It's weird. Whenever I say that floating exchange rates can't absorb all shocks and that balance of payments crises can happen even in fiat currency systems, I am accused of gold standard thinking. Gold standard? Me? Perish the thought. I am the world's biggest fan of fiat currencies. And of floating exchange rates, too. But that doesn't mean I regard them as a panacea.Firstly, about gold standards. Under a strict gold standard, the quantity of money circulating in the economy is...

Read More »GDP, Trade, Personal income and outlays, Consumer sentiment, China deficit spending, 7DIF, US surveys, German business morale

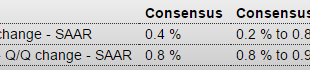

Revised up but for the worst reasons possible- unsold inventories were higher. Also, consumption expenditures were a bit lower, and note the deceleration of GDP growth on the chart. And in all likelihood Q1 GDP is now being reduced by inventory liquidation substituting for production: GDPHighlightsAn upward revision to inventory growth made for an upward revision to the second estimate of fourth-quarter GDP, to an annualized plus 1.0 percent rate for a 3 tenths increase from the initial...

Read More »Britain, Brexit, and sovereignty

In-depth analysis on Credit Writedowns Pro. You are here: Political Economy » Britain, Brexit, and sovereignty By Marc Chandler originally posted at Marc’s blog, Marc to Market As the European Union grew, the unanimity in decision-making increasingly gave way to qualified majority voting. This development took away an important weapon the UK deployed to pursue its national interest. It use often to frustrate the collectivist decision-making in Brussels and...

Read More »Inventories, Payrolls, Trade

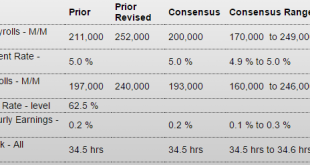

This is getting out of control. Sales are slowing faster than inventories are being sold.A weak print and year over year growth continues to decelerate as per the chart: Employment SituationHighlightsHeadline weakness masks an otherwise solid employment report for January. Nonfarm payrolls rose 151,000 vs expectations for 188,000. December was revised 30,000 lower to 262,000 but November was revised 28,000 higher to 280,000. Now the signs of strength as the unemployment rate fell 1 tenth to...

Read More »The trade effect of negative interest rates

Yesterday, HSBC prepared the ground for imposing negative rates on business depositors. This is an excerpt from HSBC's letter announcing the necessary change to the Terms & Conditions of HSBC business accounts: Now, this requires some explanation. Firstly, the change applies only to BUSINESS accounts. Retail depositors are unaffected. Secondly, it applies only to currency accounts, not sterling accounts. And thirdly, despite HSBC's mention of "negative rates set by central...

Read More »Why China cares about Japan’s negative rates

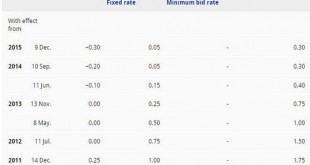

In-depth analysis on Credit Writedowns Pro. By Frances Coppola originally posted at Coppola Comment Japan has just introduced negative rates on reserves, following the example of the Riksbank, the Danish National Bank, the ECB and the Swiss National Bank. The Bank of Japan has of course been doing QE in very large amounts for quite some time now, and interest rates have been close to zero for a long time. But this is its first experiment with negative rates. The new negative rate...

Read More »Japan, China, Fed comment, Capex cutbacks, South Korea

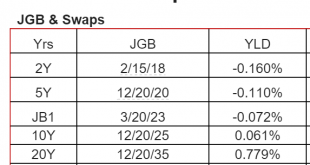

This is the yen yield curve after over 20 years of a 0 rate policy, massive QE, and now negative overnight rates. Maybe now the economy will finally respond.:( (And how good can the BOJ think the economy is?) The western educated kids/monetarists who’ve taken control don’t seem to be doing all that well, as China begins to look like the other countries they’ve taken over, like the EU, US, etc. etc. etc. What they learned is that it’s about balancing the federal budget and using monetary...

Read More »Japan’s negative rates: the China connection

Japan has just introduced negative rates on reserves, following the example of the Riksbank, the Danish National Bank, the ECB and the Swiss National Bank. The Bank of Japan has of course been doing QE in very large amounts for quite some time now, and interest rates have been close to zero for a long time. But this is its first experiment with negative rates. The new negative rate framework is complicated, to say the least. The Bank of Japan has helpfully produced a pretty picture to...

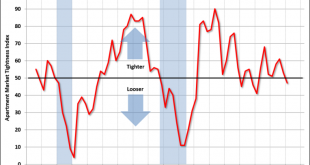

Read More »Apartment market tightness, Euro area trade surplus, Spain

This just keeps going up, which fundamentally tends to drive up the euro which tends to continue to be subject to said upward pressure until the trade picture reverses: Euro Area Balance of TradeThe Eurozone trade surplus increased to €23.6 billion in November of 2015 compared to a €20.2 billion surplus a year earlier. Exports recorded the highest annual gain in four months and imports rebounded. Potential showdown that could drive up Spanish rates: Guindos Ditches Pledge on Spain...

Read More »Jobs, Wholesale trade, China, Rail traffic

Anyone notice that the annual growth rate of employment continues the deterioration that began with the collapse in oil capex?Or that, once again, it looks like most all the new jobs were taken by people previously considered out of the labor force?And the anemic wage growth also contributes to the narrative of a continuously deteriorating plight for people trying to work for a living: Employment SituationHighlightsThe labor market is stronger than most assessments with December results...

Read More » Heterodox

Heterodox