Considering the present architecture of the Eurozone – there is according to Erwan Mahé no obvious way to solve the Italian Euro crisis… From: Erwan Mahé I sent this little collage on 25 May, via IB Bloomberg chat, as the BTP began to decline, since it seemed to sum up the best attitude to take towards the near hysteria afflicting the Italian debt market at the time. From a high of 132.88 on Monday 25 May, it plunged to as low as 120.10 the next day, reflecting a full one per cent rate...

Read More »Open thread June 8, 2018

Swiss sovereign money referendum

from Lars Syll [embedded content] The people behind the proposal in Switzerland are effectively trying to get gold back into the monetary system. This is an extremely bad idea. Eighty-seven years ago Keynes could congratulate Great Britain on finally having got rid of the biggest ”barbarous relic” of his time – the gold standard. He lamented that advocates of the ancient standard do not observe how remote it now is from the spirit and the requirement of the age … [T]he long age of...

Read More »The big bad pension scare.

On Voxeu, Hervé Boulhol and Christian Geppert published an article a about population ageing and pensions which tries to scare us: “on average in the OECD, stabilising the old-age dependency ratio between 2015 and 2050 requires an increase in retirement age of a stunning 8.4 years. This number far exceeds the projected increase in longevity and increases in retirement age driven by pension reforms alone.”. The pension age has to go up. But not for the reasons and by the amount they...

Read More »Krugman’s modelling flimflam

from Lars Syll Paul Krugman has a piece up on his blog arguing that the ‘discipline of modeling’ is a sine qua non for tackling politically and emotionally charged economic issues: You might say that the way to go about research is to approach issues with a pure heart and mind: seek the truth, and derive any policy conclusions afterwards. But that, I suspect, is rarely how things work. After all, the reason you study an issue at all is usually that you care about it, that there’s...

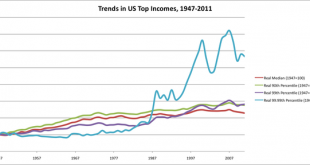

Read More »Long-term trends in U.S. income distribution – 2 graphs

Source: https://asociologist.com/2013/04/12/visualizing-inequality-in-the-us-1947-2011/

Read More »No bubbles on the horizon

from Dean Baker Ever since the collapse of the housing bubble in 2007–2008 that gave us the Great Recession, there has been a large doom and gloom crowd anxious to tell us another crash is on the way. Most insist this one will be even worse than the last one. They are wrong. Both the housing bubble in the last decade and the stock bubble in the 1990s were easy to see. It was also easy to see that their collapse would throw the economy into a recession since both bubbles were driving the...

Read More »Open thread June 5, 2018

From Wicksell to Le Bourva and MMT

from Lars Syll Comparing the limited work of Wicksell, Le Bourva, and MMT, we find that they share many similarities. Obviously, the institutions and issues being discussed have changed during the decades these scholars were writing, yet all three views agree on some fundamental issues. The methodology is quite similar, with a strong focus on balance sheets opposed to theoretical models based on assumptions that are necessary for the mathematics to work. There is also a strong consensus...

Read More »The Bank of Canada should target full employment: 61 economists

On May 28th, 61 Canadian economists (myself included) signed the following letter urging the federal government to instruct the Bank of Canada to consider full employment and not only inflation when conducting interest rate decisions. It was through the great organization of Mario Seccareccia that this was made possible and has received reviews by several media commentators, notably Barrie McKenna and Neil Macdonald. Follow the links for the PDFs of the English letter, French letter. This...

Read More » Heterodox

Heterodox