Sensible investing requires understanding to avoid overreaction. We are inherently afraid of things we don’t understand. Being in a foreign environment, for instance, is sometimes scary. Not because foreign environments are necessarily scary, but because we don’t understand them. Investing, for most of us, is a constant state of a foreign environment because it involves so many things that we don’t understand. That exposes us to a perpetual state of behavioral biases due to...

Read More »Why “Buy Low and Sell High” is so Difficult to Implement

Warren Buffett once said: “investing is simple, but not easy”. Given his love of cheeseburgers and Diet Coke and also being 87 years old, he might not agree with this analogy, but I’ve compared investing to getting healthy. Being healthy is simple, but not easy. That is, we all know that you eat right and workout. That’s simple. But it’s really hard to avoid cheeseburgers while also maintaining a strict workout schedule. One of the simple things we always hear about is how the key to good...

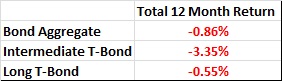

Read More »Do Bonds Still Diversify When Rates Rise?

Rates have inched up enough now that if you squint your eyes you can see the change on a 40 year chart. I say that partly in jest, but the important part is the 40 year part. Because yes, we’ve all become a bit deluded about asset returns thanks in large part to the once-in-a-lifetime change in rates from 15% to 0%. I’ve noted on several occasions that the 60/40 stock/bond portfolio of the future is not going to look much like the 60/40 stock/bond portfolio of the past. This is just simple...

Read More »Three Things I Think I Think – So. Much. Politics.

1) Investing and Politics Don’t Mix. I posted this chart on Twitter the other day – it’s the MAGA ETF. Basically, the index provider took companies that are highly supportive of Republican candidates. It’s kind of an interesting idea since we tend to think that Republican policies are better for the economy than what is generally perceived as more “socialist” ideas sometimes espoused by Democrats. Anyhow, the interesting thing for me here is that this all comes down to stock picking at the...

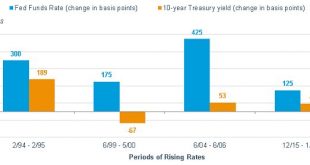

Read More »Putting the Rise in Yields in Perspective

Is it just me or have there been a whole bunch of really scary sounding stories about rising interest rates in the last few months? While some of these worries are warranted it’s important to pan out and take a more objective view of the environment so we can avoid making excessively short-term judgements about what may or may not happen. There’s a lot of people out there who rely on selling you short-term fear in exchange for your attention and your money. So let’s see if I can save you...

Read More »Thoughts on the Swiss Project

Sorry for the radio silence these last 10 days. I was in Switzerland for work (and some fun). It was my first time there for an extended period and proved to be one of the more interesting experiences I’ve had abroad. I am by no means an expert on Switzerland, but here are some thoughts from an outsider’s perspective. I think you might find them interesting. What the European Monetary Union Seeks to Become? What makes Switzerland so interesting (for an economics nerd like me) is its...

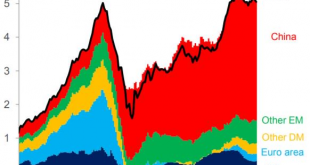

Read More »Three Things I Think I Think – China, Tesla And Weird Stuff

Here are some things I think I am thinking about: 1. Here’s Something Weird For Ya….So there’s this story going around this week about “Incels”. I had never heard of the term before, but apparently it describes a male who is “involuntarily celibate”. And apparently they argue that their celibacy is sex inequality and is contributing to male mental health problems that can lead them to kill people like the mass shooting in Canada last month. So…an economist at George Mason went into some...

Read More »Three Things I Think I Think – Marx, Value Stocks & Bitcoin

Here are some things I think I am thinking about: 1) Time to buy value stocks? Value stocks have done very badly for a long time when compared to growth stocks. So we’re starting to hear more and more contrarians argue that value stocks are much more attractive. I always find this idea interesting. You see, what financial salesman did was create all of these brands within the stock market. Things like “growth” stock or “value” stock or whatever. Then they supported that brand with some...

Read More »The Fed is in a Pickle

Well, we’ve been here before. In 2006 house prices were booming, stock prices were surging and the Fed was raising rates aggressively trying to get ahead of what looked like an overheating economy. But as the Fed raised short-term rates the end of the curve refused to budge. It was Alan Greenspan’s famous “conundrum”. None of this is that unusual though. When the Fed raises rates they are typically signalling that they want the economy to slow. So short rates rise and long rates barely...

Read More »The Difference Between Asset Price Inflation & Consumer Price Inflation

One of the more common responses to the fact that inflation is low is the idea that the inflation is all in asset prices. So, for instance, if someone were to say that all the Fed’s post-crisis stimulus didn’t result in inflation you might look at stock prices and argue that the price increases all flowed into stocks. That’s not necessarily wrong, but I think it needs to be well understood because asset price inflation is generally good for the economy while consumer price inflation could...

Read More » Heterodox

Heterodox