The relentless flattening of the Treasury yield curve has been a topic of ongoing debate -- is this a signal that a recession is near? The key to interpreting the flattening is that bond market participants are not paid to to anticipate economic outcomes (outside the corner case of the inflation-linked market), rather to anticipate the path of short-term rates (and the term premium). The flattening yield curve tells us that market participants (on average) believe that we are near the end...

Read More »Richard Turnill — What a Flattening U.S. Yield Curve Means

The flatter yield curve is not a recessionary signal, so what is it telling us? Much of this year’s earlier yield curve flattening represented a reversal of the 2016 steepening that accompanied surging economic growth and inflation expectations after the U.S. presidential election. Markets had bet that fiscal stimulus and infrastructure spending would spur growth and inflation. Long-term yields jumped in response. Those market expectations unwound over the course of 2017 when policy changes...

Read More »Edward Harrison — Why the flattening yield curve doesn’t worry me yet

Ed Harrison looks at inversion historically.Credit Writedowns Why the flattening yield curve doesn’t worry me yetEdward Harrison

Read More »Zero Hedge — Treasury Yield Curve Crashes To Post-Crisis Flats

Not a good indicator of the business cycle, but it is a pretty fair indicator that inflation expectations are not rising. Zero HedgeRecession Red Flag Rears Its Ugly Head - Treasury Yield Curve Crashes To Post-Crisis Flats Tyler Durden

Read More »Bill Mitchell — When relations within government were sensible – the US-Fed Accord – Part 1

The topic centres on an agreement between the US Federal Reserve System (the central bank federation in the US) and the US Treasury to peg the interest rate on government bonds in 1942. What the agreement demonstrated is that a central bank can always control yields on government bonds, which includes keeping them at zero (or even negative in the current case of Japan). What it demonstrates is that private bonds markets, no matter how much they might huff and puff about their own importance...

Read More »Bill Gross and the Yield Curve

Tyler Durden at ZeroHedge, and others, are discussing Bill Gross's recent rant on his monthly letter to investors about the yield curve and the possibility of a Trump recession. Bill Gross sees in the decline of the 10-year bond rate since the early 1980s a secular (like Summers and his secular stagnation, it seems everything is secular now) trend, and concludes that the long term rate cannot go above 2.6% or so. In his words: "So for 10-year Treasuries, a multiple of influences obscure a...

Read More »On the possibility of a recession, again

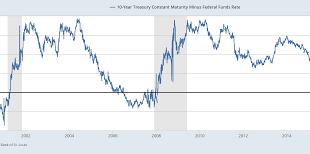

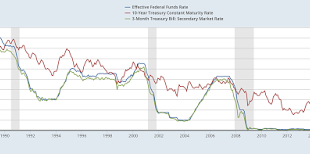

So the yield curve is really flat, not inverted, but really flat, and that has many (or here) afraid of an impending recession. The fear is basically associated to the inverted yield curve (see below: when the blue line is above the red and green lines, there is an inverted yield curve, with a high short rate and lower longer rates, signaling a recession) which is really flat, and the danger that the Fed will rise the rate in the next meeting in a few weeks. Yield Curve (click to...

Read More » Heterodox

Heterodox