broad inflation update wherein I stated that core inflation was likely to tick higher from 1.8% to 2.3%. The June CPI report showed a core inflation rate of…2.3%. That remains a very low historical rate, but it’s been on the move higher in the last year. So now that we’re at my target from the beginning of the year – where to from here? Now, I know that forecasting is never a great idea. But it’s a necessary part of any good financial plan. And for me it helps...

Read More »Who Are the Greatest Investors of All-Time?

People are obsessed with the “greatest of all-time” for many reasons. The first reason is because we like to confirm our preconceived biases. For instance, if Tom Brady is the greatest QB in NFL history then it means that Boston has been one of the best places to live in the last 20 years.¹ Or, if Warren Buffett is the greatest investor of all-time then that means that your value investing strategy, as bad or good as it has been, has still been a smart strategy since that’s what Warren...

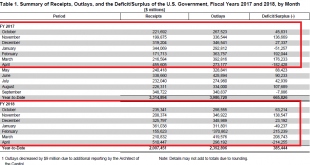

Read More »Let’s Talk About that “Rapidly” Falling Deficit

Here’s an interview of Larry Kudlow, National Economic Council Director, saying that the deficit is “coming down rapidly”. I don’t know why he’s saying this because it’s not remotely true and there’s no reason for him to shy away from the rising deficit. The US Treasury’s Monthly Treasury Statement clearly shows the deficit is rising. The deficit is UP 12% this year versus the same period last year. Here it is in black and white: Now, the really interesting thing is why this is happening....

Read More » Heterodox

Heterodox