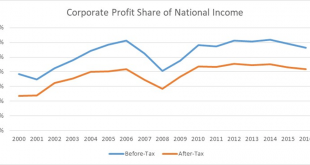

from Dean Baker That’s the implication of this CNBC piece that claims that hiring is down because businesses can’t find qualified workers. If this is really the problem, then the solution, as everyone learns in intro economics, is to raise wages. For some reason, CEOs apparently can’t seem to figure this one out, since wage growth remains very modest in spite of this alleged shortage of qualified workers. Businesses should be well-positioned to absorb higher wages since their profits have...

Read More »The LDP: Trumpism in Australia

The reaction to Senator David Leyonhjelm’s recent attacks on women have mostly focused on Leyonhjelm personally. If he were a private citizen or an independent member of Parliament, that would make sense, and would lead to the conclusion that best thing to do is to ignore him. In fact, however, Leyonhjelm is the most senior elected representative of the Liberal Democratic Party, a national political party. His statements on the matter give his position as Parliamentary leader of the...

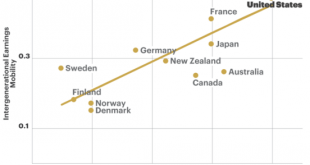

Read More »The Great Gatsby Curve

from The Atlantic Economists represent this concept with a number they call “intergenerational earnings elasticity,” or IGE, which measures how much of a child’s deviation from average income can be accounted for by the parents’ income. An IGE of zero means that there’s no relationship at all between parents’ income and that of their offspring. An IGE of one says that the destiny of a child is to end up right where she came into the world.

Read More »Open thread July 6, 2018

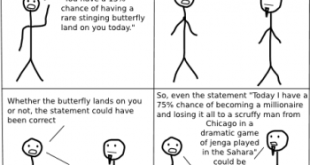

So much for ‘statistical objectivity’

from Lars Syll Last year, we recruited 29 teams of researchers and asked them to answer the same research question with the same data set. Teams approached the data with a wide array of analytical techniques, and obtained highly varied results … All teams were given the same large data set collected by a sports-statistics firm across four major football leagues. It included referee calls, counts of how often referees encountered each player, and player demographics including team...

Read More »A Tale of Three Classes in the USA

from The Atlantic Saez / Zucman

Read More »The indiscreet aggression of the bourgeoisie

from C. P. Chandrasekhar Neoliberal economic policy—the framework of measures that preaches market fundamentalism but uses the state to engineer a redistribution of income and assets in favour of finance capital and big business—has lost its legitimacy. A huge financial crisis and a decade of recession or low growth, that have hurt most sections except the elite 1 per cent, have convinced the majority in many countries that neoliberalism is no alternative. That change in mood was revealed...

Read More »The mess at the heart of the EU

from Lars Syll The EU establishment has been held to account for the euro mess, for austerity policies that turned recession into depression, for the galloping inequality, and for the millions and millions of unemployed. The EU austerity policies bread understandable and righteous anger — but also ugly far-right xenophobic political movements taking advantage of the frustration that austerity policies inevitably produce. Ultimately this underlines the threats to society that austerity...

Read More »Finding a progressive methodology

from Asad Zaman Ever since the Global Financial Crisis, there have been an increasing number of voices calling for change in the economics curriculum/syllabus. However, even people who are sharply critical of mainstream (Rodrik, Stiglitz, Krugman) merely suggest minor and peripheral changes, and do not question the fundamental methodological basis on which neoclassical economics rests. In fact, a radical paradigm shift is required. According to current nominalist methodology, any model...

Read More »Three-day Workweeks and Four-day Weekends

David Gelles interviewed Richard and Holly Branson for The New York Times Saturday David Gelles (NYT): What do you think those in positions of power should do to address social problems like income inequality? Richard Branson: A basic income should be introduced in Europe and in America. It’s great to see countries like Finland experimenting with it in certain cities. It’s a disgrace to see people sleeping on the streets with this material wealth all...

Read More » Heterodox

Heterodox