No that is not the real story here today. It does give a perspective on why so many too big, too fast, and too often vehicles are eating up limited supplies of gasoline and oil. However, what is being missed is we are not buying more oil for the Strategic Oil Reserve. Although, I am recalling our younger days when for Christmas the boys (meaning my brothers and I) would get “metal” Tonka pickup trucks and other versions of the same brand. Not a...

Read More »OPEC Aligns with Russia, “Letters from an American”

This “Letter from an American” author Prof. Heather has a different spin to it. Prof. Heather is discussing OPEC and the impact it is going to have on the US as well as other counties not having the wealth we have. One thing I did not know is, Russia is the Vice-Chair of OPEC. Or Putin has his input to OPEC. Leading up to the MBS ‘s decision to cut oil production, the market was stabilizing and prices were dropping. “October 5, 2022,” Letters...

Read More »SPR, Oil, and Distillate Supplies Low

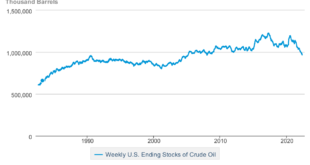

RJS, Focus on Fracking Summary: Strategic Petroleum Reserve at a 20 year low, US oil supplies at a 14 year low; distillates supplies at a 14 year low, total oil + product inventories at an 13½ year low The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending April 22nd indicated that because of a drop in our oil exports and a big increase in oil that could not be...

Read More »Asymmetric Whining

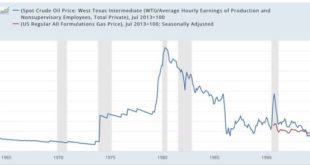

Asymmetric Whining This is not news, but yet again we see the old phenomenon of people whining a lot when something gets worse but then saying nothing when it gets better. The latest example of that involves gasoline prices. They were rising and got into the range of near-real highs seen in times like 2008, 1981, and 1918. But now they have slid backward, down in the neighborhood of 20 cents per gallon where I am. Crude prices are down as...

Read More »The return of the “Oil Choke Collar”!

The return of the “Oil Choke Collar”! For the first five years after the end of the Great Recession, one of the staples of my analysis was the concept of the “oil choke collar.” By that I meant that typically recessions had occurred after there was a sudden and sharp upward spike in the cost of gas, inflicting such pain that consumers cut back drastically on other spending – causing a prompt economic downturn. But what if, instead, gas prices rose...

Read More »Oil Price highest since 2014; natural gas price falls from 12 year high – largest inventory build in 16 months

and gasoline exports at a 26 month low . . . Blogger and Commenter R.J.S., Focus on Fracking: “Oil price is highest since 2014; natural gas price fell from 12 year high after largest inventory increase in 16 months” Oil prices finished higher for the 7th straight week after OPEC decided to only add the minimum to global supplies in the coming months . . . after rising 2.6% to $75.88 a barrel last week as rising global demand amid tight...

Read More »The Euro is Poised for a Rise, Expect $1.50 in 2 to 4 Years

We present twelve reasons that could sustain a further euro appreciation to $1.40 or even 1.50 in the upcoming two to four years. The main one is that Germans are net global creditors and Americans net debtors. This is reflected in fiscal and monetary policy and in investors' behaviour. The post was written in December 2013, but the arguments are still valid today and will continue to be valid in the future.

Read More » Heterodox

Heterodox