If there is one industry Brexit has stimulated, it is the production of daft ideas for regenerating the UK economy after its exit from the EU. Many of the offerings have been from people who really like the idea of Britain becoming a European version of Singapore. But the left wing is not short of silly schemes either. This one, from businessman and self-styled economist John Mills, is one of the silliest I have seen.John Mills is chairman of John Mills Limited (JML). On his biography,...

Read More »More on productivity

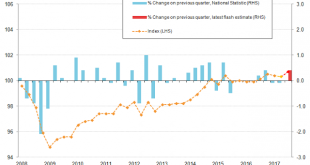

The ONS's latest flash productivity estimate is rather good. Productivity in Quarter 3 2017 was up by 0.9% on the previous quarter. Here's what ONS has to say about it: Output per hour growth in Quarter 3 2017 was the result of a 0.4% increase in gross value added (GVA) (using the preliminary gross domestic product (GDP) estimate) accompanied by a 0.5% fall in total hours worked (using the latest Labour Force Survey data). This fall in total hours was driven primarily by a 0.5% fall in...

Read More »Simon Wren-Lewis — Dani Rodrik talks straight on trade

Short review of Dani Rodrik's latest book, Straight Talk on Trade: Ideas for a Sane World Economy. In that sense the title of the book is rather misleading. Although it is discussed a lot, this is hardly just a book about trade. Indeed the subtitle “Ideas for a sane world economy” conveys a better picture of what it is about. The book is based on a collection of articles written for Project Syndicate and elsewhere, and occasionally the joins show. But that feeling quickly gets lost in a...

Read More »Peter Cooper — Open Economy Considerations: The Balance of Payments

One suggestion in the comments to the ongoing “short & simple” series is to cover the balance of payments. This will be covered at some point in the introductory series, but I am still considering how best to present it in brief, simple form. With that in mind, it seemed worth attempting a regular post on the topic. The post is still intended to be elementary in nature, but is perhaps at about the introductory university level. The post is also too long to qualify as “short”, even...

Read More »Zero Hedge — China Launches Yuan-Ruble Payment System

In the latest push for convergence, China has established a payment versus payment (PVP) system for Chinese yuan and Russian ruble transactions in a move to reduce risks and improve the efficiency of its foreign exchange transactions. The PVP system for yuan and ruble transactions, designed to streamline commerce and curency transactions between the two nations, was launched on Monday after receiving approval from China’s central bank, according to a statement by the country’s foreign...

Read More »Ken Moak — US the likely loser of trade war with China

Continuation of part one, previously linked to here at MNE. Asia TimesUS the likely loser of trade war with ChinaKen Moak

Read More »Sooo…I have a bit of a confession to make- I’ve…

Sooo…I have a bit of a confession to make- I’ve established a bit of a cottage industry tutoring students in the course I taught while I was in grad school. Not gonna lie, it’s pretty nice to be seen as an advocate as opposed to the thing between the student and the grade that the student wants, in part because students are more willing to admit what they find confusing to me than to their “real” instructors. As a related project, I figured it would make sense to create videos for the items...

Read More »Tariffs, trade and money illusion

In the past few days, I have read three pieces from Economists for Brexit - now renamed "Economists for Free Trade" - extolling the virtues of "hard" (or "clean") Brexit and calling for the UK to drop all external tariffs to zero unilaterally after Brexit. Two are written by professors of finance (Kent Matthews and Kevin Dowd). The third is from the veteran economist Patrick Minford.All three of these pieces wax lyrical about the benefits to GDP and welfare from unilaterally reducing...

Read More »The “German Problem” Is Not a Problem for Anyone to Worry About. Or Is It?

It took a very long time. Too long. But just in time for the recent G20 meeting in Hamburg on July 7-8, The Economist’s cover page story featured Germany’s persistent current account surpluses as the world community’ new “German problem”; supposedly an issue of foremost interest to the G20. In fact, Germany has run up current account surpluses exceeding 4 percent of GDP in each and every year since 2004. For the last couple of years Germany’s surpluses even exceeded 8 percent of GDP....

Read More »Why Macron Should Not (and Cannot) Follow the German Model

Jörg Bibow | June 2, 2017 The Economist‘s analysis of Germany’s job market miracle of the past ten years offered in “What the German economic model can teach Emmanuel Macron” is more balanced than the usual accounts one hears in Germany itself. Germans are in love with the idea that structural reform of their labor market and persistent budgetary austerity were solely responsible for the German economy’s superior performance...

Read More » Heterodox

Heterodox