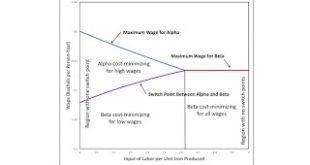

Figure 1: Bifurcation Diagram1.0 Introduction This post continues a series investigating structural economic dynamics. I think most of those who understand prices of production - say, after working through Kurz and Salvadori (1995) - understand that technical innovation can change the appearance of the wage frontier. (The wage frontier is also called the wage-rate of profits frontier and the factor-price frontier.) Changes in coefficients of production can create or destroy a reswitching...

Read More »The Choice Of Technique With Multiple And Complex Interest Rates

My article with the post title is now available on the website for the Review of Political Economy. It will be, I gather, in the October 2017 hardcopy issue. The abstract follows. Abstract: This article clarifies the relations between internal rates of return (IRR), net present value (NPV), and the analysis of the choice of technique in models of production analyzed during the Cambridge capital controversy. Multiple and possibly complex roots of polynomial equations defining the IRR are...

Read More »A Switch Point Disappearing Over The Wage Axis

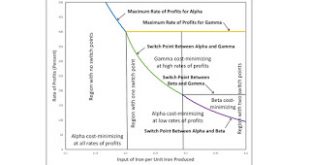

Figure 1: Bifurcation Diagram1.0 Introduction In a series of posts, I have been exploring structural economic dynamics. Innovation reduces coefficients of production. Such reductions can vary the number and sequence of switch points on the wage frontier. I call such a variation a bifurcation. And I think such bifurcations, at least if only one coefficient decreases, fall into a small number of normal forms. One possibility is that a decrease in a coefficient of production results in a...

Read More »Bifurcations Along Wage Frontier

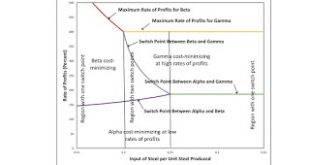

Figure 1: Bifurcation Diagram1.0 Introduction This post continues my exploration of the variation in the number and "perversity" of switch points in a model of prices of production. This post presents a case in which one switch point replaces two switch points on the wage frontier. 2.0 Technology The example in this post is one of an economy in which four commodities can be produced. These commodities are called iron, steel, copper, and corn. The managers of firms know (Table 1) of one...

Read More »A Switch Point on the Wage Axis

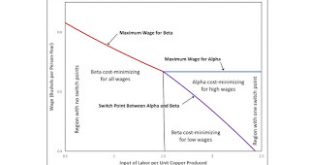

Figure 1: Bifurcation Diagram1.0 Introduction I have been exploring the variation in the number and "perversity" of switch points in a model of prices of production. I conjecture that generic changes in the number of switch points with variations in model parameters can be classified into a few types of bifurcations. (This conjecture needs a more precise statement.) This post fills a lacuna in this conjecture. I give an example of a case that I have not previously illustrated. 2.0...

Read More »Generic Bifurcations and Switch Points

This post states a mathematical conjecture. Consider a model of prices of production in which a choice of technique exists. The parameters of model consist of coefficients of production for each technique and given ratios for the rates of profits among industries. The choice of technique can be analyzed based on wage curves. A point that lies simultaneously on the outer envelope of all wage curves and the wage curves for two techniques (for non-negative wages and rates of profits not...

Read More »Bifurcations And Switchpoints

I have organized a series of my posts together into a working paper, titled Bifurcations and Switch Points. Here is the abstract: This article analyzes structural instabilities, in a model of prices of production, associated with variations in coefficients of production, in industrial organization, and in the steady-state rate of growth. Numerical examples are provided, with illustrations, demonstrating that technological improvements or the creation of differential rates of profits can...

Read More »Bifurcation Analysis in a Model of Oligopoly

Figure 1: Bifurcation Diagram I have presented a model of prices of production in which the the rate of profits differs among industries. Such persistent differential rates of profits may be maintained because of perceptions by investors of different levels of risk among industries. Or they may reflect the ability of firms to maintain barriers to entry in different industries. In the latter case, the model is one of oligopoly. This post is based on a specific numeric example for...

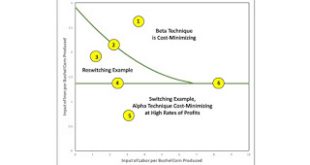

Read More »Continued Bifurcation Analysis of a Reswitching Example

Figure 1: Bifurcation Diagram This post is a continuation of the analysis in this reswitching example. That post presents an example of reswitching in a model of the production of commodities by means of commodities. The example is one of an economy in which two commodities, iron and corn, are produced. Managers of firms know of two processes for producing iron and one process for producing corn. The definition of technology results in a choice between two techniques of production. The...

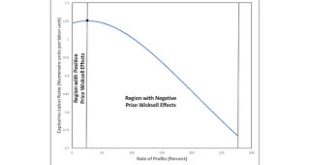

Read More »Another Three-Commodity Example Of Price Wicksell Effects

Figure 1: Price Wicksell Effects in Example1.0 Introduction This post presents another example from my on-going simulation experiments. I am still focusing on simple models without the choice of technique. The example illustrates an economy in which price Wicksell effects are positive, for some ranges of the rate of profits, and negative for another range. 2.0 Technology I used my implementation of the Monte-Carlo method to generate 20,000 viable, random economies in which three...

Read More » Heterodox

Heterodox