NB – I have been unfairly general with the term “hedge fund” and “banker” in this piece and I hate myself a little bit (just a little bit) for doing that. Sorry in advance. It’s fashionable these days to hate on bankers. And at the same time it’s glamorous to be a venture capitalist. Which is weird because these businesses are extremely similar. For instance, I was amused by the recent ranting of a venture capitalist on Twitter who was criticizing the “usurious” fees that banks charge...

Read More »Thinking About Bonds and Benchmarks

With interest rates at record lows and relatively rich fixed income valuations across many sectors the bond market is becoming an increasingly tricky place to navigate. As a result I find myself researching new ways to squeeze returns out of this segment of the market on a near daily basis. Increasingly, I feel like I am squeezing blood from stones. One place where that blood is becoming increasingly difficult to squeeze is in the mortgage backed securities market which has been a...

Read More »Leon Cooperman: 5 Reasons to be Bullish

You won’t find many investors with an all encompassing market understanding like Leon Cooperman. He’s one of the only investors I know of who has a truly comprehensive micro and macro perspective. In fact, his views on value investing combined with a macro approach are so well thought out that I find myself questioning my own top down approach every time I hear Cooperman speak. You should check out his interview with Barry Ritholtz if you haven’t listened to it. I tuned into Bloomberg for...

Read More »Game Theory Thinking – Mets/Dodgers Edition

Tonight’s Mets vs Dodgers game is going to be an interesting one. The playoff series is tied 1-1, but game 2 was decided in a controversial manner. Chase Utley was on first base with 1 out in the seventh inning and a man on first. The batter hit a ball up the middle where the Mets looked like they might turn a double play (ending the inning and scoring threat). Instead, Utley left the base path and slid into Ruben Tejada breaking up the double play and subsequently leading to a 4 run...

Read More »Three Things I Think I Think – Stopping the Next Crash Edition

Here are some things I Think I am thinking about: 1. Hillary Clinton has a plan to stop the next crash. Here’s an op-ed over on Bloomberg View by Hillary Clinton about reforming Wall Street. It’s titled “My Plan to Prevent the Next Crash”. It’s basically a whole bunch of reforms that Hillary wants to slap on Wall Street. Some of it makes a lot of sense (like the part about ensuring that executives can’t leave an imploding firm with a golden parachute) and some of it is excessive (like...

Read More »Who Cares if Economics is a “Science”?

It’s silly season again. The Nobel Prize in economics is being announced in a few hours and we’re already seeing the uproar over the award. This annual tradition usually amounts to: Economics isn’t a science. The Nobel in Economics is fake. Let’s just stop with all the silliness here. There are Nobel prizes for peace and literature in addition to the hard sciences. I don’t see anyone in an uproar over how “scientific” they are. And while I love peace and literature, I don’t know think...

Read More »Do Markets and Economies Move in Cycles?

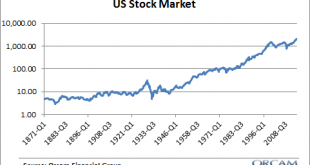

Someone emailed the other day asking for my opinion on theories of wave cycles such as Kondratiev cycles. There are numerous different versions of this idea utilized by various market pundits and investors including Robert Precher’s Elliot Wave Theory, Harry Dent’s long wave theories and Ray Dalio’s debt cycle theories. These theories usually assume three key characteristics: The economy and the markets exist in a state of disequilibrium as opposed to an equilibrium or an environment in...

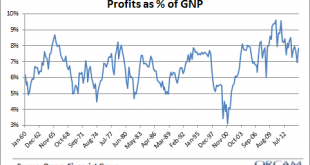

Read More »Why Are Corporate Profit Margins So High?

There’s a lot of scary chatter in the last few years about profit margins. The basic thinking usually goes something like this: “Profit margins are mean reverting and since profit margins are high then that means stocks are risky because they’ll crash when profit margins mean revert” This reminds me a lot of the scary “high valuation” discussions about Tobin’s Q and Shiller’s CAPE which usually go something like this: “Stock valuations are mean reverting and since stock valuations are...

Read More »What If Everyone Indexed?

I see this question more and more as indexing grows in popularity. People generally think that more indexing will make the markets function less efficiently . I don’t think this is true at all. Unfortunately, the question and its answers are usually shrouded in misunderstandings about how assets are priced and myths about what it means to invest “passively”. So, let’s think about this from an operational perspective. An index fund is not really an “index”. They are portfolios managed...

Read More »“Price is a Liar”

This is a very good lecture by John Burbank of Passport Capital. I particularly like his explanation of prices: “Price is all the information that exists in the market…it’s just what people think….price means nothing other than the equilibrium of liquidity…It doesn’t mean it’s good or bad, it’s just where people agree.” That’s really clean thinking. And it’s very different from something like the efficient market hypothesis which says that all available information is reflected in...

Read More » Heterodox

Heterodox