This does nothing apart from supporting their policy rate: Port Traffic Grew at Slowest Rate Since Recession in 2015 Container traffic rose only 0.8% last year at the 30 busiest ports worldwide, the smallest increase since 2009, according to an estimate by AlphalinerBy Robbie WhelanJan 4 (WSJ) — Container traffic at the world’s busiest ports grew last year at its slowest rate since the recession, according to an estimate by Alphaliner, a shipping industry data provider.Demand was held back...

Read More »Atlanta Fed, US current account, Philly Fed

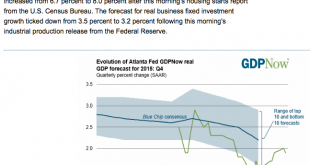

Blue chip consensus dropping quickly now, and today won’t help any:Remember a year ago when they said the oil price drop would be an unambiguous positive for the trade balance?;) Anyway, this is weak dollar stuff, vs the euro area current account surplus, which is strong euro stuff: Current AccountHighlightsThe nation’s current account deficit widened sharply in the third quarter, to $124.1 billion from a revised $111.1 billion in the second quarter. This is the widest gap of the recovery,...

Read More »Saudi oil pricing, import and export prices, Japan Manufactures’ sentiment

Not a lot of change for January, most ‘discounts’ still at or near the wides, so price action likely to be more of same:Something the Fed takes into consideration: Import and Export PricesHighlightsCross-border price pressures remain negative with import prices down 0.4 percent in November and export prices down 0.6 percent. Petroleum fell 2.5 percent in the month but is not an isolated factor pulling prices down as non-petroleum import prices fell 0.3 percent in the month. Agricultural...

Read More »Payrolls, Trade

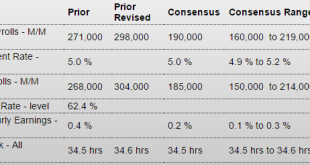

The growth rate continues to decelerate (see chart): NFP HighlightsPayroll growth is solid and, though wages aren’t building steam, today’s employment report fully cements expectations for December liftoff. Nonfarm payrolls rose a very solid 211,000 in November which is safely above expectations for 190,000. And there’s 35,000 in upward revisions to the two prior months with October now standing at a very impressive 298,000. The unemployment rate is steady and low at 5.0 percent with the...

Read More »Lumber Prices, Small Business Index, Import Export Prices, Redbook Retail Sales, Wholesale Trade

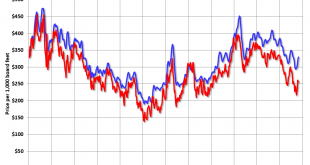

Along with most indicators, this one turned south as oil capex collapsed: Update: Framing Lumber Prices down Sharply Year-over-year Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).Prices didn’t increase as much early in 2014 (more supply, smaller...

Read More »Saudi Output, Mtg Purchase Apps, NY ISM, ADP, International Trade, PMI services, ISM Non-manufacturing, Motor Vehicle Sales

If the Saudis are looking to pump more seems they have to continue to lower prices:Sure looks like housing still can’t get out of its own way: MBA Mortgage ApplicationsHighlightsMortgage applications are settling down after spiking and dipping sharply in volatility tied to new disclosure rules put in place last month. Both the purchase and refinance indexes fell an incremental 1.0 percent in the October 30 week with the purchase index up a very solid 20 percent year-on-year. Rates were...

Read More »Crude Oil, Euro, Opec Spending Cuts

So when the Saudis widened their discounts on October 5 it looked to me like they were inducing a downward price spiral that would continue until either they altered pricing or their output increased to full capacity so they couldn’t sell any more at those discounts. So far neither has happened: Fundamentally the euro also looks very strong to me, with a large and rising trade surplus vs a rising trade deficit for the US, and negative rates and QE ultimately further remove euro income from...

Read More »Draghi Comments, Global Comments

ECB will do what is needed to keep inflation target on track: Draghi By Stephen JewkesOct 31 (Reuters) — “If we are convinced that our medium-term inflation target is at risk, we will take the necessary actions,” ECB president Draghi told Il Sole 24 Ore. “We will see whether a further stimulus is necessary. This is an open question,” he said, adding it would take longer than was foreseen in March to return to price stability. Draghi said inflation in the euro zone was expected to remain...

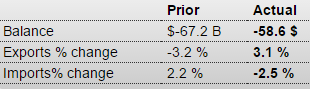

Read More »US Trade

This is just for ‘goods’ but seems to be counter to all other releases reporting weak exports, but it has been zig zagging it’s way lower and August was particularly weak. And note the weakness in car imports: International trade in goodsHighlightsSeptember reversed August’s outsized goods trade gap, coming in at $58.6 billion vs $67.2 billion. Exports jumped 3.1 percent following August’s 3.2 percent decline with wide gains in consumer goods, autos, industrial supplies and capital goods....

Read More »Euro Trade Surplus, Euro Inflation

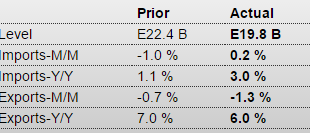

Trade surplus still trending higher along with deflation both make the euro ‘harder to get’ and ‘more valuable’: European Union : Merchandise TradeHighlightsThe seasonally adjusted merchandise trade balance returned a E19.8 billion surplus in August after an unrevised E22.4 billion excess in July. This was the least black ink since March. The unadjusted surplus was E11.2 billion, up from E7.4 billion in August 2014.The headline reduction reflected mainly a 1.3 percent monthly fall in...

Read More » Heterodox

Heterodox