Brexit GIF

Read More »Durable goods orders, KC fed, Mtg growth, GDP forecasts, ND cutback, Distillate demand

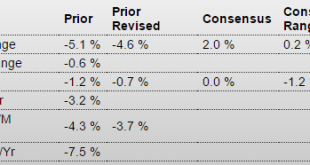

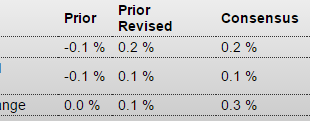

Nice headline, but charts looking like it’s just a ‘volatility’ in a down trend: Durable Goods OrdersHighlightsThe factory sector bounced back strongly in January, indicated first by last week’s industrial production report and now by durable goods orders which are up a very strong 4.9 percent. Aircraft did add to the gain but when excluding transportation equipment, durable orders still rose 1.8 percent. And core capital goods orders, which had been weakening, bounced back strongly with a...

Read More »Richmond Fed, Existing home sales, Consumer confidence, Tsy statement, Tax receipts, Miles driven

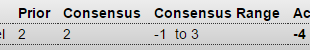

Another worse than expected and details deteriorating as well: Richmond Fed Manufacturing Index A bit better than expected but not the price data, and as the chart shows it’s not going anywhere: Existing Home SalesHighlightsExisting home sales, up 0.4 percent in January to a 5.47 million annualized rate, held on to the bulk of December’s surge. Year-on-year sales growth is in the double digits, at 11.0 percent. In a sign of underlying household strength, the single-family component rose...

Read More »Chicago Fed, Euro portfolio shifts, Startups, Jan mtg data, PMI manufacturing

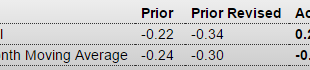

This is volatile so best to go by the 3 mo moving average, as shown on the chart: Chicago Fed National Activity IndexHighlightsDoubts over the outlook may be building but January was a solid month for the economy as the national activity index rose to plus 0.28 from a revised minus 0.34 in December. The gain lifts the 3-month average to minus 0.15 from minus 0.30. It was a jump in industrial production that led January’s charge, lifting the production component which contributed 0.27 to the...

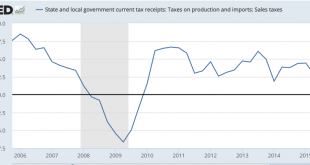

Read More »Cash crunch, State taxes, Income and expendures

It’s all going the wrong way now, with fewer proactively spending more than their incomes to ‘offset’ those desiring to spend less than their incomes. That is, as previously discussed, the private sector tends to be highly pro cyclical: Online lenders see cash crunch By Jon MarinoFeb 19 (CNBC) — A cash crunch is impeding the online lending industry’s growth as the cost of borrowing grows, funds become increasingly scarce and ratings agencies maintain a cautious outlook toward the...

Read More »Jamie Galbraith’s Letter to Former CEA Chairs

Jamie Galbraith has written an excellent letter to the four former Chairs of the Council of Economic Advisers under Clinton and Obama regarding their letter to Professor Gerald Friedman and Senator Bernie Sanders. The full text is below. February 18, 2016 I was highly interested to see your letter of yesterday’s date to Senator Sanders and Professor Gerald Friedman. I respond here as a former Executive Director of the Joint Economic Committee – the congressional counterpart to the CEA....

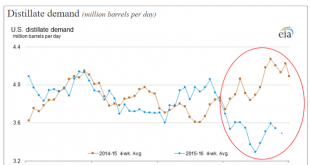

Read More »Distillate demand, WRKO interview, CPI

Looks like the lower oil prices have not increased US demand:Interview: Warren Mosler (Federal Reserve And OECD) First, CPI is historically very low. Second, the deflationary influence of lower energy prices is still working its way through the economy. Third, the chart looks to me like it’s still working it’s way lower Fourth, core CPI is useful as a forecasting tool but the Fed’s mandate is headline inflation: Y/Y: Consumer Price IndexHighlightsConsumer prices are on the rise and the...

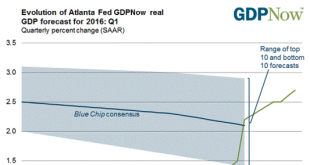

Read More »Atlanta Fed, Japan GDP, Consumer comment. LA port traffic

This is supported by increases in inventories that were already too high and likely to either be revised down or followed buy large declines for the rest of Q1. The retail sales number is also suspect and likely to revert to lower numbers: The Myth Of The Resilient Consumer By Lakshman AchuthanThe premise of incomes powering a consumer-driven pickup in U.S. economic growth is demonstrably false. And for people renting their homes the squeeze is even greater.One clue is the extent of the...

Read More »Retail Sales, Import and Export prices, Business inventories, Consumer sentiment, Japan

Retail SalesHighlightsVehicles are back on top, helping to lift retail sales to a 0.2 percent gain in January. Excluding vehicles and pulled down by falling gas prices, sales inched only 0.1 percent higher. But retail sales excluding gasoline stations — which is a central reading given the price fall — are up 0.4 percent for a very respectable year-on-year gain of 4.5 percent. The reading excluding both autos and gasoline is also up 0.4 percent in the month for a year-on-year rate of plus...

Read More »The Inaugural Financial Fraud Lemons of the Week Award Goes to DOJ

William K. Black February 12, 2016 Bloomington, MN The Bank Whistleblowers United announce the inaugural Financial Fraud Lemons of the Week award. There can be no more fitting recipient than the ironically named Department of Justice (DOJ). The “lemon” is used in the economics and criminology literature to refer to a car of surpassingly terrible quality. The quality is so bad that the car can only be sold through fraud. We will award it each week to an example of dishonesty or...

Read More » Heterodox

Heterodox