First I should note that at a time when I had totally messed up my life, Larry Summers saved me from well earned unemployment. As my PhD Supervisor, he was amazingly patient about the amazing delays preceding my actually producing anything along the lines of a written document. The title is a reference to a hypothetical dog. an economics professor, Solomon Fabricant, coined the term ”growth recession” to describe a period in which the economy...

Read More »Construction Increases 0.2% in April After March is Revised 0.5% Higher

MONTHLY CONSTRUCTION SPENDING, APRIL 2021, June 1, 2021Angry Bear Commenter RJS blogs at MarketWatch 666 and presents current economic market information. Estimates the impact of the February and March revisions on the 1st quarter GDP and is estimating the impact of this April report on 2nd quarter GDP (see below past Census reports. ___________________ The Census Bureau’s report on construction spending for April (pdf) estimated that the...

Read More »Slamming Chase CEO Jamie Dimon – Overdraft Fees

I would watch Elizabeth Warren pummel Jamie Dimon all day. pic.twitter.com/S1XPzMriZf— Sawyer Hackett (@SawyerHackett) May 26, 2021Elizabeth Warren Slams JPMorgan Chase’s Jamie Dimon on Overdraft Fees – Rolling Stone I could watch this over and over. It is similar to when she put the spotlight on John Roberts in the Senate. This is a good take down of Jamie Dimon by Senator Elizabeth Warren. The Senator is relentless. It appears Chase was...

Read More »Comprehensive April housing report: beware the inventory and price boomerang!

by New Deal democrat Comprehensive April housing report: beware the inventory and price boomerang! Now that we have all of the April housing data, my comprehensive look at this long leading sector is up at Seeking Alpha. It’s pretty clear that sales and new construction have peaked in the short term. So, what happens when all of those people who would have put their houses on the market in 2020, but didn’t because of the coronavirus,...

Read More »2050

Needing a new shirt? Pair of pants? Sports jacket? Suit? Log on, get your body profiled, if you haven’t recently; chose material. Screen shows what you would look like in the item while you make changes if any. Place the order and item shows up at your door in 7 days; still untouched by human hands. Prêt à porter? Même chose. Could fly to Albuquerque to see your, or your spouses’, mom and dad. Or, you could avoid the old hassle of the airport, of...

Read More »Revised 1st Quarter GDP Report Still Shows Growth at a 6.4% Rate

“Revised 1st Quarter GDP Report Still Shows Growth at a 6.4% Rate,” Marketwatch 666, Commenter RJS and analyst The Second Estimate of our 1st Quarter GDP from the Bureau of Economic Analysis indicated that our real output of goods and services grew at a 6.4% rate in the 1st quarter, unchanged from the 6.4% growth rate reported in the advance estimate last month, as upward revisions to growth of real personal consumption expenditures and to growth...

Read More »April Personal Income Down a Record 13.1%,

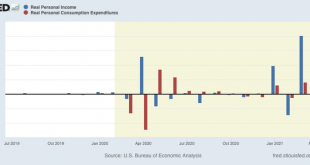

April Personal Income Down a Record 13.1%, Disposable Personal Income Down a Record 14.6%, Savings Falls 54.0%, Marketwatch 666, RJS The April report on Personal Income and Outlays from the Bureau of Economic Analysis reflects the partial unwinding of the March government stimulus in just about every metric it tracks except for prices, which are said to be “transitory“, influenced by temporary shortages and supply chain issues….as you’ll recall,...

Read More »Real personal income has completely made up its recession losses, now exceeds pre-recession peak

Real personal income has completely made up its recession losses, now exceeds pre-recession peak The last of the 4 monthly coincident markers for whether the economy is in recession vs. expansion was reported this morning for April. Let’s take a look. In nominal terms, personal income declined -13.1%, taking back most, not by no means all, of March’s big 20.7% gain. After taking inflation into account, in real terms, it declined -13.7%....

Read More »“Unshakeable Burden of Student Loans”

“Americans stress over ‘unshakeable burden’ of student loan payments,” The Guardian, Michael Sainato, May 2020 The nation can alleviate one person of their debt multiple times; but, it can not do so for the younger contingent consisting of minorities and white former students who would add to the growth of the economy if freed. Much ofd this debt consists of usurious penalties, the interest on those penalties, forbearance interest and the interest...

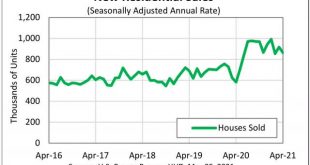

Read More »New home sales decline in April, revised sharply lower for March; prices continue to skyrocket, while inventory increases

New home sales decline in April, revised sharply lower for March; prices continue to skyrocket, while inventory increases This morning both new home sales and two price indexes for houses were released for April, completing our view of that important long leading sector. As anticipated, not only did new home sales decline for the month, but March was also hugely revised to the downside ( over 10%!): Figure 1 With these revisions,...

Read More » Heterodox

Heterodox