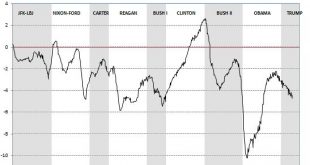

Under Trump the federal deficit has rebounded to some 4.4 % of GDP — it is the same whether you look at it quarterly or monthly data as this chart does. The monthly estimate is calculated by Haver Analytics. So much for the tax cut paying for itself. The shaded areas are by Presidential term, not of recessions as is usually the case. Typically, Republicans leave office with a larger deficit than they inherited while Democrats leave with a smaller one,...

Read More »Bill Black says what if…

(Dan here… Via Real News Network, Bill Black discusses the what-ifs of President Trump’s policies in a spectacular contrast to current expectations…providing. a jumping off point from what we expect from the way it is framed now. I assume the complex interalationships of the wealthy elites (let us see how the Epstein case unwinds for another aspect) plays an important but not so well known role in this drama. I find his thought his conclusions dismaying...

Read More »Eliminate The Debt Ceiling

Eliminate The Debt Ceiling Several days ago in WaPo, Catherine Rampell published a highly reasonable column calling for eliminating the century-old US debt ceiling, something no other nation has ever had, a position supported by a wide array of economists including such a conservative GOP stalwart as the recently deceased Martin Feldstein, a former CEA Chair for Reagan. I have made numerous posts here on this in the past, but the issue is hot again as...

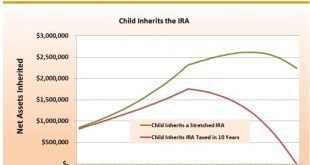

Read More »House’s SECURE Act and the Senate’s RESA Act

Congress has been busily working on a much-needed way to improve Middle Class savings and growth over the span of their employment to boost their retirement. Dueling bills to restructure IRAs and 401ks appear to be redundant. Better known as the “Setting Every Community Up for Retirement Act” (SECURE Act) H.R.1994 and the Senate has a similar bill, the “Retirement Enhancements and Savings Act” S.792 (RESA). Both bills were passed with bipartisan support. For the ultra rich? A...

Read More »WARNING: another “debt ceiling debacle” is looming, and could cause nearly immediate recession

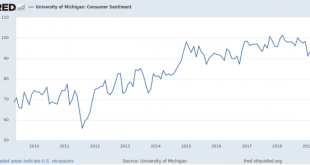

WARNING: another “debt ceiling debacle” is looming, and could cause nearly immediate recession It’s time to start to get seriously worried about another “debt ceiling debacle.” In 2011, the GOP refused to authorize a “clean” debt ceiling hike. The hike in the debt ceiling, for those who may not know, is necessary for the US government to pay debts that *it has already incurred.* In 2011, as a result of the impasse, US creditworthiness was downgraded...

Read More »S&P 500 P/E

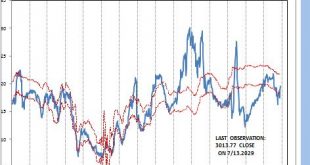

Friday evening the S&P 500 closed at 3013.77, up 20.2 % year to date. But much of that gain is just recovering from the drop in late 2019, as it is only up some 3.4% from September, 2019. This is the first time the S&P closed above 3000 and people are wondering if the market is overvalued. The S&P 500 PE is now at 19.6, almost exactly where my model implies it should be. As the chart shows it is right in the middle of my estimated fair value...

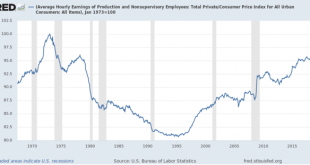

Read More »Real average and aggregate wages improved in June

Real average and aggregate wages improved in June Now that we have the June inflation reading, let’s finish out our week focusing on the labor market. First of all, nominal average hourly wages in June increased +0.2%, while consumer prices increased +0.1%, meaning real average hourly wages for non-managerial personnel increased +0.1%. Together with upward revisions to prior months, this brings real wages up to 97.2% of their all time high in January...

Read More »The Rise of Global Innovation by US Multinationals

The Rise of Global Innovation by US Multinationals Lee G. Branstetter, Britta Glennon, and J. Bradford Jensen of the Peterson Institute for International Economics provide an interesting discussion of the risks and opportunities from the following: Total US R&D spending as a share of GDP increased slightly from 2.5 percent in 1999 to 2.7 percent in 2016.2 Multinationals are an important driver of aggregate R&D spending in the United States.3...

Read More »Destroying Social Security to Save It

Connecticut Representative John Larson Proposes Plan To Destroy Social Security In Order To Save It, by Dale Coberly Connecticut Congressman John Larson introduces H. R. 860, Social Security 2100 Act which will cuts taxes, strengthen benefits, prevents anyone from retiring into poverty, and ensure Social Security remains strong for generations. larson.house.gov It sounds good, but of course he wants it to sound good. In the past we have had to be...

Read More »Housing: Elizabeth Warren v. John Cochrane

Housing: Elizabeth Warren v. John Cochrane Noah Smith has a lot of praise for the economic policy proposals from Elizabeth Warren. I’ll mention only one: With costs for shelter eating a bigger piece of Americans’ paychecks, and local government paralyzed by incumbent homeowners, the country needs a big solution. Warren’s would combine incentives for raising zoning density with increased public construction”. This is interesting in light of John...

Read More » Heterodox

Heterodox