Covid dip, recovery, and now a decline: Covid dip, recovery, and now sideways at levels of some 25 years ago when there were a lot fewer people: Through June,Saudis caused the big dip and recovery, then attempted to stabilize.The most recent Reuters report suggested price increases vs benchmarks,which is a move to firm prices over time:

Read More »Open thread July 20, 2021

Tags: open thread

Read More »The drug companies are killing people

from Dean Baker I get to say this about the drug companies, now that President Biden has said that Facebook is killing people because it was allowing people to use its system to spread lies about the vaccines. There is actually a better case against the drug companies. After all, they are using their government-granted patent monopolies, and their control over technical information about the production of vaccines, to limit the supply of vaccines available to the world. As a result, most...

Read More »What to do when you’re wrong

We all get things wrong from time to time, particularly in relation to fast moving events like the pandemic. So, how can you respond when this happens. Here’s a list of possibilities, generally from best to worst in terms of intellectually responsibility and from least to most common in terms of frequency Admit error, look at why you were wrong, try and do better next time (let’s get real, we are talking about human beings here. this almost never happensGo quiet for a while, and...

Read More »Weekend Read – Econometrics — science based on unwarranted assumptions

from Lars Syll There is first of all the central question of methodology — the logic of applying the method of multiple correlation to unanalysed economic material, which we know to be non-homogeneous through time. If we are dealing with the action of numerically measurable, independent forces, adequately analysed so that we were dealing with independent atomic factors and between them completely comprehensive, acting with fluctuating relative strength on material constant and homogeneous...

Read More »Open thread July 16, 2021

One failure too many

That’s the title of my latest piece in Inside Story , also printed in the Canberra Times under the headline Sydney’s coronavirus outbreak highlights hard choices“” Key para Poor understanding of uncertainty was evident in the rush to label New South Wales as the gold standard and assume that a handful of successes was evidence that there was nothing to worry about. This conclusion didn’t take account of the fact that the policy could not afford even one failure. All high-risk...

Read More »The concept of homeostasis

from Ken Zimmerman (originally a comment) On the one side were those who believed that the existing economic system is in the long run self-adjusting, though with creaks and groans and jerks, and interrupted by time-lags, outside interference and mistakes … These economists did not, of course, believe that the system is automatic or immediately self-adjusting, but they did maintain that it has an inherent tendency towards self-adjustment, if it is not interfered with, and if the action...

Read More »The failure to start from real, concrete questions and issues in the real world

from Gerald Holtham (originally a comment) The biggest problem, it seems to me, is not the tools that economists use but the failure to start from real, concrete questions and issues in the real world. Someone builds a model of a real situation. It may be useful or not but if it is ingenious it gets published. People then play tunes on the model; they seek to “generalise” it in various ways. We embark on a process of theoretical development for its own sake, increasingly divorced from...

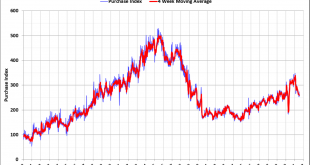

Read More »Weekly Indicators for July 5 – 9 at Seeking Alpha

by New Deal democrat Weekly Indicators for July 5 – 9 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. To the surprise of many, interest rates have gone down in the past few weeks, to the point where they have resumed being a positive in my long leading model. Meanwhile, as the “delta wave” of COVID builds in the unvaccinated States, once again the pandemic will begin to assert control over the economy, at least as to...

Read More » Heterodox

Heterodox