A bit of a rewrite on this article. Still a little too long. Talking about railroads, the East Palestine derailment February 2023 crash and how little has been done since then. Outside interests including Koch Industries have been blocking much needed reform through their lobbying of friendly resources in Congress. A good read. Last year’s toxic train derailment in East Palestine, Ohio, prompted new legislation with the aim of making railways...

Read More »Snake oil sellers in the stablecoin world

It's been evident for some years now that those selling risky crypto products to risk-averse investors like to have federal branding on their snake oil. Tether claimed to have 100% actual dollar backing for its stablecoin. Various exchanges and platforms claimed that customer deposits were FDIC insured. The New York Attorney General showed that Tether didn't have 100% dollar backing or anything like it. And now the FDIC has sent cease & desist orders to FTX, Voyager and several other...

Read More »There’s no such thing as a safe stablecoin

Stablecoins aren't stable. So-called algorithmic stablecoins crash and burn when people behave in ways the algorithm didn't expect. And reserved stablecoins fall off their pegs - in either direction. A stablecoin that does not stay on its peg is unstable. Not one of the stablecoins currently in circulation lives up to its name. Don't believe me? Well, here's the evidence. Exhibit 1, USDT since the end of April:Exhibit 2, USDC over the same time period:(charts from Coinmarketcap)Both coins...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »European banks and the global banking glut

In a lecture presented at the 2011 IMF Annual Research Conference, Hyun Song Shin of Princeton University argued that the driver of the 2007-8 financial crisis was not a global saving glut so much as a global banking glut. He highlighted the role of the European banks in inflating the credit bubble that abruptly burst at the height of the crisis, causing a string of failures of banks and other financial institutions, and economic distress around the globe. European banks borrowed large...

Read More »Weird Is Normal

This post was originally published on Pieria in December 2013. Since then, the idea that the long-term real equilibrium interest rate must be equal to or lower than the long-term sustainable growth rate has become much more mainstream. I am just amazed that anyone ever thought it could be otherwise. A long-term real interest rate persistently above the sustainable growth rate cannot possibly be an "equilibrium" rate. As I show in this piece, it can only be maintained through rising...

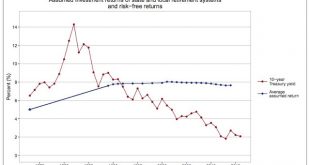

Read More »If only we could return to the glorious 1990s…..

The chart below comes from Silver Watch on Twitter. I haven't been able to identify the original source, but it illustrates perfectly the point I have been trying to make for quite some time now. Pension funds are not taking on more risky investments because the risk premium has fallen, but because the risk-free rate has fallen: In fact, as the chart shows, the risk-free rate has been falling steadily for over thirty years. This is not a post-crisis blip. It is a secular trend. Yet pension...

Read More »Schroedinger’s assets

In a new paper*, Michael Woodford has reimagined the famous “Schroedinger’s Cat” thought experiment. I suspect this is unintentional. But that’s what happens when, in an understandable quest for simplicity, you create binary decisions in a complex probability-based structure.Schroedinger imagined a cat locked in a box in which there is a phial of poison. The probability of the cat being dead when the box is opened is less than 100% (since some cats are tough). So if p is the probability of...

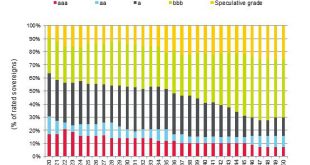

Read More »The safe asset scarcity problem, 2050 edition

This is a silly chart: Why is it silly? Just look at what it implies for government and investor behaviour - and the future of the ratings agency that issued it.S&P forecasts a serious shortage of safe assets by 2050 if the developed nations, in particular, do nothing to adjust their fiscal finances in the light of ageing populations. Clearly, therefore, the price of sovereign bonds in the three "A" categories will rise significantly. S&P doesn't indicate which nations would be the...

Read More » Heterodox

Heterodox