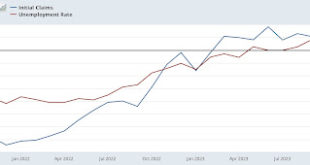

So both the (inverted) yield curve and the Sahm rule indicate a recession. This together with two months of slower employment creation, and the slightly higher unemployment rate, has many wondering whether the economy will crash soon. I discussed before -- a while ago, before the pandemic recession, that had nothing to do with the yield curve -- why an inverted yield curve doesn't necessarily mean a forthcoming recession. The Sahm rule, like the inverted yield curve has an impressive track...

Read More »Her Recession Indicator Triggers . . .

If you have been keeping up with New Deal democrat’s reports on the economy. He is not yet quite sold on the US slipping into recession. The Establishment Survey numbers are still positive. Numbers He believes and the numbers support his beliefs we are in a slight expansion mode. NDd also believe it is time to turn lose on the FED rates as it is in a slight expansion. Frustration of Claudia Sahm As Her Recession Indicator Triggers From the...

Read More »One more time: bifurcation in the jobs report, as Establishment Survey shows continued jobs growth, while Household Survey comes close to triggering the “Sahm Rule”

– by New Deal democrat AB: July 3rd, NDd mentioned he would review the comparison between the Household and the Establishment Survey Reports today. He had initially look at the comparison July 3. In the past few months, my focus has been on whether jobs gains are most consistent with a “soft landing,” i.e., no further deterioration, or whether deceleration is ongoing. In particular: Last month I wrote that “There is a common thread in the...

Read More »The Economy and “A Trump Thanksgiving”

As suggested by New Deal democrat, the nation is experiencing an expansion of the economy which seems less likely to end in a recession. “There has been some commentary that continuing claims mean a recession is imminent or may even be underway. I am discounting that because initial claims have always signaled first, and also because continuing claims have been in the range of 25%-30% higher YoY for the last 6 months without worsening. Turning...

Read More »Initial jobless claims confirm benign employment conditions

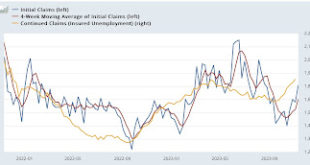

Initial jobless claims confirm benign employment conditions – by New Deal democrat Initial claims declined -14,000 to 209,000 last week, and the four week moving average declined -750 to 220,000. With the usual one week lag, continuing claims declined -22,000 to 1.840 million: On a YoY basis, both weekly claims and their four week average were up only 4.6%. Continuing claims, which have been much more elevated YoY, were up 24.0%:...

Read More »Initial claims rise, but remain below the caution threshold

Initial claims rise, but remain below the caution threshold – by New Deal democrat Initial jobless claims rose 13,000 to 231,000 in the past week. The 4 week moving average increased 7,750 to 220,250. With a one week lag, continued claims rose 32,000 to 1.865 million: I had speculated that the big decline in claims through September may have been affected by some unresolved post-pandemic seasonality, and the last several weeks have...

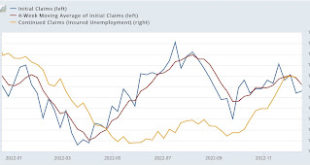

Read More »Jobless claims: a good example of why my forecasting discipline demands a confirmed trend

Jobless claims: a good example of why my forecasting discipline demands a confirmed trend – by New Deal democrat Initial jobless claims for the last week of July rose 6,000 to 227,000. The 4 week average decreased -5,500 to 228,250. Continuing claims, with a one week lag, rose 21,000 to 1.7 million: The YoY% change is much more important for forecasting purposes. There, initial claims were up 4.1%, the 4 week average up 5.8%, and continuing...

Read More »Jobless claims: a good example of why my forecasting discipline demands a confirmed trend

Jobless claims: a good example of why my forecasting discipline demands a confirmed trend – by New Deal democrat Initial jobless claims for the last week of July rose 6,000 to 227,000. The 4 week average decreased -5,500 to 228,250. Continuing claims, with a one week lag, rose 21,000 to 1.7 million: The YoY% change is much more important for forecasting purposes. There, initial claims were up 4.1%, the 4 week average up 5.8%, and continuing...

Read More »They will give us a lead on when the Sahm rule for recessions may be triggered

Initial claims continue in range; why they will give us a lead on when the Sahm rule for recessions may be triggered Initial claims ticked up 2,000 last week to 216,000. The 4 week moving average declined 6,250 to 221,750. Continued claims, with a one week delay, declined 6,000 to 1.670 million: To state the obvious continued good news, it remains the case that almost nobody is getting laid off. Also continued good news is that claims, and...

Read More » Heterodox

Heterodox

-310x165.png)