April housing permits and starts: a pullback from peak, but no recessionary signal UPDATED The monthly statistics on housing permits and starts, reported this morning, were mixed, as permits increased slightly and starts declined: The less volatile single-family permits also declined slightly. On the one hand, a high level of construction activity is continuing. But the three-month moving average of both single-family and total...

Read More »Grading the U.S. response to the pandemic

How should we grade our collective response to the covid pandemic? What lessons should we draw for the future? I believe that our response was poor. To see why, just imagine where we would be today if effective vaccines had not been developed. Our current strategy of moderate social distancing, intermittent partial lockdowns, and economic assistance for businesses and the unemployed would not have been sustainable for another 1 or 2 years as...

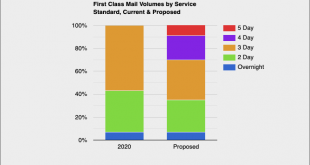

Read More »New dashboard on the PRC Advisory Opinion on the change in service standards

Steve Hutkins from Save the Post Office. As you can see, postal service delivery would lengthen from a maximum of 3 – day delivery to 4 and 5-day delivery service for First Class mail and Periodicals. The impact of the changes in delivery would would slow approximately 20.7 billion pieces of First Class Mail, or about 39 percent of FCM volume (see chart below). The Postal Service has requested an Advisory Opinion from the Postal Regulatory...

Read More »April retail sales “disappoint,” but maintain almost all of March’s surge

April retail sales “disappoint,” but maintain almost all of March’s surge [Note: I’ll comment on industrial production in a separate post later]At first glance, April’s retail sales report looks like another Big Miss. Nominally (blue) sales increased less than 0.1% (rounded to unchanged). Adjusted for inflation (red), they declined -0.7%: But the important point is that the big jump in March didn’t get taken back. As I wrote last month:...

Read More »April’s consumer and producer prices, etc.

April’s consumer and producer prices, retail sales, and industrial production; March business inventories and JOLTS, Commenter RJS, Market Watch 666 Retail Sales Unchanged in April after Big Revisions to Prior Months’ Sales Seasonally adjusted retail sales were statistically unchanged in April, after retail sales March were revised higher, while sales for February were revised much lower. The Advance Retail Sales Report for April (pdf) from the...

Read More »Weekly Indicators for May 10 – 14 at Seeking Alpha

Weekly Indicators for May 10 – 14 at Seeking Alpha by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. The big news in this past week, even though it has been expected for several months, was on the inflation front. That doesn’t affect the nowcast, and hasn’t affected the short term forecast yet. The long term forecast continues to be buffetted by increased interest rates. In my commentary this week, I make reference...

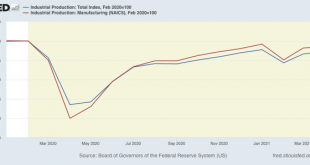

Read More »April Industrial Production slightly disappoints – but only due to supply chain bottlenecks

April Industrial Production slightly disappoints – but only due to supply chain bottlenecks Industrial production is the King of Coincident Indicators, and is the one whose peaks and troughs most frequently mark the beginning and end of recessions. It had been bouncing back strongly, but in the last several months, has hit something of a snag. In April, total production increased 0.7%, while manufacturing production increased 0.4%:...

Read More »Record High Trade Deficit

Trade Deficit Increases 5.6% to Record High in March on Rising Imports of Consumer Goods, MarketWatch666, Commenter RJS Our trade deficit was at another record high in March, 5.6% higher than in February, as both our imports and exports increased, but our imports increased by more. The Commerce Department’s report on our international trade in goods and services for March indicated that our seasonally adjusted goods and services trade deficit rose...

Read More »“Ambivalence” has dropped!

“Ambivalence” has dropped! “The Ambivalence of Disposable Time: The Source and Remedy of theNational Difficulties at Two Hundred,” Tom Walker,Simon Fraser University Two things I am especially pleased about that were sort of incidental at the time: 1. The prominence in the title of “Ambivalence” — the future is ambivalent — and 2. The ending quote by Benjamin of a quote about stereoscopic vision. The “author’s original version” can...

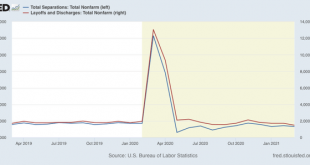

Read More »March JOLTS report confirms that month’s strong jobs report

March JOLTS report confirms that month’s strong jobs report This morning’s JOLTS report for March confirmed that month’s stellar jobs report. Job openings made a new series high, while layoffs and discharges made a new series low. Hires, quits, and total separations all also moved in the right direction.This report has only a 20 year history, and so includes only two prior recoveries. In those recoveries: first, layoffs declinedsecond,...

Read More » Heterodox

Heterodox