Real retail sales continue to be weak; continue to forecast weakening jobs reports – by New Deal democrat As usual, retail sales is one of my favorite metrics because it tells us so much about the consumer and, indirectly, the labor market and the total economy. Nominally, retail sales rose 0.6% in August. So did consumer inflation, and the difference rounded to -0.1% for the month. Here’s what the past 2.5 years since the 2021 stimulus look like (blue) compared with personal spending on goods deflated by the PCE goods deflator. Both are normed to 100 as of just before the pandemic: Nominally both usually track close to one another; the difference is in the deflators. In any event, you can see that the trend in real retail sales for the

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, real retail sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Real retail sales continue to be weak; continue to forecast weakening jobs reports

– by New Deal democrat

As usual, retail sales is one of my favorite metrics because it tells us so much about the consumer and, indirectly, the labor market and the total economy.

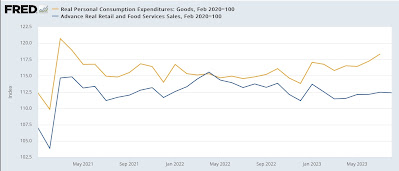

Nominally, retail sales rose 0.6% in August. So did consumer inflation, and the difference rounded to -0.1% for the month. Here’s what the past 2.5 years since the 2021 stimulus look like (blue) compared with personal spending on goods deflated by the PCE goods deflator. Both are normed to 100 as of just before the pandemic:

Nominally both usually track close to one another; the difference is in the deflators. In any event, you can see that the trend in real retail sales for the past 12 to 16 months is flat to slightly declining.

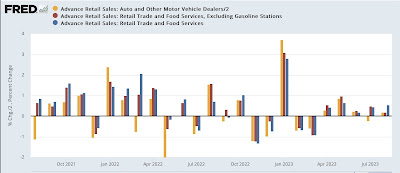

And it isn’t solely a function of gas prices. Nominally motor vehicle and parts sales (gold) rose 0.4% in August (note: in the graph below they are /2 for scale), and retail ex-gasoline (red) only rose 0.2%:

As a result, real retail sales are down -1.2% YoY. Although I won’t bother with a graph, over the past 75 years such YoY declines have more often than not occurred during a recession. Even so, despite being negative YoY for most of the past 12 months, needless to say no recession has occurred, at least not yet.

Finally, although there is a great deal of noise, the percent change in real retail sales YoY/2 typically forecasts the trend in monthly jobs reports. For over the past 18 months, that trend has been marked deceleration:

Needless to say, the forecast from real retail sales is that monthly gains in nonfarm payrolls will continue to decelerate further. It will be interesting to see if real spending on goods (gold) continues to diverge from retail sales. My bet would be on more of a convergence instead.