Here I go again, commenting on Krugman. But this time on a 5 year old talk on the risk that investors will lose confidence in the solvency of the US Treasury “CURRENCY REGIMES, CAPITAL FLOWS, ANDCRISES”. I think the talk about the risks of excessive budget deficits and unsustainable debt accumulation is much more relevant today than it was in 2013, since Republicans currently in power (not just Trump) will eliminate confidence that the US Treasury...

Read More »March jobs report: surprisingly weak

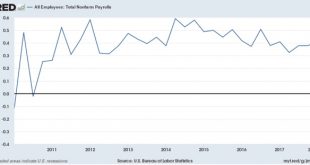

HEADLINES: +103,000 jobs added U3 unemployment rate unchanged at 4.1% U6 underemployment rate fell -0.2% from 8.2% to 8.0% Here are the headlines on wages and the chronic heightened underemployment: Wages and participation rates Not in Labor Force, but Want a Job Now: fell -35,000 from 5.131 million to 5.096 million Part time for economic reasons: fell -141,000 from 5.160 million to 5.019 million Employment/population ratio ages 25-54: fell -0.1%...

Read More »Kudlow’s Trade Coalition of the Willing

Kudlow’s Trade Coalition of the Willing Who knew when I posted this: We could go back to 2002 and how the Authorization for Use of Military Force Against Iraq Resolution of 2002 was sold to people like Senator John Kerry and Senator Hillary Clinton. The Bush-Cheney White House sold this as a means to encourage Iraq to comply with certain UN resolutions and not necessarily a prelude to war. Of course the White House was lying as we knew by March 2003. Of...

Read More »Trump’s Trade War, Stranded Assets, and Wilbur Ross’s Shipping Company

Trump’s Trade War, Stranded Assets, and Wilbur Ross’s Shipping Company Paul Krugman relates declines in stock valuations to the insanity of trade policy from Donald Trump and taught me a new expression – stranded asset: An asset that is worth less on the market than it is on a balance sheet due to the fact that it has become obsolete in advance of complete depreciation. Paul notes: Yet there is a reason why stock prices might overshoot the overall...

Read More »Evergreen Looks in the Mirror and Says It’s OK

Evergreen Looks in the Mirror and Says It’s OK The “Independent” External Review Panel on The Evergreen State College Response to the Spring 2017 Campus Events (quotes not in the original) just released its report, and it says that everything campus administration has done in connection with this episode and everything it is now doing in response to it is beyond reproach. It repeats the arguments of the college’s “equity” faction (again my quotes—it has...

Read More »Our Depleted National Defense Budget?

Our Depleted National Defense Budget? Our title is perhaps the most obnoxious line in the Hoover Five oped per some of the appropriately harsh comments to Cochrane’s post, which alas I did not cover here. Before I do so, let me turn the microphone over to Jonathan Chait: It is a foundational belief of Republican Party doctrine that tax cuts cannot have any adverse impact on the national debt. Indeed, Republicans have invented a new language in which...

Read More »A note on personal income and spending

A note on personal income and spending Personal income and spending data from February intimates a weak Q1 GDP report, but doesn’t suggest any imminent downturn. The first graph below compares real personal spending with real retail sales: Real retail sales have pulled back from their autumn surge, and real personal spending has also declined slightly from its last peak in December. But we’ve had similar small drawbacks before, as in early 2012 and...

Read More »Why “Entitlement” Cuts and Not Tax Increases Again?

Why “Entitlement” Cuts and Not Tax Increases Again? John Cochrane has to remind us that he co-authored a really bizarre oped: Unless Congress acts to reduce federal budget deficits, the outstanding public debt will reach $20 trillion a scant five years from now, up from its current level of $15 trillion. That amounts to almost a quarter of million dollars for a family of four, more than twice the median household wealth. This string of perpetually rising...

Read More »Globalization

The story of globalization from a US point of view continues. Here AB reader Denis Drew is highlighted at DeLong’s website: Paul Krugman on globalization Brad DeLong asks ‘what did PK miss?’ Comment of the Day: Dennis Drew: GLOBALIZATION: WHAT DID PAUL KRUGMAN MISS?: “I’m always the first to say that if today’s 10 dollars an hour jobs paid 20 dollars an hour… …(Walgreen’s, Target, fast food less w/much high labor costs) that would solve most social...

Read More »The Coordinated Activity Theory of the Firm

The Coordinated Activity Theory of the Firm I just got around to posting this paper on SSRN, although it was written a couple of years ago. I need to cite it for other work I’m currently doing, so it has to be out there, somewhere. It is a more concise version of the theory than previous renditions and stays closer to the main point. What it shows: There is a simple explanation for why firms exist, why they have the boundaries they have, and why they...

Read More » Heterodox

Heterodox