I am generally very very impressed by Paul Waldman at the Plum line blog (for one thing I admire the lack of Ego he demonstrates by writing for a blog subtitled “Greg Sargent’s take from a liberal perspective). Waldman is reliably brilliant (so is Sargent). Now finally I find something he wrote with which I disagree. In the generally excellent “President Trump Appoints Tax Fairy to Key Economic Post” Waldman wrote ” The point isn’t that tax increases help...

Read More »Tax Justice Network Taxcast, March 2017: Brexit and Tax Havens; Losses to Tax Avoidance

by Kenneth Thomas Tax Justice Network Taxcast, March 2017: Brexit and Tax Havens; Losses to Tax Avoidance Will Brexit harm the City of London’s tax haven? With weak regulation, money laundering, and satellites like BVI, Cayman Islands, and Jersey, everyone knows it’s already a tax haven. The UK is threatening to be more of a tax haven if they don’t get their way on other issues in the Brexit negotiations, but the EU will be vigilant on this issue, in John...

Read More »Real wages and spending: I don’t think consumers will roll over that easily (part 2)

by New Deal democrat Real wages and spending: I don’t think consumers will roll over that easily This is the second part of a post about “hard data” and consumer spending. (Dan here…First part here) Yesterday I noted that self-reported consumer spending, as measured by Gallup, has been running 10% or better YoY since the beginning of February, consistent with Amazon.com’s earnings growth, but in contrast to a small slump in retail sales as reported for the...

Read More »How wrong is IBD on California? Let us count the ways

by Kenneth Thomas How wrong is IBD on California? Let us count the ways Investor’s Business Daily has a hit piece out on California, as you can tell from the headline, “Taxifornia does it again.” Here’s the first paragraph of the editorial*, to give you a good flavor of it: California’s far-left government has done it again. Not realizing its real problems are excessive spending on misplaced priorities, excessive taxes, too much debt and a far-too generous...

Read More »Turkey And The Trend To Authoritarianism

by Barkley Rosser Turkey And The Trend To Authoritarianism The big surprise in the Turkish referendum to make Turkey a presidential system was not that Erdogan’s side won, but that it was close enough that opponents are charging fraud based on ballots not being counted properly. It may in fact be that it really did lose by a narrow margin, as some I know said it would. But, officially it won by a bit more than Hillary beat Trump and a bit less than Brexit...

Read More »The Amazon.com effect: retailers say they’re not selling, but consumers report they are buying

by New Deal democrat The Amazon.com effect: retailers say they’re not selling, but consumers report they are buying This was originally one post but I think it works better divided into two parts. One of the issues I keep reading about recently is the (alleged) divergence between “soft” and “hard” data. For example, consumer sentiment as measured by the University of Michigan (and the Conference Board, and Gallup) has been making new highs since the...

Read More »Crises and Coordination

by Joseph Joyce Crises and Coordination Policy coordination often receives the same type of response as St. Augustine gave chastity: “Lord, grant me chastity and continence, but not yet.” A new volume from the IMF, edited by Atish R. Ghosh and Mahvash S. Qureshi, includes the papers from a 2015 symposium devoted to this subject. Policymakers in an open economy who take each other’s actions into account should be able to reach higher levels of welfare than...

Read More »Angry Bear 2017-04-17 06:20:39

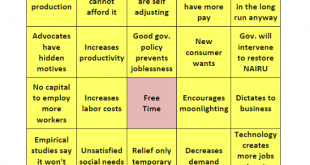

It was actually quite amusing to see an article in my provincial newspaper a while back where two sides were arguing about a reduction in the work week, and you could play bingo with the excuses the anti-side used. There wasn’t an original idea in the whole article, as the pro-side was almost apologizing and got one paragraph of the six on offer. – “Salty,” comment at AngryBear. See also “Boundless Thirst for Surplus Labor”...

Read More »The Simpsons on Immigration

A post from 2006 on immigration by Kash Mansori seems timely… The Simpsons on Immigration Kash | March 28, 2006 1:31 pm Simpsons aficionados among you already know that the Simpsons addressed the issue of immigration back in 1996, in the episode “Much Apu About Nothing”. Here’s a summary of the beginning of the episode, thanks to Wikipedia (Btw, I never would have guessed that Wikipedia contains entries on individual Simpsons episodes…) On an ordinary day, a...

Read More »Noah Smith: “Why the 101 model doesn’t work for labor markets”

by Sandwichman Noah Smith: “Why the 101 model doesn’t work for labor markets” At Noahpinion: A lot of people have trouble wrapping their heads around the idea that the basic “Econ 101″ model – the undifferentiated, single-market supply-and-demand model – doesn’t work for labor markets. To some people involved in debates over labor policy, the theory is almost axiomatic – the labor market must be describable in terms of a “labor supply curve” and a “labor...

Read More » Heterodox

Heterodox