Share the post "Would I Make a Buffett Bet 2.0?"Here’s the first question in the Abnormal Returns blogger wisdom series:Question: Let’s say Warren Buffett re-ups his famous decade-long bet. (He’s not.) He takes the S&P 500. What would you take (and why)?My answer:This is a more interesting bet now. In the 5 years prior to the 2008 bet the US markets had only compounded at about 9% vs the 13% rate of the last five years. But I’d throw in a caveat. Comparing the nominal returns of the...

Read More »Donald Trump is Wrong About the National Debt (Again)

Share the post "Donald Trump is Wrong About the National Debt (Again)"Here’s a very inaccurate comment by Donald Trump from yesterday:“Now, if you look at the stock market, that’s one element, but then we have many other elements. The country — we took it over, it owed $20 trillion, as you know, the last eight years they borrowed more than it did in the whole history of our country, so they borrowed more than $10 trillion — and yet, we picked up $5.2 trillion just in the stock market,...

Read More »The Future of Active Management

Share the post "The Future of Active Management"Here is a great debate on active vs passive investing between Barry Ritholtz and Nir Kaissar. Go have a read and let me know what you think about it in the forum. But before you do that here’s what I think the future of active management will look like.I started writing about the myth of passive investing several years ago.¹ At the time this was a pretty controversial idea. So controversial that, when I tried to explain it in the popular...

Read More »Congratulations Richard Thaler!

Share the post "Congratulations Richard Thaler!"Richard Thaler has won the Nobel Prize in economics which is very awesome. Thaler is a cool dude. Not only is he a master academic, but Thaler is a market practitioner as well. He’s among the small group of people in this world who do a lot of theorizing about how the economy works, but also backs it up by running a pretty big asset management firm.Thaler has an insane 110,000 citations on Google Scholar which shows how broadly influential his...

Read More »All In or All Out?

Share the post "All In or All Out?"I love this line from a recent John Bogle interview:“One thing that I strongly urge: Don’t ever, ever, ever if you’re an investor think of being out of the market or in the market,”Bogle is discussing the “fully valued” nature of today’s stock markets and advocating slight changes to one’s allocations. He says it’s okay to reduce your stock market exposure a little bit to offset the potential for higher risk. This is an approach I fully endorse. I think...

Read More »Some Bad Days

Share the post "Some Bad Days"There’s a company near San Diego called “No Bad Days”. Their logo is a palm tree with the saying and I see it all over cars and stuff. I’m sure you can derive the message – living in San Diego or any place tropical can feel like there are no bad days. That’s total bullshit, but it’s a nice mentality to try to maintain.You see, the last few days have been bad days. No, it’s 70 degrees and sunny as I type. I am literally staring at a palm tree. But San Diego is...

Read More »Goldman Sachs: No Signs of Recession

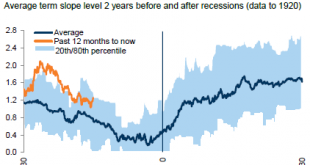

Share the post "Goldman Sachs: No Signs of Recession"I’ve spent a lot of time in my career toying with regime change strategies. That is, strategies that operate one way in one regime environment and change in another. So, for instance, if you knew when a recession was going to occur you might downshift your portfolio to something less aggressive. Since recessions are pretty rare and often involve traumatic market environments you can be relatively passive, but still try to manage the risk...

Read More »Why MMT is Important

Share the post "Why MMT is Important"Modern Monetary Theory (MMT) has been in the news quite a bit in the last few weeks.¹ It’s refreshing to see this considering how bad the state of macroeconomics is. I say this as someone who has been very critical of MMT for many years. I think they overreach on some items, but as a general theory I think they provide a much clearer and more useful picture of the macroeconomy than most mainstream economic schools do. Among the important things they get...

Read More »Three Things I Think I Think – Bubbles Edition

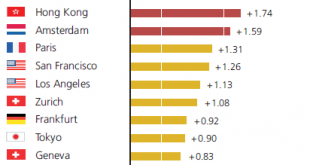

Share the post "Three Things I Think I Think – Bubbles Edition"Here are some things I think I am thinking about:1) Is there an emerging global housing bubble? Here’s a nice perspective from UBS on the state of the global housing market. They provide a Global Real Estate Bubble Index that puts the highest risk markets in perspective. Their conclusions – there isn’t widespread sign of a bubble as there was in 2006, but there are pockets and cities that are unusually risky. The top names...

Read More »Donkey Economics

Share the post "Donkey Economics"Here’s a piece in the LA Times by Stefanie Kelton of MMT fame. The piece is titled:Congress can give every American a pony (if it breeds enough ponies)The basic gist of the article is that the US government has a printing press and it can afford to buy whatever quantity of output that it wants. It is not constrained by the quantity of funds that it can obtain, rather, it is constrained by the real resources available to buy.This is nothing new to anyone...

Read More » Heterodox

Heterodox