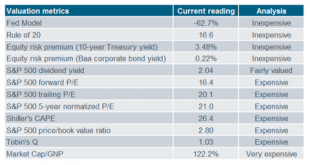

Share the post "Conflicting Value Indicators Lead to Confusion over Clarity" I’m not a particularly big fan of relying on traditional “value” metrics. It’s not just my mistrust of factor investing. It’s that I just don’t think anyone really knows what the “value” of the market is at any particular time. As I’ve stated in the past, the concept of value is dynamic so the perception of value is much like the perception of beauty. And what’s beautiful to some people in some eras might be ugly...

Read More »There is no Defense of Closet Indexing

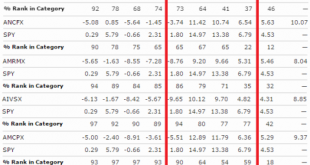

Share the post "There is no Defense of Closet Indexing" Closet indexing occurs when a high fee mutual fund or ETF promises to be able to “beat the market”, charges a fee premium relative to its benchmark and then largely mimics the performance of the benchmark. This is a tremendous problem for investors because they usually end up paying hefty fees in exchange for empty promises. When I review client portfolios I find that an alarmingly high number of them hold closet index funds (before...

Read More »The Great Normalization

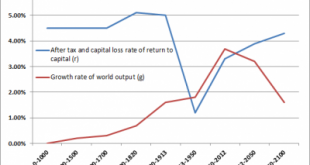

Share the post "The Great Normalization" The slowing growth of the global economy has many people confused about what’s going on. There are all sorts of explanations out there including the “secular stagnation” theory, the “New Normal”, the “rise of the robots”, etc. But what if the “new normal” and “secular stagnation” are merely the normal normal? Thomas Piketty put things in perspective for us in his popular book “Capital” when he discussed the long-term trends in growth. Piketty...

Read More »Thanks!

Share the post "Thanks!" It’s that time of year when millions of Americans will sit down at dinner and give thanks for mashed potatoes, turkey, loose pants and American football. I will be somewhere in Paris continuing my attempt to go from Ironman to Dougboy in record time (in all seriousness, how is everyone in France not 800 pounds?). Of course, Thanksgiving isn’t about calorie consumption records. It’s about being thankful for all the things life affords us. I am grateful for many...

Read More »Covariation Bias and the Bear Market “Genius”

Share the post "Covariation Bias and the Bear Market “Genius”" Covariation bias is the tendency for people to overestimate the relationship between fearful stimuli and negative outcomes. The classic example in scientific studies is people’s reactions to spiders. Death from spider bites are extremely rare and there hasn’t been a recorded spider death in Australia (where spiders are most common) since 1979 (see here and here). But you’d be hard pressed to find someone who doesn’t think...

Read More »Three Things I Think I Think – We Are All Stupid Edition

Share the post "Three Things I Think I Think – We Are All Stupid Edition" Here are some things I think I think: 1) The older I get the more I know how little I know. There’s some version of this quote in many places, but I think it’s always a good reminder to remember that we live in an inordinately complex and dynamic world that no one fully understands. If I’ve ever had one strength it’s that I know how much I don’t know (in other words, I know I am pretty stupid about a lot of...

Read More »The Budget Deficit is (Mostly) Endogenous

Share the post "The Budget Deficit is (Mostly) Endogenous" People love to assign economic blame or credit to the President. Government debt and deficits are particularly popular talking political points when one is trying to confirm their political bias. For instance, since President Obama took over in 2008 we constantly hear Republicans talk about how he has expanded government debt. Since 2011 he’s been widely credited by Democrats with bringing the deficit down. This is almost...

Read More »Why Not Just Print More Money?

Share the post "Why Not Just Print More Money?" With zero signs of inflation and weak economic growth we’re starting to see more comments about “printing money” to boost the economy. For instance, the other day in the New Yorker John Cassidy discusses Adair Turner’s proposal to print more money: Adair Turner, an academic, policymaker, and member of the House of Lords, has another idea. In his new book, “Between Debt and the Devil: Money, Credit, and Fixing Global Finance” (Princeton),...

Read More »When Theory Meets Reality

Share the post "When Theory Meets Reality" As a market practitioner who reads way too much academic economics and finance I often find myself disagreeing with theoretical perspectives. This is the result of this strange disconnect on Wall Street where economists and financiers are often segregated. Although finance and economics overlap in many ways they are viewed as two distinctly different worlds. This creates a huge gap between theory and reality because the academic economists are...

Read More »ISIS is About to Make the Euro Crisis a lot more Challenging

Share the post "ISIS is About to Make the Euro Crisis a lot more Challenging" 2015 has seen an increasingly challenging environment across Europe. The Greek crisis nearly boiled over to a defection earlier in the year and now the tragic attacks in Paris are likely to make things even more challenging as we head into 2016. There are two effects from the terrorist attacks that are likely to exacerbate the Euro crisis: Budget deficits are likely to expand and create more tension over the...

Read More » Heterodox

Heterodox