Digital Sales Tax v. Tariffs on French Wine Even before Donald Trump departed for the G7 in Biarritz France, he threatened another trade war this time with the host country over the digital sales tax: U.S. President Donald Trump on Friday reiterated criticism of a French proposal to levy a tax aimed at big U.S. technology companies and threatened again to retaliate by taxing French wine. Speaking to reporters at the White House before leaving for a...

Read More »Record Income Taxes?

Record Income Taxes? I should read more posts from Kevin Drum: The Yahoo News reporter comes close to explaining what happened by noting that there were more returns in 2018 than 2017. As you might guess, this happens every year as the US population increases. So let’s take a look at personal income tax receipts adjusted for inflation and population growth … In reality, income tax receipts were down 2.6 percent in 2018 compared to 2017. What this means,...

Read More »Cheerleading for Austerity

Cheerleading for Austerity Not content to follow a news strategy that maximizes Trump’s prospects for re-election, the New York Times leads today with a story that combines economic illiteracy and reactionary scaremongering in a preview of what we’re likely to see in the 2020 presidential race. “Budget Deficit Is Set to Surge Past $1 Trillion” screams the headline, and the article throws around a mix of dollar estimates and vague statements about...

Read More »Importance of Imports

It is standard analysis to see real and nominal imports as a share of GDP quoted to estimate the importance of imports in the economy. Currently that shows nominal imports are about 15% of GDP and real imports are some 18% of real GDP. But I suspect that this comparison understates the role of imports in the economy because services are some 45% of GDP but only about 16% of imports. As my high school algebra teacher was fond of saying, you are adding...

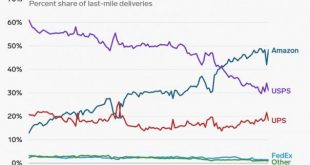

Read More »Amazon, FedEx and the Post Office

Both Amazon and Fed ex have embarked on plans to deliver their own “last mile” package delivery previously contracted with the US Post Office. Here is a link to run75441 (postmaster Mark Jamison’s) piece on this process Fake News, Flawed Analysis, and Bogus Tweets from 2018 for a much more complete description. I have pulled a quote from the more recent Business Insider post on “last mile” delivery. According to the US Postal Service Inspector...

Read More »No more mister nice guy

(Dan here…lifted from Robert’s Stochastic Thoughts) by Robert Waldmann Nomoremisterniceblog almost states the bitter truth, but he’s too nice to tell us what fools we are. He wrote: I don’t want to relitigate the McGovern and Mondale campaigns, but Dukakis? “Free everything and impossible promises” weren’t what defeated him. My comment I want to relitigate events of 1984, which Delaney has sent down the memory hole. Mondale was not hammered because he...

Read More »Barro’s Misstated Case for Federal Reserve Independence

Barro’s Misstated Case for Federal Reserve Independence I guess I should applaud Robert Barro for standing up for the independence of the Federal Reserve and hoping it can resist political pressure to lower interest rates too much. But there are two aspects of his case that strike me as silly to say the least starting with his opening sentence: In the early 1980s, the chairman of the US Federal Reserve, Paul Volcker, was able to choke off runaway...

Read More »The Change in the U.S. Direct Investment Position

by Joseph Joyce (Joseph P. Joyce is a Professor of Economics at Wellesley College, where he holds the M. Margaret Ball Chair of International Relations. He served as the first Faculty Director of the Madeleine Korbel Albright Institute for Global Affairs.) The Change in the U.S. Direct Investment Position The U.S. has long held an external balance sheet that is comprised of foreign equity assets, mainly in the form of direct investment (DI), and...

Read More »Pledging Zero Carbon Emissions by 2030 or 2050: Does it Matter?

Pledging Zero Carbon Emissions by 2030 or 2050: Does it Matter? We now have two responses to the climate emergency battling it out among House Democrats, the “aggressive” 2030 target for net zero emissions folded into the Green New Deal and a more “moderate” 2050 target for the same, just announced by a group of mainstream legislators. How significant is this difference? Does where you stand on climate policy depend on whether your policy has a 2030...

Read More »Climate Chaos?

Dan here. You will be reading more of him soon…David Zetland has contributed here on water issues via Aguanomics. He now publishes his blog The one-handed economist. He is a native Californian who moved to Amsterdam several years ago. David is an assistant professor of political economy at Leiden University College, a liberal arts school located in The Hague. He teaches courses in social and business entrepreneurship, cooperation in the commons, and...

Read More » Heterodox

Heterodox