On March 16th, George Osborne unveiled his shiny new Budget. Full of populist tax giveaways to help "hard working people", it was the sort of budget that we might expect from a Chancellor riding the crest of an economic recovery. UK plc is growing well, profits are rising and the Board can afford to increase the dividend.But this is not the current economic situation. Far from an economic recovery gathering pace, the latest figures from the OBR show that UK plc is slowing. In its March 2016 Economic & Fiscal Outlook, the OBR trimmed its GDP growth forecast for the next few years: Not only has it trimmed its forecast down to 2% pa, it has also indicated considerable uncertainty. There is even a not-insignificant chance of a recession in the Chancellor's Fiscal Mandate year of 2019-20.From the Chancellor's perspective, growth below 1% - or even a recession - might be welcome, since it would enable him to justify breaching his fiscal surplus target. The biggest risk for the Chancellor is that growth comes in just above 1% of GDP, which would make delivering a fiscal surplus by 2019-20 all but impossible. Unfortunately for George, this is rather likely.

Topics:

Frances Coppola considers the following as important: austerity, fiscal policy, GDP, growth, UK

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

Angry Bear writes GDP Grows 2.3 Percent

Angry Bear writes A Fiscal Policy in a Global Context?

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

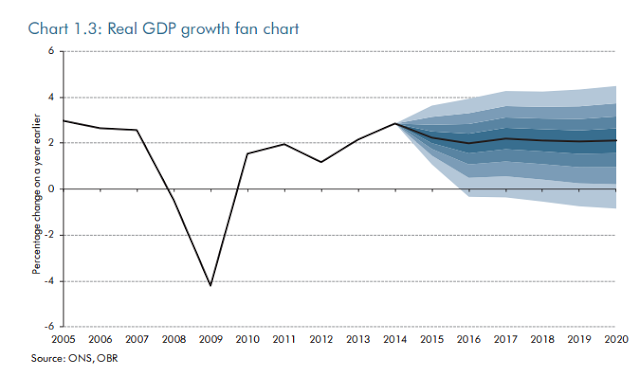

But this is not the current economic situation. Far from an economic recovery gathering pace, the latest figures from the OBR show that UK plc is slowing. In its March 2016 Economic & Fiscal Outlook, the OBR trimmed its GDP growth forecast for the next few years:

Not only has it trimmed its forecast down to 2% pa, it has also indicated considerable uncertainty. There is even a not-insignificant chance of a recession in the Chancellor's Fiscal Mandate year of 2019-20.

From the Chancellor's perspective, growth below 1% - or even a recession - might be welcome, since it would enable him to justify breaching his fiscal surplus target. The biggest risk for the Chancellor is that growth comes in just above 1% of GDP, which would make delivering a fiscal surplus by 2019-20 all but impossible. Unfortunately for George, this is rather likely.

The Chancellor is already failing on his other self-imposed targets: the welfare cap will now be breached in every year of this parliament, and the target for debt to fall every year as a percentage of GDP will be breached at the end of this month. If he is to succeed Cameron as PM, he must deliver that fiscal surplus. Failing to do so without economic justification would leave his credibility in tatters. The OBR's growth forecasts are bad news.

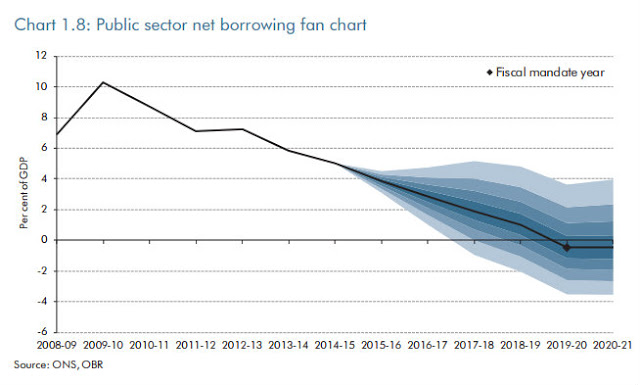

Nor is potential GDP (output) growth the only factor affecting the Chancellor's prospect of delivering his fiscal mandate. Inflation, interest rates and fiscal changes also have an impact:

The OBR's forecasts show that the fiscal finances are considerably weaker than they were even last November. The planned surplus is highly sensitive even to small changes in economic conditions. Far from the Board being able to afford a generous dividend, it should be retaining earnings to build up buffers. From this perspective, the Chancellor's largesse appears foolhardy.The surplus in 2019-20 could fall to zero due to relatively small differences in the output gap (if it were -0.7 per cent in that year, not zero), potential output (if it were 1.0 per cent lower), whole economy prices (1.2 per cent lower), debt interest spending (due to interest rates 1.2 percentage points higher than market expectations or a 2.2 percentage point upside surprise in RPI inflation), effective tax rates (a 0.5 percentage point lower tax-to-GDP ratio, due to the composition of GDP, distribution of incomes or movements in asset prices), or the delivery of public spending cuts (a quarter less than planned)...

This is achieved by means of an additional fiscal squeeze in that year ONLY:

I think they call this "boomerang economics".

This remarkable fiscal spike will be achieved by:

- bringing forward capital expenditure to 2017-18

- delaying to 2019-20 the implementation of changes to business taxation that would force some groups to pay tax early - thus generating additional revenue for that year

- pencilling in £3.5bn of unspecified further cuts to departmental spending in 2018-19, apparently to be achieved through "efficiency savings", though no-one has any idea what these might be.

But since the UK economy is slowing and the fiscal outlook worsening, how are the tax cuts in this Budget to be achieved while still putting downwards pressure on the debt/gdp ratio and aiming for a fiscal surplus? Well, by cutting spending, of course.

Not that this is proving at all easy for our George. Among other things, he thought he could fund his higher rate income tax and capital gains tax increases by cutting personal independence payments (PIP) to the disabled. Even before the Budget there were discomfited rumblings about this: the BBC's Andrew Marr, for example, described it as a "very callous set of priorities". But worse was to come.

Two days after the Budget, the Work & Pensions Secretary, Iain Duncan Smith, resigned. His resignation letter pointed the finger directly at Osborne's decision to cut welfare spending in order to fund tax cuts for the better-off:

And he complained about manipulation of fiscal strategy for political ends:I have for some time and rather reluctantly come to believe that the latest changes to benefits to the disabled and the context in which they've been made are, a compromise too far. While they are defensible in narrow terms, given the continuing deficit, they are not defensible in the way they were placed within a Budget that benefits higher earning taxpayers. They should have instead been part of a wider process to engage others in finding the best way to better focus resources on those most in need.

Sound economics and concern for the poor taking second place to Osborne's ambition. Well I never.I am unable to watch passively whilst certain policies are enacted in order to meet the fiscal self-imposed restraints that I believe are more and more perceived as distinctly political rather than in the national economic interest. Too often my team and I have been pressured in the immediate run up to a budget or fiscal event to deliver yet more reductions to the working age benefit bill.

Perhaps predictably, Duncan Smith's resignation forced what was described as a "screeching U-turn" from the government on PIP cuts. In fact it went even further. The new Work & Pensions Secretary, Stephen Crabb, has now announced that there will be no further "planned" welfare cuts" - though that doesn't mean there couldn't be ad-hoc ones if the fiscal finances deteriorate further, and it doesn't mean that the government is backing down on £12bn of welfare cuts already announced.

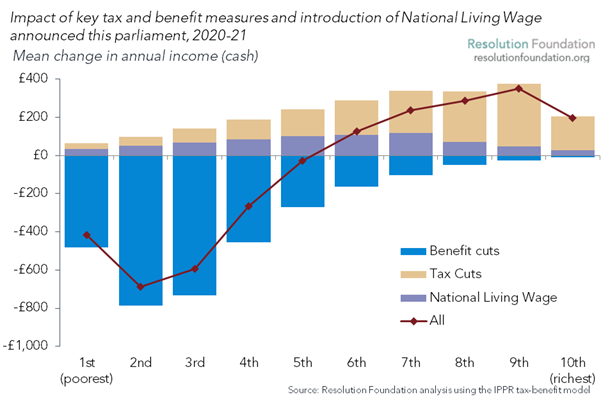

But the Government's U-turn over PIP cuts has unfortunately distracted attention from the real issue. This was by no means the only cut which would disproportionately affect poorer people. In fact as this chart from the Resolution Foundation shows, the distributional effect of successive Budget changes in this parliament significantly penalises the poor and benefits the better off:

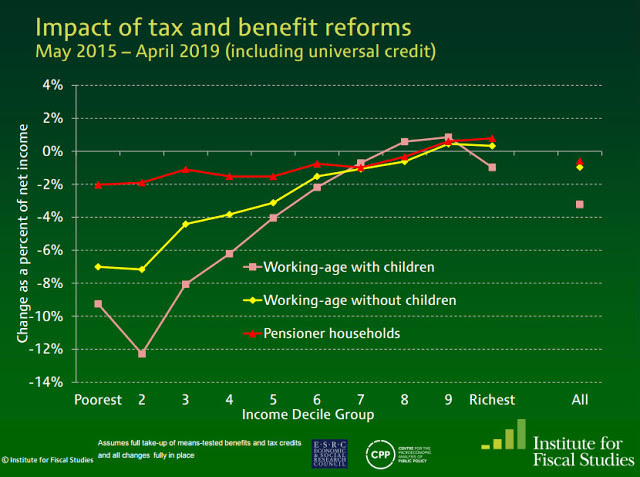

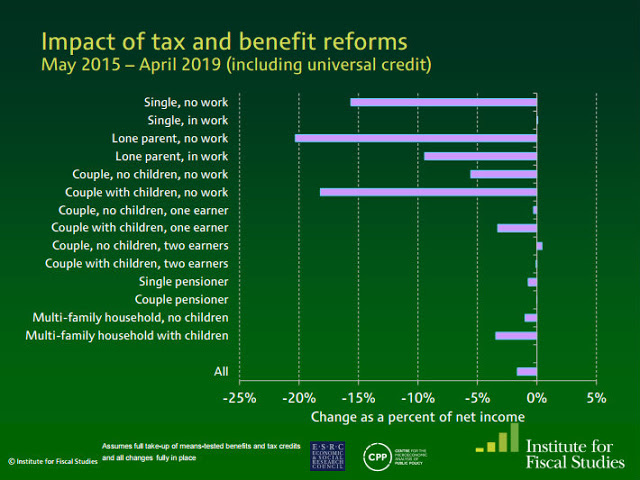

And these charts from the IFS show that the biggest cuts will be borne not by the disabled, but by low-income families with children:

George's claim that this was a "Budget for the next generation" looks very thin in the light of such a hit to "hard-working families", doesn't it?

In fact the Budget was universally panned. The highly respected IFS, in the most negative review I have ever heard it give, criticised just about every key policy proposal in the Budget for regressiveness, pointlessness or political scheming.

Paul Johnson complained about the "disingenousness" of Osborne's claim that the personal allowance rise “means another 1.3 million of the lowest paid workers taken out of tax altogether”:

The people who really benefit from the tax allowance rises are middle-class couples where one pays higher rate tax and the other is a low-income earner, perhaps working part-time. These people also benefit most from the new Living Wage. Since their household income can be quite high, and they are therefore likely to have assets, they also stand to benefit from the capital gains tax cuts. As the charts show, all of this more than offsets the losses they suffered in previous Budgets. It would be ungrateful of them not to vote Conservative after this, wouldn't it?No it does not mean that. Taken out of income tax, yes. But not taken out of direct taxes on income. It remains the case that National Insurance Contributions, which are just another tax on earnings, start to be paid once earnings rise above about £8,000. Low paid workers are not taken out of tax by raising the personal allowance.

The IFS questioned whether the new saving schemes would help anyone to save who was not already saving. The severe cuts to Universal Credit make it unlikely that the "Help to Save" scheme would have much effect - after all, if people are not saving now, they are hardly more likely to do so after experiencing double-digit cuts in their net income, whatever tax breaks the government offers. And the Lifetime ISA merely encourages young people to save from taxed rather than untaxed income. This has an interesting fiscal effect, as Johnson points out:

More fiscal fudge. Remarkable. In fact as Jolyon Maugham shows, George relies extensively on various flavours of fudge to make his sums add up, mostly at the expense of future generations. A "budget for the next generation" this is not. Anything but.Of course if people respond by saving less in pensions and more in ISAs Mr Osborne will get more tax revenues today, his successors will get less tomorrow.

But the U-turn on PIP has now rendered a finely balanced Budget all but impossible to deliver. George now has a £4.4bn hole to fill, and not much to fill it with. He has committed to tax cuts he can't afford, and now that the welfare budget is effectively ring-fenced alongside the NHS, education, pensions, overseas aid and defence, it is hard to see where he is going to find sufficient cuts in the remaining unprotected departments to deliver his prized fiscal surplus.

How he deals with this depends on where George thinks his interests lie. This Budget - like all of his previous ones - has little to do with economics and much to do with securing a Conservative victory at the next election (and his own place in No.10). Will he resort to further bloodletting - perhaps in local authority budgets - and hope the restive Conservative backbench MPs accept it? Or will he quietly change the mandate and hope no-one notices?

The attitude of Conservative backbenchers is key to Osborne's survival. Duncan Smith's motives may be questionable, but his analysis hit hard. The Government's fiscal strategy, of which this Budget is the latest instalment, places an unacceptable burden on the poorest and most vulnerable people in the country while giving unjustified handouts to the well-off. Some Conservative MPs already find this hard to stomach. Further fiscal transfers from poorer to richer may be more than they will tolerate. Duncan Smith's resignation exposed a deep rift in the Conservative party, not only over Europe but also over domestic fiscal policy. Far from creating "one nation", dear to the hearts of many Tories, Osborne's regressive policies deepen the rich-poor divide. The Conservative party may not be able to afford George's ambition.

More importantly, this Budget is unaffordable under the Chancellor's own rules, themselves only set for political reasons. He has sacrificed sound economic management on the altar of political ambition. The price for this will be paid by us all.

I don't think the country can afford him.