Pubblichiamo la traduzione su Brave New Europe, una rivista online edita a Berlino, del pezzo su Econopoly. Sergio Cesaratto and Antonio Iero – It’s the interest rate, stupid! November 16, 2018 Economics, EU politics, EU-Institutions, Finance, National Politics Words of reason, but this is about German led social re-engineering in the EU rather than economics. Sergio Cesaratto is Professor of Growth and Development Economics and of Monetary and Fiscal Policies in the European Monetary Union, University of Siena Antonino Iero is Head of the Unipol Research Office. He has published several articles related to economic and financial issues in magazines and online sites. Cross-posted from Econopoly Translated and edited by BRAVE NEW

Topics:

Sergio Cesaratto considers the following as important: Cesaratto, Economics, EU politics, EU-Institutions, euro, Europe, Finance, Interest Rate, Italian government, Italy, National Politics, Paolo Savona, public debt, Toni Iero

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Sergio Cesaratto and Antonio Iero – It’s the interest rate, stupid!

Sergio Cesaratto is Professor of Growth and Development Economics and of Monetary and Fiscal Policies in the European Monetary Union, University of Siena

Antonino Iero is Head of the Unipol Research Office. He has published several articles related to economic and financial issues in magazines and online sites.

Cross-posted from EconopolyTranslated and edited by BRAVE NEW EUROPE

In the midst of the controversy of recent weeks, European

Commissioner Pierre Moscovici claimed: “A manoeuvre that increases the

public debt which is already 132%, whose annual repayment amounts to 65

billion euros, the equivalent of the budget for education, and which

means 1,000 euros per Italian, is not good for the people. It is the

people who pay and it is the people who repay. They are the most

vulnerable”. Moscovici’s recommendation, presented as pure common sense

by most opinion leaders, would be to reduce public debt in order to

reduce the amount of interest. But manoeuvres to reduce the ratio of

public debt-to-GDP are a labour of Sisyphus, since they often depress

the denominator rather than the numerator. Interest expenditure is not

an “independent variable” or an inescapable fact: interest rates are

made by central banks and not by markets, unless they are allowed to

operate freely.

The Italian economic pundit, Carlo Bastasin, attributes the increase in the weight of interest and therefore of debt to the fear of an Italexit. But this depends precisely on the increase in interest rates: once a fateful threshold has been crossed (the “sages” of the economy in 2012 spoke of a yield on ten-year bonds at 7%) a country should no longer resort to the markets. Solvency and the material possibility of paying salaries and pensions can only be guaranteed by regaining the ability to print one’s own currency. In short, it is all, and perhaps only, a question of interest rates. In our analysis we quantify the weight of interest expenditure compared to other factors in explaining the trend of the public debt-to-GDP ratio in recent decades. We then ask whether this has been the result of unavoidable circumstances or whether abnormal interest expenditure is not the result of deliberate or supinely accepted and shared choices?

It’s the interest rate, stupid.

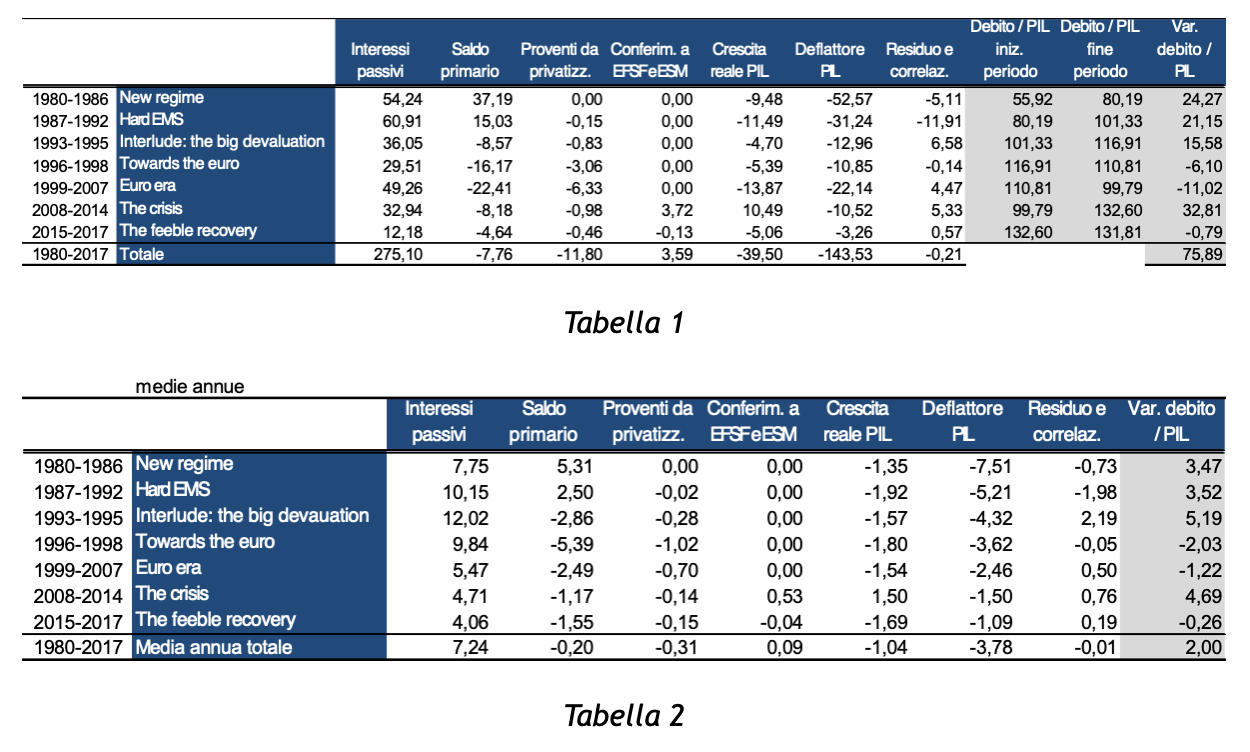

We have subdivided the past decades according to the economic policy

regime. Table 1 shows, for each period, a summary of the contributions

to the dynamics of the public debt-to-GDP ratio. The numbers express the

increase (positive sign) or decrease (negative sign) in the ratio

attributable to each variable in the specified period (the last line is

the column total). The algebraic sum of each row in the last column

gives the change in the government debt-to-GDP ratio over the period.

Table 2 shows the annual average for each period (useful as periods

contain a different number of years).

Let’s start by looking at the totals, the last line of Table 1.

Between 1980 and 2017, the public debt, in terms of its ratio to GDP,

increased by almost 76 points. This is the exclusive (and impressive)

result of the contribution of interest expenditure, equal to 275 points

(7.24 points of annual average). All other factors, taken as a whole,

have “been favourable”. In particular, the primary balance, i.e. the

difference between tax revenue and public expenditure (net of interest

expenditure), shows a negative balance (-7,76): in the almost four

decades examined, Italians received less in public goods and services

than they paid in taxes. This is a definitive answer to the accusations

of fiscal laxity made by north European governments. The Italian

contribution to the European funds ESFS and ESM (in practice, the rescue

of German and French creditor banks following the reckless lending to

Greece) totals 4% of GDP. Privatisations played a secondary role in

alleviating the debt-to-GDP ratio (-11.80 points), a dismal outcome

considering it involved the demolition of the Italian industrial

apparatus. Real GDP growth and, above all, inflation (GDP deflator)

contributed to alleviating the ratio. It should be noted that a high GDP

deflator reduces the real rates paid on sovereign debt securities

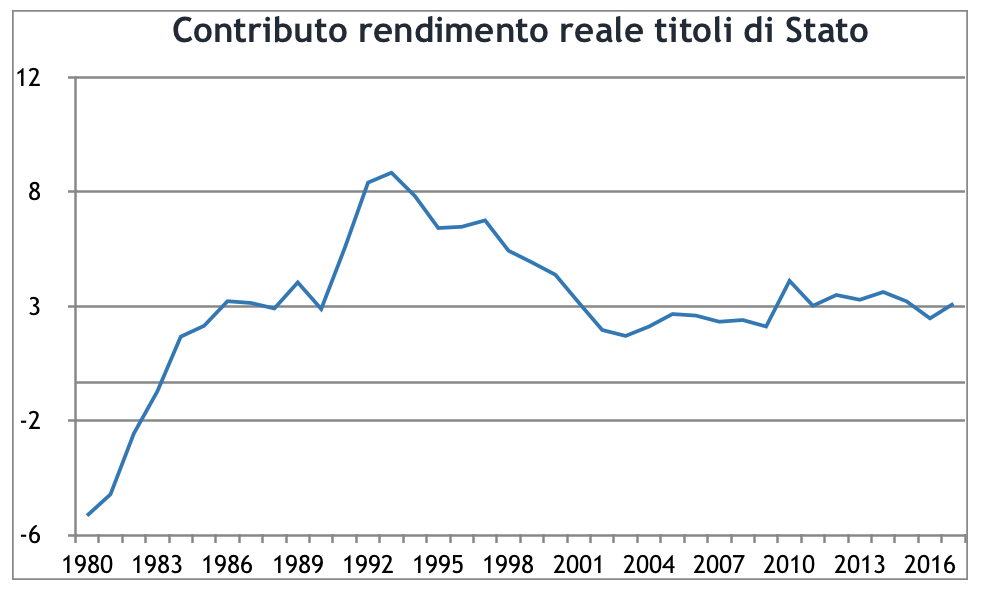

(figure shown in Figure 1).

Real rates paid on sovereign debt securities

Let’s now briefly analyse these periods.

1980-1992 The “new regime”

The “new regime” became established in Italy in 1979 through the

accession to the European Monetary System (EMS) and “divorce” between

the Treasury and central bank, the Bank of Italy. The “old regime” was

characterised by conflict, inflation, devaluation of the lira, expansion

of public spending. However, an accommodating monetary policy

guaranteed the Italian state negative real interest rates, so that the

public debt-to-GDP ratio grew moderately. It was the Italian way of

managing the distribution conflict, whose victim was price stability.

Under the new regime, monetary and exchange rate policies moved away

from fiscal policies: the first two aimed at containing inflation and

the third at growth and employment. The governments of the time did not

give up growth and employment, supporting them with an expansive fiscal

stance, all the more necessary because the loss of competitiveness that

followed the accession to the EMS depressed foreign demand. The high

interest expenditure at the time reflected high international rates, but

also the need to attract capital to finance external deficits. Interest

paid and the primary balance pushed up the debt-to-GDP ratio, while it

supported, but not sufficiently, growth and, above all, inflation. The

negative aspect of the new regime was the public debt, which grew by

45.4 points in relation to GDP (24.27+21.15 last column of Table 1), at

an annual rate of 3.49 percent.

The great devaluation

In 1992, Italy exited the European Exchange Rate Mechanism (ERM),

achieving the readjustment of external imbalances. However, in just

three years, the debt ratio increased by 15.6 points (5.2 points per

year). This is despite the fact that already in 1992 the country had

begun to achieve a continuous series of primary surpluses, as can be

seen from the second column of Table 1. The causes were the high

international interest rates, the liberalisation of capital movements

completed in 1990, and the need to stabilise the lira in order to return

to the ERM – as required by the Maastricht Treaty. That raised interest

expenditure to a good 12 points per year (Table 2), the all-time high.

Real interest rates peaked at that time (Figure 1).

Moving towards the euro

The periods of transition to the euro (1996-1998) and the pre-crisis

euro (1999-2007) have similar characteristics: the burden of interest

paid decreased while the while the primary surplus increased, especially

in the transition period (-5.4 per year in 1996-98). The effect of

inflation in reducing the ratio continued to decline as it had in

previous periods. The contribution of privatisations grew, but remained

irrelevant compared to the other factors, confirming that the

deleterious effect on the country’s industrial autonomy outweighed the

modest improvement in public finances.

Crisis and weak recovery

During the years of the crisis (2008-2014), the burden of interest

expense declined further, but this was not enough to compensate for the

worsening of the primary balance and, above all, for the first time, the

decline in GDP growth. This was due to a restrictive fiscal stance and a

decline in the positive effect of price dynamics (which were also

influenced by other factors such as the international cycle and the

prices of raw materials and energy).

The weak recovery (2015-2017) saw the stabilisation of the

debt-to-GDP ratio (-0.79, equivalent to -0.26 per year) due to a further

fall in rates (linked to the effects of the “quantitative easing”

launched by the European Central Bank in March 2015) and a moderate

primary surplus. The result was a more modest dampening effect on

growth, which turned positive again.

Conclusions: Is the interest rate an “independent variable”?

In the light of the above, the dynamics of public debt seem to be

linked to interest rates. However, contrary to what Moscovici claims, it

is not on debt that action should be taken to reduce interest

expenditure, but on interest rates to reduce debt. As shown in Figure 1,

efforts in this direction have not been sufficient in recent years.

Today, nominal interest rates are once again increasing.

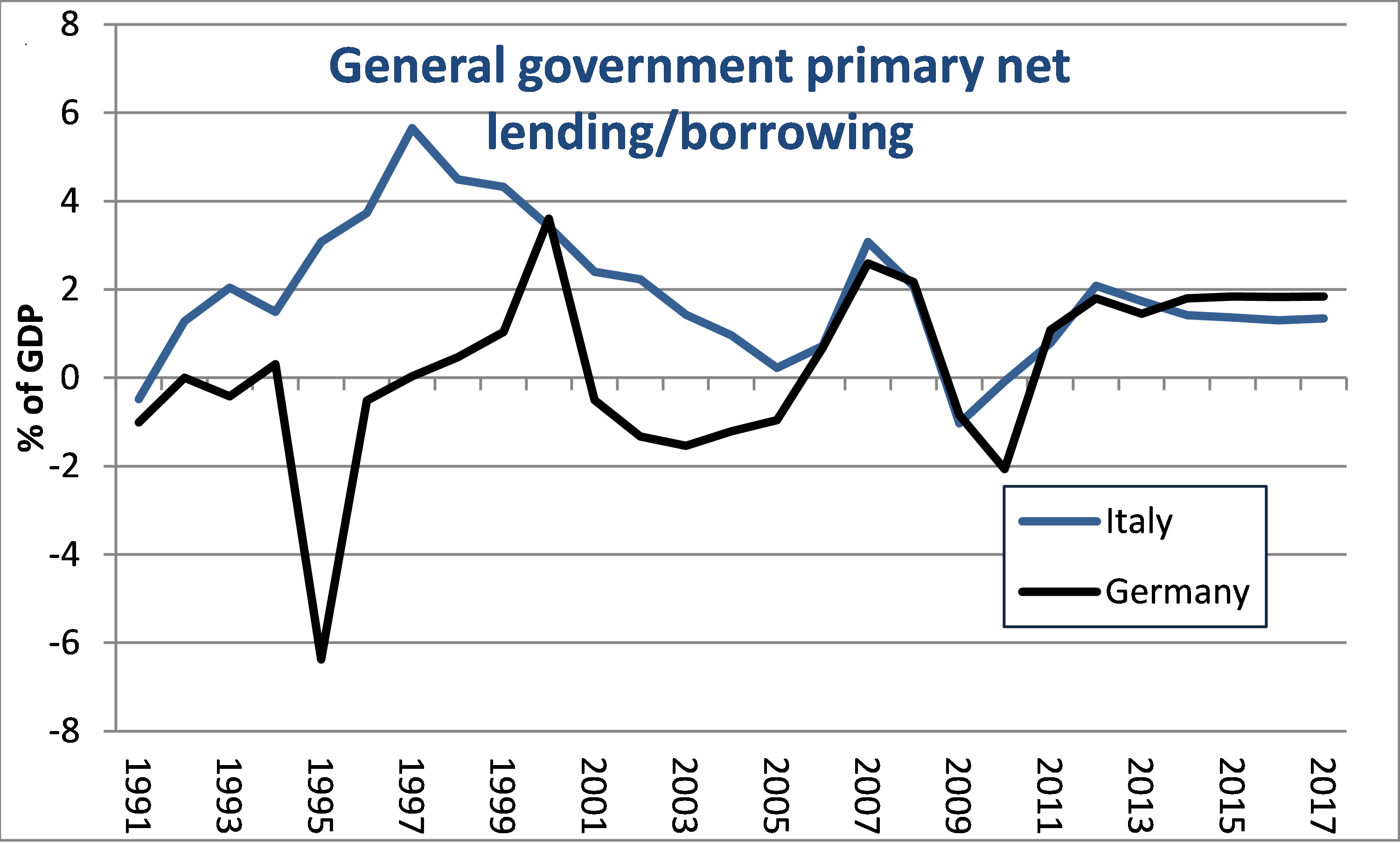

We cannot but agree with the economist and former politician Giorgio

La Malfa – an authoritative voice that is not prejudicially opposed to a

break with the policy set by previous governments – when he states that

the strategy set by this government has been foolish from the outset.

Confusing announcements of magnificent spending plans by the new

coalition government were enough to cause disarray in the market for our

public securities. Yet, La Malfa points out, there were numerous

reasons in favour of a change in fiscal policy: the failure of austerity

policies; decades of unparalleled fiscal rigour unmatched even by by

Germany (Figure 2), which cancels out the idea of an Italian moral

hazard (1); the solidity of foreign accounts; a fiscal policy stance

that does not justify disjointed European reactions.

This is why it is foolish to respond to European objections, as

government leaders have repeatedly done, with trivial slogans such as

“we will go on” or “they are commitments made to voters”. Furthermore,

the populist contents of the policies are questionable and have an

unreliable impact on aggregate demand, both in terms of the substance of

the measures and the timing of their implementation. Measures to

support investment would have been more palatable for Europe and would

have produced more certain effects. Accordingly, the risks for Italy

have increased: spreads have increased dramatically with uncertain

effects, especially in light of a weakening international economy. We

have no particular intellectual sympathy for Ignazio Visco, the governor

of the Bank of Italy, but his alarm does not appear to be unfounded.

In the negotiations with Europe, the government should have a clear strategy. Comparison with the European institutions should be used to rethink the contents of these policies and direct them towards investments in support of the real economy. No growth is conceivable without a supply policy that accompanies support for aggregate demand. But the Italian government should also know what it wants in return. The answer is: a drastic reduction in interest rates on Italian debt, which has always been the key variable in its dynamics, as illustrated above.

In this regard, Paolo Savona, Italy’s minister for European Affairs, in a document sent a few weeks ago to Brussels, called for a selective intervention by the ECB to support Italian government bonds. The ECB has argued that it does not have this right. The ECB president Mario Draghi himself, in his latest press conference, said that interest rates are a variable independent of the central bank – which is not true, in view of the “bazooka” of 2012, that is the threat of an unlimited purchase of government bonds by the ECB to support a country at risk of default. Of course, OMT (Outright Monetary Transactions) operations are subject to the signing of a Greek-style fiscal memorandum. But in the meantime it has been acknowledged that they are possible; so much so that in the summer of 2012 the announcement of this possibility was enough to calm the troubled financial waters. Admittedly, quantitative easing, which began in early 2015, was carried out in proportion to the countries’ participation in the ECB’s capital.

However, between 2010 and 2012, the ECB adopted the so-called “Securities Markets Programme” (SMP), which involved the targeted purchase of government bonds from specific peripheral European countries for about 220 billion euro. The measure had little effect because it was timid and poorly communicated, but it shows that the choices are political, not technical. In the case of the SMP, the ECB justified its selective action by stating that it fulfilled its mandate to ensure the “transmission of monetary policy”, i.e. to rebalance the cost of credit between the different jurisdictions of the euro zone. The decision of selective support is political, not technical.

Italy, without denying its fragility, is still a solid economy, for

example without a significant net foreign debt, unlike France and Spain

(respectively, as a percentage of GDP, -3.4%, -19.1%, -82.4%). There is

therefore no reason why rates on Italian government bonds should not be

at the French level. This would provide fiscal support to domestic

demand while ensuring the stabilisation and progressive reduction of the

debt-to-GDP ratio). A new pact of trust between Italy and Europe is

needed, based on reasonable compliance with budgetary rules in exchange

for support from the European institutions for the credibility of

Italian public finances.

Let us be clear, there is a risk of returning to the situation seen

in the period 1999-2007 with low interest rates associated with a

restrictive fiscal stance and consequent anaemic growth. Aid would come

from the current historically very low level of interest rates. It is

possible that these rates are not adequate for the German economy in the

long term: but, in a sustainable monetary union, economic policy must

help the weaker euro nations – again a political choice. In theory, a

controlled devaluation of a re-created national currency would help a

robust recovery of the Italian economy, allowing it to recover the cost

competitiveness gaps accumulated in the years of the euro. If this

choice is rejected, for various reasons, including the financial

uncertainties it implies, this is one more reason for expenditure aimed

at strengthening both aggregate demand and the productive apparatus.