from Lars Syll The Coin-tossing Problem My friend Bengt says that on the first day he got the following sequence of Heads and Tails when tossing a coin: H H H H H H H H H H And on the second day he says that he got the following sequence: H T T H H T T H T H Which day-report makes you suspicious? Most people I ask this question says the first day-report looks suspicious. But actually, both days are equally probable! Every time you toss a (fair) coin there is the same probability (50 %)...

Read More »Response to “Janus”: Take their intellectual “property”

from Dean Baker For the last four decades, the right has been actively working to rig the rules to undermine progressives both politically and economically. They aren’t just interested in winning an election; they want to destroy any basis for progressive change. This is why they have been so intent on attacking unions. Unlike many centrist Democrats, the right realizes that the labor movement has been at the center of most progressive change in the last century. This is why Reagan made...

Read More »“They aren’t laws of nature”

from David Ruccio Nicola Headlam is, I think, right with respect to “how the rules of the economy are set”: “Somehow, someone, somewhere made these rules up. They aren’t laws of nature.” And they determine “who’s got what and where and why”. The question is, how do we teach economics so that that message gets through? Aditya Chakrabortty [ht: ja] reports on one way of doing it—a makeshift classroom in a converted church, with nine “lay people” and two facilitators (Headlam and Anne Hines,...

Read More »Sandpit

A new sandpit for long side discussions, conspiracy theories, idees fixes and so on. Like this:Like Loading...

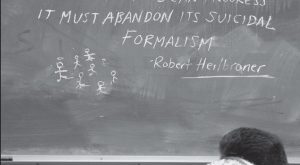

Read More »Paul Krugman — a math-is-the-message-modeler

from Lars Syll In a post on his blog, Paul Krugman argues that ‘Keynesian’ macroeconomics more than anything else “made economics the model-oriented field it has become.” In Krugman’s eyes, Keynes was a “pretty klutzy modeler,” and it was only thanks to Samuelson’s famous 45-degree diagram and Hicks’ IS-LM that things got into place. Although admitting that economists have a tendency to use ”excessive math” and “equate hard math with quality” he still vehemently defends — and always has —...

Read More »We face disasters on every front

from Neva Goodwin and RWER issue #84 The need for reform is huge – seemingly overwhelming. Yet the motives for reform are springing up all over the place. Maybe this is a moment to be a Pollyanna, rather than a Cassandra: Yes, we face disasters on every front – political, environmental, social – but, as was long ago remarked, nothing so concentrates the mind as the prospect of hanging. The public purpose economy is staggering under the need for reform in education and politics, while the...

Read More »Krugman’s formalization schizophrenia

from Lars Syll In an article published last week, Nicholas Gruen criticized the modern vogue of formalization in economics and took Paul Krugman as an example: He’s saying first that economists can’t see what isn’t in their models – whereas Hicks and pretty much every economist until the late twentieth century would have understood the need for careful and ongoing reconciliation of formal modelling and other sources of knowledge. More shockingly he’s saying that those who smell a rat at...

Read More »By the 1990s, economics was a social scientific discipline fast retreating from a public role

from Michael Bernstein and RWER #84 The transformation of the American political landscape in the wake of Vietnam era had subverted the very foundations of the liberalism that had made sense out of a genuinely public economics. An emphasis on political economic issues that had framed the high tide of activist government since the Great Depression of the 1930s had provided a community of professionals with both the means and the ends to deploy their expertise. As soon as social issues...

Read More »Open thread June 29, 2018

The main reason why almost all econometric models are wrong

from Lars Syll Since econometrics doesn’t content itself with only making optimal predictions, but also aspires to explain things in terms of causes and effects, econometricians need loads of assumptions — most important of these are additivity and linearity. Important, simply because if they are not true, your model is invalid and descriptively incorrect. And when the model is wrong — well, then it’s wrong. The assumption of additivity and linearity means that the outcome variable is,...

Read More » Heterodox

Heterodox