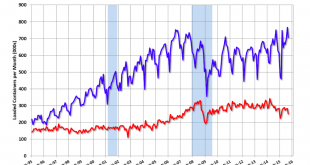

September 2015 Sea Container Counts Show Trade Recession Continues By Steve HansenOct 15 — The data for this series continues to be less than spectacular – and both imports and exports are in contraction. The year-to-date volumes are contracting for both exports and imports. We can safely say trade is in a recession. Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending...

Read More »Exports, Bank Revenues, Chips, Japan, Mtg Purchase Apps, Oil Comment

At U.S. Ports, Exports Are Coming Up Empty Oct 13 (WSJ) — In September, the Port of Long Beach Calif. handled 197,076 outbound empty boxes. September was the eighth straight month in which empty containers leaving Long Beach outnumbered those loaded with exports. Last month, however, Long Beach and the Port of Oakland both reported double-digit gains in exports of empty containers. So far this year, empties at the two ports are up more than 20% from a year earlier. Long Beach’s...

Read More »China trade, WRKO interview

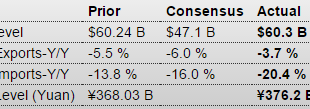

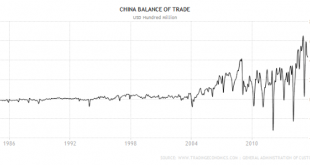

Total trade is down, but the surplus is still high and holding, which ultimately supports the currency: China : Merchandise Trade Balance Highlights Every month China’s trade data are reported in both the renminbi and U.S. dollars by the National Bureau of Statistics. The renminbi report comes out first, followed about an hour later by the more closely-watched U.S. dollar report. Since the August 11 devaluation of the renminbi there is a wider discrepancy between the two sets of data...

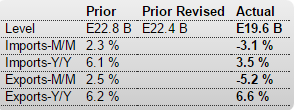

Read More »German Trade, Japan

Exports down but so are imports, indicating a weak global economy and continued euro support from trade net flows: Germany : Merchandise Trade German exports plunge at fastest pace since global financial crisis Oct 8 (Reuters) — German exports plunged in August. Data from the Federal Statistics Office showed seasonally-adjusted exports sliding by 5.2 percent to 97.7 billion euros month-on-month, the steepest drop since January 2009. Imports tumbled by 3.1 percent to 78.2 billion...

Read More »Exports, News Headlines, Atlanta Fed, German Comment

They say its the strong $ that’s hurting exports. I say it’s the drop in oil related capex after the price collapse: This is what news headlines have been looking like (not good): From Rüdiger (top German Specialist) research: German new business orders for August were broadly lower. Compared to July, which was revised downward, they fell a seasonally adjusted 2.1pc. Compared to August 2014 orders rose 3.4pc. However, there are two critical factors behind this figure....

Read More »If we don’t understand both sides of China’s balance sheet, we understand neither

In-depth analysis on Credit Writedowns Pro. By Michael Pettis originally published on 1 September 2015. With so much happening in China in the past month it seems that there are a number of very specific topics that any essay on China should focus. I worry, however, that we get so caught up staring at strange clumps of trees that we risk losing sight of the forest. What happened in July this year, and again in August, or in June 2013, or a number of other times, were not unexpected shocks...

Read More »“Quantitative Tightening” is a myth

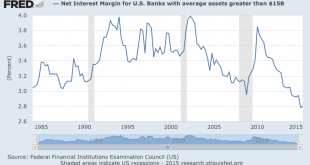

(But that doesn't mean we don't have a problem).Deutsche Bank has frightened everyone by warning that if China sold substantial quantities of US Treasuries (USTs) to support the yuan, this would amount to a substantial tightening of US monetary policy.The reason why China accumulated USTs in the first place was because of its trade surplus: The excess of exports over import sucked dollars into China, where the People’s Bank of China (PBoC) exchanged them for domestic currency (yuan). The...

Read More »A Finnish cautionary tale

Eurozone growth figures came out today. And they are horribly disappointing. Everyone undershot, apart from Spain which turned in a remarkable 1% quarter's growth, and Greece which somehow managed an even more incredible 0.8% (yes, I will write about this, but not in this post). France didn't grow at all, Italy all but stagnated at 0.2%, and even the mighty Germany only managed 0.4%. Despite low oil prices, falling commodity prices, weak Euro and the ECB's QE programme, Eurozone...

Read More »Internal and external balance of savings and investment

I was recently asked by an Australian economics journal to write a review of a book I had already read, The Leaderless Economy, by Peter Temin and David Vines (published in 2013). Because the book is a great place from which to start a discussion on the links within the global economy, I decided to base this essay on the book. I had already read Peter Temin’s Lessons from the Great Depression (1991), The Roman Market Economy (2012), and Prometheus Unshackled (2013), and I know his work...

Read More » Heterodox

Heterodox