Let’s not forget that she once played a union worker, in ‘The pajama game’. With the song ‘racing with the clock‘. Also, here a blogpost of mine about how in ‘The Age of Doris Day’ apt new institutions enabled everybody to work less and have better lives, in stead of a part of the population being entirely unemployed and miserable.

Read More »Modern economics is sick

from Lars Syll Modern economics is sick. Economics has increasingly become an intellectual game played for its own sake and not for its practical consequences for understanding the economic world. Economists have converted the subject into a sort of social mathematics in which analytical rigour is everything and practical relevance is nothing … If there is such a thing as “original sin” in economic methodology, it is the worship of the idol of the mathematical rigour invented by Arrow and...

Read More »DSGE models can be even worse in practice

from David Richardson There have been numerous postings on this blog that go the problems associated with dynamic stochastic general equilibrium models. Most of these posts have questioned their use in the hands of the high priests of the orthodox economics profession. For example, Lars Syll has said “DSGE models are simply — from both empirical and methodological points of view — not suited for understanding modern monetary economies” (28 Nov 2018). I have no argument at all with this...

Read More »Economists have no ears

from Steve Keen Thomas Kuhn once famously described textbooks as the vehicle by which students learn how to do “normal science” in an academic discipline. Economic textbooks clearly fulfil this function, but the pity is that what passes for “normal” in economics barely deserves the appellation “science”. Most introductory economics textbooks present a sanitised, uncritical rendition of conventional economic theory, and the courses in which these textbooks are used do little to counter...

Read More »Inequalities, societies and “alternative facts”

from Ken Zimmerman There are inequalities and then there are inequalities. In any society, some members are taller, smarter, run faster, are better at math, build houses better, etc. than other members. In most societies these are not converted into inequalities in food, clothing, housing, wealth, and the other necessities for staying alive. And they have little effect on one’s status and prestige and power within the society. Durkheim wrote about it. It’s called “division of labor.”...

Read More »Open thread May 10, 2019

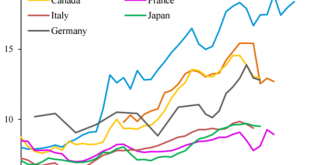

Share of income earned by Top 1 Percent, 1975-2015 – 7 countries

Trade wars: Easy to win?

The trade war between the US (or rather the Trump Administration) and China (or rather Xi Jinping) is heating up again. The standard view seems to be that, because of the massive imbalance in merchandise trade between the two countries, Trump has the advantage. China could retaliate by dumping US bonds, but this is seen as a weapon too dangerous to use. I don’t think this exhausts the options. As we’ve seen in Australia, the Chinese government can do all sorts of things to...

Read More »Debunking NAIRU

from Lars Syll In our extended NAIRU model, labor productivity growth is included in the wage bargaining process … The logical consequence of this broadening of the theoretical canvas has been that the NAIRU becomes endogenous itself and ceases to be an attractor — Milton Friedman’s natural, stable and timeless equilibrium point from which the system cannot permanently deviate. In our model, a deviation from the initial equilibrium affects not only wages and prices (keeping the rest of...

Read More »The Fallacy of the Natural Rate of Interest and Zero Lower Bound Economics: Why Negative Interest Rates May not Remedy Keynesian Unemployment

This paper provides a critique of zero lower bound (ZLB) economics which has become the new orthodoxy for explaining stagnation. ZLB economics is an extension of pre-Keynesian economics which attributes macroeconomic dysfunction to rigidities and market imperfections. The ZLB is the latest rigidity in that pre-Keynesian tradition. The paper argues negative nominal interest rates, even […]

Read More » Heterodox

Heterodox