GROWTH. It’s what we all strive for as investors and people. At the end of the day, we’re all just trying to grow and become a little bit better. Better spouses. Better workers. Better parents. Better friends. The Kobe Bryant death hit me harder than I would have expected. Honestly, I didn’t like Kobe early in his career. He seemed self centered and the sexual assault case only worsened the way I felt about him. But I’ll never forget seeing his apology and how sincerely sorry he seemed....

Read More »The Investors Podcast – Contrarian Investing Ideas

I joined Stig and Preston again on The Investor’s Podcast to talk about about contrarian market ideas at the start of 2020. Topics include: Why you can’t truly be a passive investor Why the stock market is a better inflation hedge than gold What are the differences and similarities between financial markets and the economy Is the US government running out of money? Ask The Investors: Should I invest in a leveraged ETF if I think the stock market will go up over the next few decades? I...

Read More »Let’s Talk About the Utility of Balance Sheet Consolidation

I caused a bit of a fuss in my last post regarding MMT and what I believe is an obscure consolidation of government entities in their accounting. But I want to go into this a bit more because it’s useful to understand in a bit more detail. Accounting is a nice way of constructing and deconstructing the financial world so we can better understand it. Part of the way we do that is by looking at the various components of the world in terms of sectors. There are households, corporations,...

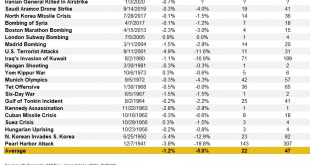

Read More »Does War Matter for Your Portfolio?

Happy new year everyone. I hope it’s off to a bombastic start. Too early for that joke? Okay. Sorry. Anyhow, with the news in Iran and the potential of another war in the Middle East I wanted to discuss what this may or may not mean for portfolios. The media will obviously whip you into a frenzy over this stuff. Remember, their job is to sensationalize everything and keep you tuned in. If the news was honest every day it would be roughly this: “Some assholes did some bad stuff. The...

Read More »What Should You do When the Stock Market Goes Bonkers?

The stock market was sneaky strong this past year. The MSCI All World Index was up 27% in 2019. The S&P 500 was up 31%. Those are big numbers when you consider that the global stock market averaged a return of about 6% in the last 10 years and 8.5% in the last 15 years. It’s often tempting to look at an environment like the current one and think “gosh, I should have been more aggressive, maybe I should be more aggressive in the future?” Now, this might not be an inappropriate...

Read More »How the Democrats Can Embrace Capitalism and Crush Donald Trump

I see a growing narrative in some wings of the Democratic party arguing that Capitalism is the cause of all the world’s current ills. This is wrong in a very fundamental way and one which has the potential to hurt the Democratic party’s chances to take back the White House. In a recent article I described how the economy is essentially a bunch of private businesses that create a capital base that we then leverage into a government. Think of the government like a Homeowners Association. The...

Read More »A Pragmatic View on the Existence of Billionaires & Government

I’ve spent a lot of time defending the government on this website. And I’ve also spent a lot of time defending capitalism on this website. To me, they are both good when they work together. Recently, I’ve discussed how this might not be occurring optimally and the political left has pilloried billionaires as the primary culprits. This is true to some degree. And it also taken out of context to some degree. The following things are all true in my opinion: Billionaires are good in the sense...

Read More »Intangible Returns

Financial professionals love to talk about beating the market. I won’t bore you again with why this is the wrong mindset for most people when they allocate their savings. In fact, I want to discuss how underperforming is sometimes a good thing. I’m in the 8th inning of a home remodel that turned into an almost entirely new rebuild of the home. It’s been three years in the making. It has, at times, consumed every ounce of my mind and body. Funny thing is, real estate listing websites say...

Read More »Three Things I Think I Think – More on Socialism

Here are some things I think I am thinking about: 1) Scandinavia really isn’t Socialist. I got a lot of emails over the weekend about my piece on Socialism and Capitalism. One of the common themes was about how “Socialist” Scandinavia is. This is a tired old myth. Scandinavian countries are predominantly Capitalist with an average of about 33% of wealth owned by the state.¹ Some are quite high (like Norway at 56%) and some are quite low (like Denmark at 12%). But even countries like Norway...

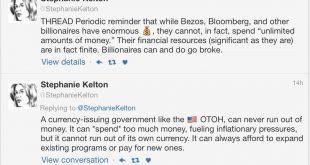

Read More »Do Rich People Debunk MMT?

Someone emailed me this Tweet about MMT asking whether I thought it was accurate or not: Okay. Disclaimer – I like a lot of what MMT says. But they take this funding narrative too far and I think it discredits their other more important narratives. This Tweet gets to a pretty fundamental problem in the MMT narrative. MMT people like to say that taxes don’t fund government spending and that the government doesn’t need income to spend. This is wrong in a rather basic sense. After all, in...

Read More » Heterodox

Heterodox