from Lars Syll The world is made up of systems. Our body is a system, or in fact a system of systems. What we call “society” is another system of systems, as is the natural environment … But these systems are very complex, difficult to explain or predict. One successful strategy, which has had a revolutionary impact on how we live, is analysis … By biting off chewable portions of a much larger world, science makes it possible to achieve progress in our understanding of how things work...

Read More »Paying for the Pandemic

My contribution to the latest issue of Arena Quarterly I’m checking about online access. Share this:Like this:Like Loading...

Read More »Here’s my latest …

email news Share this:Like this:Like Loading...

Read More »Jeffrey Sachs’ (2021) speech at the UN

[embedded content]

Read More »Modern macro — ‘genuine plurality’ vs. ‘axiomatic variation’

from Lars Syll The DSGE mainstream — which is made up of new classical macroeconomics and neo-Keynesianism — is unanimously based on the core assumptions that characterize the paradigm of social exchange theory. These are rationality, ergodicity and substitutionality, the exclusive acceptance of a formal mathematical-deductive, positivist reductionism. After the ‘empirical turn’ of the last two or three decades, these have been combined with sophisticated micro- and macroeconometrics, or...

Read More »Open thread Sept. 7, 2021

How dynamic is global capitalism?

from C. P Chandrasekhar and Jayati Ghosh Capitalism is supposed to be all about economic growth, through the dynamism that is created by competition. This growth is meant to be driven by investment (or accumulation) which in turn is used to justify the shares of national income that are delivered to private profits, to the owners of capital. “Accumulate, accumulate! That is Moses and the prophets” famously said a certain Karl Marx in the first volume of Capital more than 150 years ago. It...

Read More »Investing During Inflation

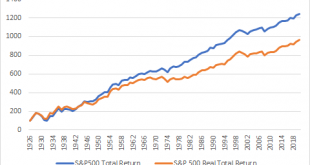

Recently I have been looking at whether inflation might be in the pipeline. The jury is still out on that, but caution would be wise given the current situation. That leads to a rather obvious question: what should investors do during an inflation? First off, if we are to be naive stock investors, how much does inflation impact stock market returns? We can see the impact in the following chart. But this chart simply does not capture the pain investors feel during proper...

Read More »On logic and science

from Lars Syll That logic should have been thus successful is an advantage which it owes entirely to its limitations, whereby it is justified in abstracting — indeed, it is under obligation to do so — from all objects of knowledge and their differences, leaving the understanding nothing to deal with save itself and its form. But for reason to enter on the sure path of science is, of course, much more difficult, since it has to deal not with itself alone but also with objects. Logic,...

Read More »Market-value in the news

from Edward Fullbrook Over the weekend I read two articles (1, 2) in The Guardian about market-value. One concerned the painter Bansky, the other a truffle hunter in Croatia. I’ve been fan of Bansky for twenty years, beginning when he was a local graffiti artist in my part of town. A couple of years ago one of his paintings, Girl With Balloon, was auctioned at Sotheby’s in London for £1.1m. As soon as the auctioneer’s hammer fell, Bansky’s canvass “passed through a secret shredder...

Read More » Heterodox

Heterodox