Share the post "My Interview on The Investor Podcast" I did an interview earlier this month on The Investor Podcast with Preston Psyh and Stig Brodersen. We covered a lot of different topics, but focused mainly on my white paper “Understanding the Modern Monetary System”. We discuss: The importance of forming a sound operational understanding of the monetary system not only for investment purposes, but for political purposes How innovation can overcome regulations and demographic...

Read More »The Impractical Economics of Bernie Sanders

Share the post "The Impractical Economics of Bernie Sanders" Extremist views don’t mesh well with economics. While they often sound good in theory they don’t work well in practice. This was the crux of much of my criticism of the Republican debates last week (see my comments on the gold standard and Rand Paul’s views). Unfortunately, some of the same (well, very different actually) extremist views are on display in the Democratic debates. Bernie Sanders is front and center here and...

Read More »A Useful Wall Street Dictionary

Share the post "A Useful Wall Street Dictionary" I just finished reading Jason Zweig’s new book “The Devil’s Financial Dictionary” and boy is it good. If you’ve ever been overwhelmed by all the jargon used in finance and economics then this is right up your alley. Jason offers up a witty, brilliant and most importantly, useful collection of honest definitions. It’s a collection of all the things most people think about these words, but are too afraid to actually say. For instance:...

Read More »Investment Activity & the Illusion of Control in Exchange for Low Real Returns

Share the post "Investment Activity & the Illusion of Control in Exchange for Low Real Returns" I take a cyclical view on things. This means I can sometimes go years without making big changes in my views or portfolio. This is a very intentional construct and I think it’s one that most people should adhere to. After all, you don’t want to be irrationally long-term which usually results in huge amounts of short-term permanent loss risk. But you also don’t want to be so short-term...

Read More »Why No One Should Support the Gold Standard

Share the post "Why No One Should Support the Gold Standard" The gold standard is silly. No one should be in favor of going back to it. Here’s why: The Gold standard does not create “Sound Money” policy. One of the biggest myths about the Gold Standard is that it will create “sound money” policies that won’t allow the government to debase the currency. History shows this is totally wrong. A gold standard does not restrict the government from devaluing the currency. Over the course of...

Read More »Rand Paul Has No Idea How the Fed Works

Share the post "Rand Paul Has No Idea How the Fed Works" Sorry for the blunt title, but I couldn’t think of anything more appropriate…. I was watching the Republican debate this evening when Rand Paul made the following comments on the Federal Reserve in response to rising income inequality: “By artificially keeping interest rates below the market rate average ordinary citizens have a tough time earning interest and a tough time making money. They’re actually talking now about negative...

Read More »Economic Bellweather CSX on the State of the Global Economy

Share the post "Economic Bellweather CSX on the State of the Global Economy" I’m a big fan of following macro rail trends around the world so I am fortunate to be in touch on occasion with Executives at CSX, one of the world’s largest rail firms. I reached out to Frank Lonegro, CFO at CSX to ask him about his opinion on the US and global economy. He was kind enough to let me publish his thoughts: 1) How does CSX see current trends in the US rail industry and are these trends...

Read More »Three Multi-Temporal Problems within Capitalism’s Victory

Share the post "Three Multi-Temporal Problems within Capitalism’s Victory" The biggest threat to capitalism is capitalists. After all, capitalists are monopolists. And monopolists are antithetical to broader prosperity because they give the monopolist an unfair pricing power over their consumers which often leads to social unrest. We need look no further than the recent case of Martin Shkreli to see how this plays out in real-life. Anyhow, I was reading through this very good report from...

Read More »Valeant and the Gambler’s Dilemma

Share the post "Valeant and the Gambler’s Dilemma" If you’ve been paying attention to the financial media in the last few weeks you’ve probably seen the drama surrounding a company named Valeant. In case you’ve been buried in your bunker waiting for China to blow up the global economy, here’s the short version – Valeant is a pharmaceutical company that has basically acquired its way to massive growth by gobbling up smaller firms, raising prices and restructuring. They’ve become a...

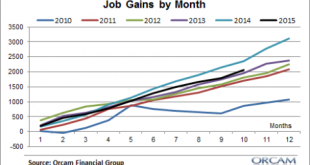

Read More »A Good Employment Report, but With Risks

Share the post "A Good Employment Report, but With Risks" Today’s Non-Farm Payrolls report was an overwhelming positive for the US economy. Total payrolls were up 271K with 268K coming from the private sector. There was considerable strength in professional and business services which is consistent with the recent strength we’ve seen in PMI Services data. The unemployment rate was down to 5% and revisions in past months did not play a significant factor. So, all in all, a pretty good...

Read More » Heterodox

Heterodox