October jobs report: extremely strong monthly gains overall, but at this rate still another 18 months from full jobs recovery HEADLINES: 638,000 million jobs gained. The gains since May total about 55% of the 22.1 million job losses in March and April. The alternate, and more volatile measure in the household report was 2,243,000 jobs gained, which factors into the unemployment and underemployment rates below. U3 unemployment rate declined -1.0% from 7.9%...

Read More »September housing construction and October manufacturing both on a tear

September housing construction and October manufacturing both on a tear It’s the first of the month, so we get the last laggard for September (construction spending) and the first read on October (ISM manufacturing). Both were very positive in their important components. While total construction spending was only up 0.3% from a downwardly revised August, private residential construction spending (i.e., non-public housing construction) increased 2.8%:...

Read More »Weekly Indicators for October 26 – 30 at Seeking Alpha

by New Deal democrat Weekly Indicators for October 26 – 30 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. Neither of the two constraints determining where the economy will go in the next few quarters are economic themselves. Rather, they are (1) the course of the pandemic, which will in turn be heavily influenced by (2) the outcome of the US elections on Tuesday. As usual, clicking over and reading rewards me a little bit for my...

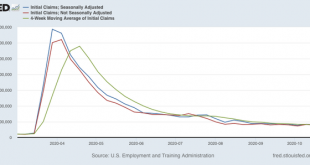

Read More »Jobless claims: continued slow progress

Jobless claims: continued slow progress A quick note about the first report of Q3 GDP released this morning: the rebound is only about 2/3’s of the decline from last year. We are still about 3.5% below that number. On a *relative* basis, this was a “good” number, but on an absolute basis, this is still quite depressed. This week’s new jobless claims continued to decline further below 800,000, and continued claims also made a new pandemic low. On a...

Read More »Personal income and spending both surprisingly continued to increase in September, plus a note on GDP

Personal income and spending both surprisingly continued to increase in September, plus a note on GDP Yesterday the first estimate of Q3 GDP was reported. Since this report includes 2 long leading indicators, it gives us insight into what the economy might be like in the 2nd half of next year. I have a post on that up at Seeking Alpha. As usual, clicking over and reading should be informative for you, and it rewards me a little bit for my efforts....

Read More »An Irony About Interest Rates And Income Distribution

An Irony About Interest Rates And Income Distribution It has long been a truism of economics that high-interest rates were favored by wealthy capitalist lenders against poor borrowers, with such a view lying behind the populist demands of the late 19th century. We are used to applauding Keynes’s forecast of the “euthanasia of the rentiers.” But now that such a situation is upon us of increasingly likely very low-interest rates for a long time ahead,...

Read More »September housing construction: another very positive month

by New Deal democrat September housing construction: another very positive month Yesterday September housing permits and starts were reported. Permits made yet another 10+ year high. This bodes very well for the economy in 2021, if the pandemic can be contained. Sorry about the delay. Seeking Alpha didn’t get around to publishing it until this morning. Here’s the link.

Read More »The Guardians of the Financial Galaxy

by Joseph Joyce The Guardians of the Financial Galaxy The rapid expansion of the pandemic and the ensuing economic and financial collapses brought about responses by policymakers, including actions undertaken on an international basis. The Federal Reserve acted together with other central banks to ensure that an adequate supply of dollars was available to support dollar-based financing outside the U.S. Similarly, the IMF moved rapidly to provide...

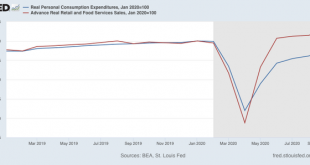

Read More »Real retail sales continue (inexplicably) strong, still bode well for employment

Real retail sales continue (inexplicably) strong, still bode well for employment This morning we got two important monthly September reports: industrial production and retail sales. I have more to say about industrial production, and some general economic analysis about retail sales, which are pending at Seeking Alpha. I will post a link once that article goes up. UPDATE: Here’s the link: Link For this blog, let’s focus on how real retail sales are...

Read More »Weekly Indicators for October 12 – 16 at Seeking Alpha

by New Deal democrat Weekly Indicators for October 12 – 16 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. What was most noteworthy about the past week is the confirmation that consumer spending, so far, has continued to hold up even as emergency Congressional assistance has been terminated for a month and a half. As usual, clicking over and reading will bring you up to the moment on all of the important economic data, and will reward...

Read More » Heterodox

Heterodox