[unable to retrieve full-text content]The following to just part of a longer report by the Physicians for a National Health Program on Medicare Advantage healthcare programs offered by commercial entities. It lays the foundation as to why Medicare Advantage is more expensive than Traditional Medicare. I will do doing the other parts to this report over the next few […] The post Medicare Advantage Overcharging appeared first on Angry Bear.

Read More »Is Social Security Sustainable?

[unable to retrieve full-text content]Social Security is sustainable. I do not know how many times Dale, Arne, and Bruce have had to explain this. And no, the US has not been on the Gold Standard for domestic transactions since 1933. In 1971, the US left the Gold Standard for International transactions under President Nixon. The U.S. switched to a […] The post Is Social Security Sustainable? appeared first on Angry Bear.

Read More »What was Experienced in 1970 and 2020 in almost the Same Area

[unable to retrieve full-text content] Kenneth Ackerman commenting on his experience in May 1970 in Washington DC. While he was there, I was out -of – country during that time period. When I returned stateside and assigned to 10th Marines, we were trained in riot control. JIC the students and protesters became too rowdy. We were never called out which […] The post What was Experienced in 1970 and 2020 in almost the Same Area appeared first on Angry Bear.

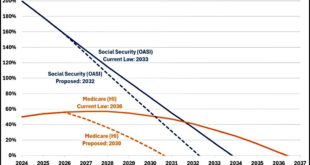

Read More »Trump’s Proposals Could Bankrupt a Vital and Popular Program Within Six Years

[unable to retrieve full-text content]A bit of a rewrite of an article. The Social Security scandal Trump doesn’t want you to know about by James Downie MSNBC Something else Donald Trump doesn’t want you to know about and how it will impact you. This type of plan always comes out later and then everyone says; “well if I had […] The post Trump’s Proposals Could Bankrupt a Vital and Popular Program Within Six Years appeared first on Angry Bear.

Read More »Medicare Doctor Payment System is Not Keeping Up with Inflation

[unable to retrieve full-text content]There is a story here somewhere, I have to look at it a bit closer in what Medicare is doing. As you can see expenditures in the US are double or more than what occurs in other countries. Yet, the US life expectancy is less than other countries. It appears there is a cut which […] The post Medicare Doctor Payment System is Not Keeping Up with Inflation appeared first on Angry Bear.

Read More »50 Years In, Most SSI Recipients Live in Poverty. That is a Policy Choice . . .

by Stephen Nuñez Roosevelt Institute Excellent piece by Stephen Nuñez on SSI and it not adjusting or growing with the changes in economic needs from 50 years ago. Indeed, for the few dollars given out, SSI appears to penalize people rather than assist them. It is ripe for a change to be more supportive of the millions of beneficiaries using it. This year marks the golden anniversary not just of Nixon’s resignation or the Happy Days premiere,...

Read More »Cutting the Retiree Social Security Tax

This does not make sense. Between Fund payouts and Social Security, we were well below $100,000. After deductions and expenses (mortgage, property tax, donations, etc.) our income taxes were very small. We set a side 7% of our SS for taxes and we had plenty left over. We are not the poorest and definitely not the richest. If we follow Trumps suggestion, we will be favoring the very rich getting Social Security. The ones who can afford to pay....

Read More »Trillions in Taxes Dodged by Ultra-Rich Could Fund the Social Security Trust Fund

Without a doubt, there are simpler ways to resolve the funding of Social Security going beyond 2035. Bruce Webb, Dale Coberly, and Angry Bear have discussed the topic enough times. They have also been verbally attacked by others for suggesting the Northwest Plan is a way to secure Social Security up till 2100 or close to it. Social Security belongs to the citizens, the people due to the way it is funded. There is no reason it can not continue to...

Read More »Eliminating taxes on Social Security is a bad idea

Normally, a sentence that begins “Donald Trump says . . . “ is not worth finishing, and that’s how a recent blog post over at jabberwocking.com begins. But finish it I did, and it turns out that DJT says he wants to eliminate all federal income taxes on Social Security. Currently, if SS is your only income, there already are no federal taxes on it. If you make additional income above your SS distributions, you can be taxed at normal federal rates on...

Read More »Bernie is wrong on Social Security

I like Bernie Sanders for many reasons, but this isn’t one of them:“As a result of those challenges, Sanders wants to see more Democrats vocally get behind measures like . . . removing the cap on Social Security taxation so the wealthy pay a full share of their income into the program.”This is a mistake. SS benefits are capped like taxes, so if you lift the cap on taxes and don’t lift the cap on benefits, SS becomes welfare instead of insurance.Look,...

Read More » Heterodox

Heterodox