Coronavirus dashboard for March 22 This is a new daily or nearly daily update I hope to post, including the most important metrics to show how controlled – or out of control – the cononavirus pandemic is. Hopefully the numbers will move ever closer to the tipping point where the epidemic is under control.In order to bring this pandemic under control, and prevent both health and economic catastrophes, in my opinion the US needs 2 weeks of China (total...

Read More »Weekly Indicators for March 17 – 21 at Seeking Alpha

b7 New Deal democrat Weekly Indicators for March 17 – 21 at Seeking Alpha A vignette…. Cognoscenti: “It’s impossible to forecast the economy.” Forecaster: “Actually, if you rely upon a tried and true series of long and short leading indicators, you ca-“ Deity: “OH YEAH??? TRY FORECASTING THE GIANT SCREAMING METEOR OF DEATH!!!!!” G.S.M.O.D.: [BOOM! Forecaster [poking head through rubble]: “Y’know, Deity, that really wasn’t very fair.” Sigh. At least,...

Read More »The best US solution to the coronavirus pandemic: SHUT.IT.DOWN — two weeks of China + one month of South Korea

The best US solution to the coronavirus pandemic: SHUT.IT.DOWN — two weeks of China + one month of South Korea For the last few weeks, I have been screaming at the top of my lungs about “exponential growth.” That’s because so few people realized the impact such growth could have in a pandemic, over the course of just a few months, even weeks.I first began thinking about this as soon as I read a Tweet by Trevor Bedford a month ago about how coronavirus...

Read More »Some Ideas for Pandeminomics

Some Ideas for Pandeminomics The starting point for all of what follows is that government, if it has the will to act, is currently in the driver’s seat. Much of the private sector is facing a terrifying confluence of crunches: supply breakdowns, demand falling off a cliff for many goods and services, and a looming shortfall of liquidity to service debt. A wide swath of business is on the ropes and needs a rescue from government. This puts the power...

Read More »The Coronavirus Recession has begun

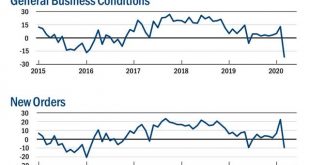

The Coronavirus Recession has begun This morning we got two reports that confirm the beginning of the Coronavirus Recession: initial jobless claims and the Philadelphia Fed manufacturing index. Initial claims rose to 281,000 one week ago. They are now 15% higher than their low last April, as well as almost 15% higher preliminarily on a monthly basis than last March, and the 4 week moving average is just shy of 5% higher than one year ago. This meets two...

Read More »Bailouts

Given the Coronavirus crisis, there will be bailouts. Should there be bailouts ? If so how should firms be bailed out ? I think it is useful to look at the last round of bailouts from 2008-9 for lessons learned. First with the benefit of hindsight, does it seem that bailing out firms was a mistake ? On the one hand one can argue that it was necessary to prevent the Great Depression. It is hard to discuss whether it was worth the cost, because there...

Read More »The Coming Fiscal Crisis Of State And Local Governments

The Coming Fiscal Crisis Of State And Local Governments Yesterday my wife Marina and I met with our personal attorney, a close friend also, to fix some loose ends in our wills due to some recent family deaths, as well the current situation. He also happens to sit on the Harrisonburg City Council, as well as having been Mayor for a while and a longtime member of the city Planning Commission, someone whose competence we have great respect for. Anyway,...

Read More »In the quaint, pre-coronavirus world of February, the economy was already very weak

In the quaint, pre-coronavirus world of February, the economy was already very weak I have a post up at Seeking Alpha, taking a look at this morning’s retail sales and industrial production reports for February, and briefly considering their implications for employment in the coming months, even before the impact of coronavirus. Here’s a graph that didn’t make it into that post, showing the past 25+ years of real retail sales (red), jobs (blue), and real...

Read More »The Coronavirus Recession (probably) begins

The Coronavirus Recession (probably) begins Looks like today is going to be an interesting one at the Wall Street casino. As I write this, futures are down -10%. Does this mean Trump has to take back his autographed copies of the surge in the indexes Friday afternoon? I’ve expected this, since the reality that Trump was, as usual, lying in his Friday afternoon announcements didn’t occur until after 4 p.m. when the markets were already closed. Yesterday’s...

Read More »To Slow Spread Of Coronovirus, End Iran Sanctions

To Slow Spread Of Coronovirus, End Iran Sanctions On 3/13/20 in Foreign Policy Focus, Ariel Gold and Medea Benjamin argue that to improve the global coronavirus problem, sanctions on Iran should be lifted, quite aside from the fact they should never have been imposed in the first place as Iran was adhering to the JCPOA nuclear deal. The effect of the sanctions has been to tank the Iranian economy, including its health care sector, much worsening the...

Read More » Heterodox

Heterodox