OECD secretary general Jose Angel Gurria, US Federal Reserve chair Janet Yellen and British chancellor of the exchequer George Osborne chat during a G20 photocall. Photograph: Rolex Dela Pena/AFP/Getty Images “For the proposition that supply creates its own demand, I shallsubstitute the proposition that expenditure creates its own income” JM Keynes Collected Writings, Volume XXIX, p. 81 G20 Finance Ministers met in Huangzhou, China recently and refused appeals from both the IMF and...

Read More »Manufacturing jobs, Vehicle sales, Govt employees, C and I loans

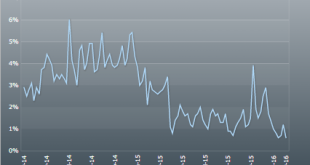

One more sign we’re losing our first world status- under Obama manufacturing jobs have actually gone up for the first time in a long time, albeit from very low levels: Sales growth is near 0: Truck sales are up some from a year ago but peaked in September: And no sign of runaway big govt here: The last mini run up has flattened out?

Read More »Oil price, Radio interview, Fed Atlanta, Canada

Some commentary on the latest Saudi price changes: Saudi raises crude price to Europe, Asia, cuts it for US Saudi Arabia, the world’s largest crude exporter, Wednesday raised the April prices of its oil to Asia and Europe but cut it slightly for shipments to the United States. My quick WRKO radio interview Down some more, as previously discussed:He’s going the right way, but it’s relatively small and he’s unfortunately still out of paradigm which puts it all at risk of ‘losing the debate’...

Read More »Factory orders, ISM non manufacturing, Consumer comfort, PMI services index

As per the charts, a big dip last month was followed but a partial recover this month, but overall it’s going nowhere: Factory Orders Employment dropped from 52.1 to 49.7- not good: ISM Non-Mfg IndexHighlightsThe great bulk of the nation’s economy enjoyed a solid February based on ISM’s non-manufacturing report where the headline index held solidly over breakeven 50, at 53.4 vs January’s 53.5.New orders came in at 55.5, down 1 point from January but still very solid. And backlog orders...

Read More »Saudi April pricing, Mtg purchase apps, ADP

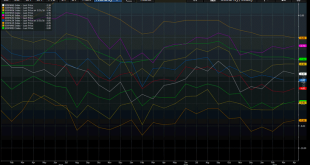

Some up a bit, some down a bit, overall looks to me like downward price pressure continues:Down this week and still moving largely sideways: This is a forecast for Friday’s employment report. It was a little better than expected: ADP Employment ReportHighlightsFriday’s employment report may be on the strong side based on ADP’s private payroll count for February which is a stronger-than-expected 214,000. ADP isn’t always an accurate barometer of the government’s data but it has been the last...

Read More »Vehicle sales

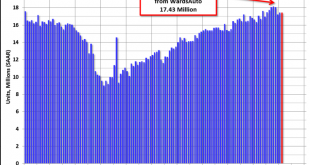

Whoops, less than expected, and as the chart shows the seasonally adjusted rate of sales continues to decelerate from the prior peak months as weakness that began with the collapse of oil capex continues to spread to the rest of the economy:From another source that spins flat to down sales as a positive for continued growth. Seems to me that if any of the ‘pieces’ grow at a lower rate than last year, some other ‘piece’ has to grow at a faster rate than it grew at last year to make up for it....

Read More »Redbook retail sales, PMI manufacturing, ISM manufacturing, Construction spending, Draghi comment

PMI Manufacturing IndexHighlightsGrowth in Markit Economics’ manufacturing sample is slowing to a crawl, at 51.3 for final February which is, next only to February’s flash of 51.0, the second lowest reading since October 2012. January, at 52.4, was a good month for the manufacturing sector with industrial production up and durable orders up, but the early indications on February are uniformly negative.Production in this report slowed as did new orders where growth is at a 3-1/2 year low....

Read More »Numb and number: where The Big Short falls short

Christian Bale as perspicacious hedge-fund manager Michael Barry in The Big Short (2015) First published (as a slightly edited version of the original, below) in the BFI Sight and Sound Magazine, 28 February 2016. As this goes to press, global capital markets appear to be stabilizing after another period of intense, and scary stock market volatility. This set the context for the arrival in Britain of Adam McKay’s The Big Short – a film about the American sub-prime mortgage meltdown, based on...

Read More »The Center of the Universe 2016-02-29 22:15:36

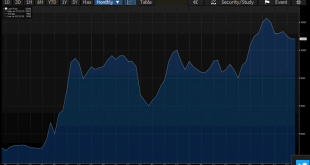

So at current prices Saudis aren’t making much progress towards their goal of higher sales: First a move up on the inventory thing, followed by a move down on the inventory thing. And looks to me like there’s a lot more downside coming from that inventory thing, etc.:Pretty lame bounce so far from an index that zig zags so much:

Read More »Whistleblowers Challenge Candidates: Stand Against Wall Street Fraud

Crossposted from Common Dreams Isaiah Poole Four people who have been at the center of some of the nation’s biggest Wall Street scandals have come together to send a message to the 2016 presidential candidates: Pledge to stand against Wall Street fraud and corruption – not just with words, but with the kind of actions that Americans have long expected but have yet to see. The four veterans of battles with banksters – Gary J. Aguirre, William K. Black, Richard M. Bowen III and Michael...

Read More » Heterodox

Heterodox