– by New Deal democrat The Bonddad Blog Here is today’s update on one of my favorite indicators: retail sales. In April they were unchanged on a nominal basis. Adjusted for inflation they declined -0.3% for the month. They are also down -6.2% from their 2021 peak and -2.9% since January 2023: On a YoY basis, they have also returned to the negative side, down -0.3% (note two graphs below adds 0.3% to show at the zero line): Here is the historical comparison going back 30 years: With the notable exception of last year, such a YoY decline has only happened during recessions (and with few exceptions the same is true going back 75 years with the predecessor series). Because the two series tend to trend similarly, below I show

Topics:

NewDealdemocrat considers the following as important: Hot Topics, May 2024, real retail sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

The Bonddad Blog

Here is today’s update on one of my favorite indicators: retail sales. In April they were unchanged on a nominal basis. Adjusted for inflation they declined -0.3% for the month. They are also down -6.2% from their 2021 peak and -2.9% since January 2023:

On a YoY basis, they have also returned to the negative side, down -0.3% (note two graphs below adds 0.3% to show at the zero line):

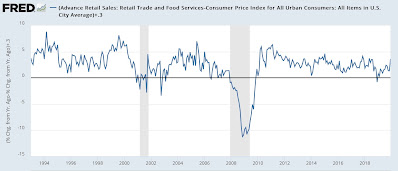

Here is the historical comparison going back 30 years:

With the notable exception of last year, such a YoY decline has only happened during recessions (and with few exceptions the same is true going back 75 years with the predecessor series).

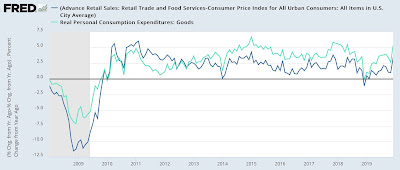

Because the two series tend to trend similarly, below I show the historical record for the past 15+ years of both YoY real retail sales (dark blue) and YoY real personal spending on goods (light blue), a similar but more comprehensive measure. The two metrics tend to trend together over time, although the latter has tended to increase more (hence I adjust to bring the trends more in line):

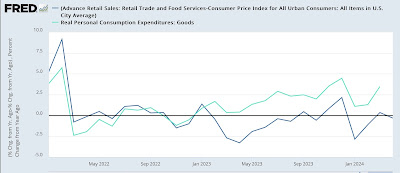

Here is the close-up post-pandemic view:

With the addition of this month’s data, the bigger picture is that real retail sales, which recently had trended neutral, now appear to be trending slightly downward, while real spending on goods has continued to trend higher.

Unless and until there is a confirming downshift in real personal spending on goods, which when positive have almost always meant continued expansion, there does not appear to be any reason for alarm.

The Bonddad Blog

Real retail sales rebound, forecast a continued “soft landing” for jobs growth, Angry Bear by New Deal democrat last time.