from Peter Radford Last week I stirred up a certain curiosity as to why I had lumped Peter Drucker into the same bag as both von Mises and Hayek. Well, simply put, the three of them, along with Karl Popper and Joesph Schumpeter, had an enormous, even oversized, impact on modern economics. Yes economics. Let’s not fall into the same trap as economists do when they, with a sweep of their hands, dismiss business theory as not an aspect of economics. Of course it is. After all if business is...

Read More »Restaurant sales, Bank loans

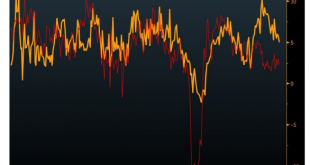

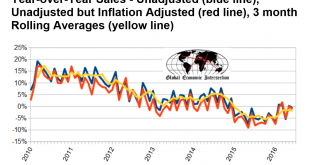

Still decelerating ever since the collapse in oil capex:

Read More »“Wealth helps accumulate more wealth”

from David Ruccio The world economy only grew by 3.1 percent in 2015. But the world’s billionaires did much better. As David Barks, associate director of custom research for Wealth-X, understands, “Wealth helps accumulate more wealth.” According to the latest Wealth-X report on the global billionaire population, the world’s billionaire population grew by 6.4 percent, to 2,473, last year. And their combined wealth increased by 5.4 percent, to a record $7.7 trillion. Needless to say, the...

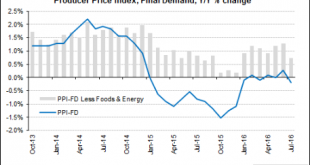

Read More »Producer prices, Retail sales, Business inventories, Consumer sentiment, Saudi output, German, Euro area GDP

Nothing here to get the Fed concerned about inflation: Not good, less then expected and excluding autos, a ‘core reading’ even worse. Seems to me that perhaps the higher gas prices that caused the increases over the last couple of month’s have taken their toll on other spending. And at the macro level, without an increase in either private or public deficit spending top line growth won’t be there: HighlightsConsumers spent their money on vehicles in July but not on much else...

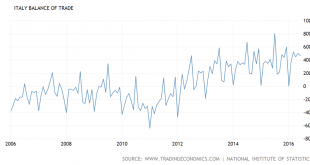

Read More »Italy trade surplus

The euro area trade surplus in general seems to be continuing, even as global trade weakens. Fundamentally this removes net euro financial assets from global markets that were sold by portfolio managers. Those managers include central bankers proactively selling their euro reserves over the last two years or so to buy US dollars, which has in turn kept the euro low enough to drive the surplus:

Read More »Trump, denial and the end of normal

from Peter Radford Shocking is an understatement. Donald Trump is unfit for public office, be it town clerk or president of the US. He’s an unbalanced egomaniac. He’s a racist. He’s an immature misogynist. He’s many other awful things. Presidential, he is not. How did we get here? Failure. But a particular kind of failure. Failure dressed as success. A success so sweeping and deep that we hardly recognize the extent of the change that it wrought. Naturally I am speaking of the victory of...

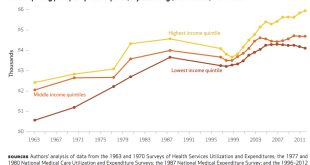

Read More »Trickle-up healthcare

from David Ruccio We’re all familiar with the usual indictment of the U.S. healthcare system: we pay much more and we get much less. For example, according to the Commonwealth Fund: Data from the OECD show that the U.S. spent 17.1 percent of its gross domestic product (GDP) on health care in 2013. This was almost 50 percent more than the next-highest spender (France, 11.6% of GDP) and almost double what was spent in the U.K. (8.8%). Since 2009, health care spending growth has...

Read More »Wholesale sales, Household debt

unadjusted sales rate of growth decelerated 0.9 % month-over-month. unadjusted sales year-over-year growth is down 0.6 % year-over-year unadjusted sales (but inflation adjusted) down 1.2 % year-over-year the 3 month rolling average of unadjusted sales decelerated 0.4 % month-over-month, and down 1,9 % year-over-year. Very modest household credit expansion coincided with very weak growth for the last several quarters: From the NY Fed: Household Debt Balances Increase...

Read More »China, Small business index, Productivity and Labor costs, Redbook retail sales

No sign of increased global demand here: China Exports Slide on Weak Demand By Mark Magnier Aug 9 (WSJ) — China’s General Administration of Customs said Monday that exports fell 4.4% in July year-over-year in dollar terms after a 4.8% decline in June. July imports fell by a greater-than-expected 12.5% from a year earlier, raising concerns over weak domestic demand. This compared with an 8.4% fall in June, the customs agency said. China’s trade surplus widened more than...

Read More »Getting the story straight

from Robert Locke In the Collapse of the American Management Mystique, Oxford UP 1996, I wrote about the rapid decline in American staple industries, “in automobiles and in the related industries of steel, glass, and tires. The total number of workers in the automobile industry declined from 802,800 in December 1978 to 478,000 in January 1983. By 1980 Japan had become the world’s major automobile producing nation. As Japanese replaced American, American automakers world market share...

Read More » Heterodox

Heterodox