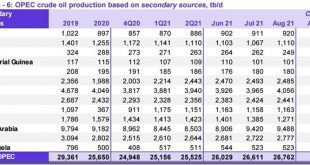

“Global oil shortage at 2.77 million barrels per day in August as OPEC, Output falls short of quota by 684,000 barrels per day,” Commenter and Blogger, RJS, Focus on Fracking OPEC’s Monthly Oil Market Report “The Latest US Oil Supply and Disposition Data from the EIA” Monday of this week saw the release of OPEC’s September Oil Market Report, which covers OPEC & global oil data for August, and hence it gives us a picture of the global oil...

Read More »US crude at 24 month low, gasoline at 22 month low, total supplies at 42 month low

Focus on Fracking: US crude supplies at a 24 month low, gasoline supplies at a 22 month low, total supplies at a 42 month low; August global oil shortage was 2.77 million barrels per day Natural gas prices at 7 1/2 year high near a 12 year high before falling back; US crude supplies at a 24 month low, gasoline supplies at a 22 month low, total supplies of crude plus all products at a 42 month low; US exports of distillates at a 6 month low; global...

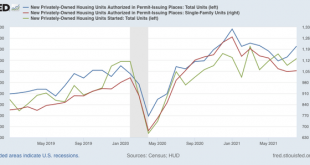

Read More »August housing construction shows stabilization, following interest rate moderation

August housing construction shows stabilization, following interest rate moderation This morning’s report on August housing permits and starts shows that the stabilizing of mortgage rates in the past few months has now stabilized housing construction. Housing starts increased 3.9% m/m, and total permits increased 6.0%. The less volatile single-family permits increased 0.6%. As a result, the overall trend for all three metrics for the past...

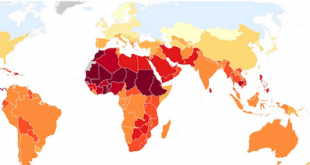

Read More »We’ve been over this before . . .

I have found Ten Bears in our comments section from time to time. I also followed the link to his blog “Homeless on the High Desert” and read a few of his posts. In “We’ve been over this before . . . ,” Ten Bears makes the point of migrants, people leaving their homeland to find better land in which to live will continue to go to other lands to live. They will go for food, water, safety, etc. Much of their leaving or all of it is due to pollution...

Read More »CPI Rose .3% on Prices for Food, Energy, New Vehicles

CPI Rose 0.3% in August on Higher Prices for Food, Energy, New Vehicles, Furniture and Appliances; Commenter and Blogger RJS at MarketWatch 666 Organization for Economic Co-operation and Development, Consumer Price Index: All Items for the United States [USACPIALLMINMEI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USACPIALLMINMEI, September 19, 2021. The consumer price index rose 0.3% in...

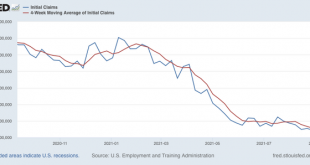

Read More »Jobless claims continue in normal mid-cycle range

Jobless claims continue in normal mid-cycle range Last week I encouraged readers to take the very low jobless claims number with a grain of salt due to Labor Day artifacts, and see if the big reduction was maintained or reversed this week. This week did indeed reverse the pattern somewhat, but not enough to interfere with the overall declining trend.Initial claims rose 20,000 to 332,000, while the 4-week average declined 4,250 to 335,750, the...

Read More »Polluting the Atmosphere for Free

Coming to a Close?, Quartz, Michael J. Coren & Clarisa Diaz Quartz has an article up on Carbon emissions which I found interesting. It is explaining why natural gas prices are increasing. Taking from the Quartz article, a few segments. The price of carbon has never been higher. In April, a metric ton of carbon in Europe traded above $50 for the first time, kept rising, and smashed through the ceiling set over the last decade. Global carbon...

Read More »Natural Gas prices at a 7 1/2 year high

Focus on Fracking: natural gas prices at a 7 1/2 year high; US crude supplies at a 23 month low, gasoline supplies at a 22 month low, Blogger RJS Natural gas prices also rose during the holiday shortened week as three-fourths of Gulf production still remained shut in as the weekend approached . . . after rising 7.8% to $4.712 per mmBTU last week on an unseasonably low inventory build while hurricane Ida disrupted both production and exports, the...

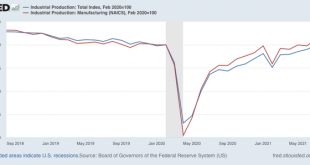

Read More »Industrial production now exceeds pre-pandemic level

Industrial production now exceeds pre-pandemic level Industrial production, the King of Coincident Indicators, was reported this morning for August and was positive in a particularly significant way. Total production increased 0.4% in August, and the manufacturing component increased 0.1%. Nothing particularly special about that; in fact the manufacturing component was a little weak compared with most recent months. Additionally, the July...

Read More »Supplies of US crude at a 23 month low and gasoline at a 22 month low

“US crude supplies at a 23 month low, gasoline supplies at a 22 month low,” Focus on Fracking, Blogger and Commenter RJS The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending September 3rd indicated that after major decreases in our oilfield production, our refinery throughput, our oil imports and our oil exports due to Hurricane Ida, we needed to withdraw oil...

Read More » Heterodox

Heterodox