There is still a lot of chatter about the potential for a September rate hike by the Fed. I have to be honest – I think this is nuts at this point. Here are some general thoughts: We are still muddling along following the financial crisis. Yes, the crisis is in the rear view mirror, but the effects still linger. Housing, for instance, is still historically weak despite some of the progress we’ve seen in recent data. Here’s private fixed residential investment as a percentage of GDP. Does...

Read More »This Ain’t Your Grandfather’s Hedge Fund Industry

This Bloomberg piece about hedge funds created quite a stir today. The basic gist of the article was – hedge fund performance is bad and they charge high fees which makes them really bad. It’s easy to jump on this bandwagon, make a bunch of oversimplifications and come to the populist conclusion that hedge funds are just a “compensation scheme masquerading as an asset class”. The reality is much more complex though and the whole idea of “hedge funds” has become a rather nebulous concept....

Read More »Goldman Sachs: We’re Still Early/Mid-Cycle in the Recovery

This is a theme I am starting to hear a lot more of lately – the idea that we’re actually still very early in the business cycle. In a weekend note Goldman Sachs reiterated this point saying: An economic contraction is decidedly NOT in our forecast. Investors point to the 18% collapse in Brent during the past six weeks, the weak macro data from China and the spillover effect on global demand growth, lingering uncertainty in Europe and the 25 bp compression in the 10-year US Treasury yields...

Read More »What is Portfolio “Risk”?

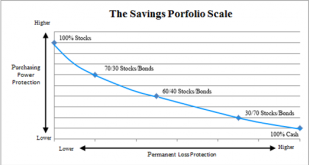

The idea of risk is a rather confusing and nebulous concept in modern finance. The traditional textbook definition of “risk” is standard deviation or volatility. This is convenient for academic purposes because it allows us to quantify risk in a portfolio. But this is a flawed concept for several reasons: Volatility isn’t always a bad thing. In fact, volatility with a positive skew is a good thing. No one complains about a portfolio allocation that rises 20% per year and falls 5% every once...

Read More »Three Things I Think I Think – Weekend Edition

Here are three things I think I am thinking about. 1) Shorting is Hard. Shorting Bubbles is Really Hard. I was thinking about the collapse in commodity prices in recent years and reviewing some of my past views. I have been highly critical of the commodity boom in recent decades arguing that the financialization of commodity products had created a false demand for these assets as Wall Street increasingly sold commodities as a part of asset allocation plans to the general public. I even...

Read More »The China Slowdown in Perspective

Last month it was Greece. This month it seems to be China. I said Greece wouldn’t wreck the global economy last month and now no one is even talking about it now. But what about China? China is a much bigger story for obvious reasons. As of 2014 China was about 15% of global GDP so we’re not talking about Greece here. This is a substantial player in the global economy. But how impactful is China in the USA? First, it’s important to note that the “China slowdown” story is nothing new. In...

Read More » Heterodox

Heterodox