The collapse of Terra in May sent shock waves round the crypto world, triggering domino-like collapses of crypto companies. One of those companies was the investment fund Three Arrows Capital. At the time, everyone thought 3AC was a conservatively-managed investment company that was simply the unfortunate victim of an unforeseen event. If anyone was to blame for 3AC's collapse, it was Do Kwon. How wrong they were. Since 3AC was ordered into liquidation by a British Virgin Islands court, more and more creditors have emerged from the woodwork claiming they are owed money. The liquidators have filed emergency motions to freeze 3AC's assets because there is evidence that funds are being moved out of reach. And 3AC's co-founders, Su Zhu and Kyle Davies, have done a runner, though Bloomberg

Topics:

Frances Coppola considers the following as important: cryptocurrency, Debt, Financial Crisis, insolvency

This could be interesting, too:

Joel Eissenberg writes Crypto capital of the world

merijn knibbe writes The incredible cost of Bitcoin.

Robert Skidelsky writes Britain’s Illusory Fiscal Black Hole

Michael Hudson writes Gold as the Peace Currency

The collapse of Terra in May sent shock waves round the crypto world, triggering domino-like collapses of crypto companies. One of those companies was the investment fund Three Arrows Capital. At the time, everyone thought 3AC was a conservatively-managed investment company that was simply the unfortunate victim of an unforeseen event. If anyone was to blame for 3AC's collapse, it was Do Kwon.

How wrong they were. Since 3AC was ordered into liquidation by a British Virgin Islands court, more and more creditors have emerged from the woodwork claiming they are owed money. The liquidators have filed emergency motions to freeze 3AC's assets because there is evidence that funds are being moved out of reach. And 3AC's co-founders, Su Zhu and Kyle Davies, have done a runner, though Bloomberg says they are planning to set up shop in Dubai.

The liquidators applied to the Singapore High Court to have the BVI liquidation order recognised in Singapore. This would give them access to 3AC's premises and documents and allow them to subpoena key individuals to obtain information. In support of their application, they helpfully provided 1157 pages of evidence. Pity the poor judge having to plough through that!

I have ploughed through it. It's actually a bundle of documentation. Or, rather, a bundle of bundles. And it paints a revealing picture of the true state of 3AC. This was anything but a conservatively-managed investment company. It was so highly leveraged that it could not absorb the fall in crypto prices since last November. Even before Terra's collapse, it was concealing its true indebtedness from its creditors. And after Luna blew a massive hole in its balance sheet, it robbed Peter to pay Paul, lied to its customers and ghosted the creditors on whose loans it was defaulting.

The document bundle contains copies of 3AC's loan agreements, together with copies of the letters and emails that its creditors sent it when it defaulted on their margin calls and repayment demands. There are an awful lot of loan agreements, and many of the loans are for very large sums.

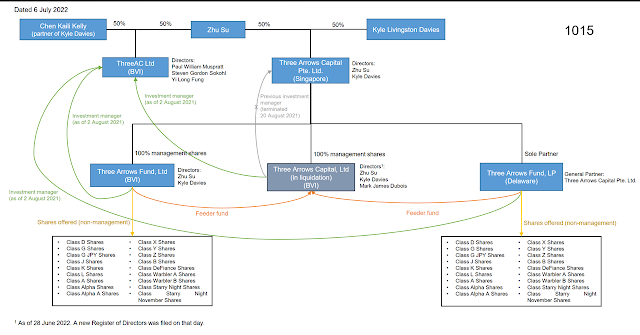

Bizarrely, among the lenders are the co-founders. Su Zhu claims to have lent the company some $5M, and Kyle Davies's partner Kelly Chen says she lent it about $65m. Su Zhu is a shareholder of both Three Arrows Capital Pte Ltd (Singapore) and Three AC Ltd (BVI), and Kelly Chen is a shareholder of Three AC Ltd (BVI):

Loans from shareholders are usually subordinated, but this pair don't seem to think normal financial good practice applies to them. They've listed themselves as senior unsecured creditors and are presumably expecting to claim a share of the remaining assets.

The most recent accounts are filed with the company's insolvency application. They are made up to December 2020, so are over 18 months old. As they reveal that 3AC's high leverage is of long standing. Here's the balance sheet:

This is by any standards highly leveraged. And the assets are held at fair value, so are exposed to fluctuations in market price. This would probably be ok if the assets were stable and low risk, but the majority are digital assets so are by definition volatile. 3AC was terribly exposed to adverse movements in crypto markets. Its entire balance sheet is a massive unhedged bet that crypto prices will always go up.

The cash flow strain is evident too:

The overall picture that emerges from this, together with the extraordinary series of loan agreements in the bundles, is of a company that was massively over-leveraged and had for some time been experiencing cash flow strain. It borrowed heavily to ride the wave of crypto appreciation during the pandemic. "The money will never run out" was its philosophy. But when the market turned and crypto prices started to fall, it had to borrow even more to maintain its collateral and meet its obligations.

Hyman Minsky called borrowing to obtain cash to meet existing obligations "Ponzi borrowing", because it depends on there being a constant supply of new lenders. This is ultimately unsustainable, of course, but it can be maintained for quite a while if the lenders don't know what is going on and there are no shocks to the system. And indeed, 3AC managed to conceal the scale of its indebtedness from lenders, customers and markets alike. But as the crypto winter deepened, it found it harder and harder to raise funds. Lenders demanded more collateral than it could afford to provide and better information than it wanted to give. One lender pulled out of a loan deal when 3AC refused to provide a balance sheet.

Terra's collapse in May 2022 was the last straw. Or perhaps the last thread. When it unravelled, so did 3AC's pile of ponzi loans. As crypto prices crashed, lender after lender demanded more collateral. But massively over-leveraged as it was, 3AC had no means of making these payments and no hope of borrowing the funds. So it defaulted on the margin calls. Rumours spread that it had a "liquidity crisis": but as is so often the case, the liquidity crisis turned out to be deep and long-standing insolvency. 3AC didn't fail because of Terra, it failed because of its insanely risky balance sheet and desperate lack of cash.

Defaulting on the margin calls made its financial situation infinitely worse. When a borrower fails to meet a margin call, the whole loan instantly becomes repayable. So 3AC was now faced with a massive steaming pile of demands for immediate loan repayment that it could not possibly meet.

What did it do? Nothing. Rather than admitting that it was insolvent and filing for bankruptcy, the co-founders ghosted their lenders. The bundle reveals that they didn't answer emails and didn't open letters. They ignored Whatsapp chats, text messages and contacts via other apps. And the phone went unanswered.

On 24th June, DRB Panama ('Deribit') applied to the High Court of the BVI to place 3AC into liquidation. Deribit's filing shows that 3AC had failed to meet margin calls and its collateral balance was far less than that required to repay the loan. As at 20th June, 3AC owed it over $80m.

It's evident from Deribit's filing that it had no idea of the true scale of 3AC's indebtedness. It knew about Voyager's loan and "monies owing to cryptocurrency platforms such as BlockFi and 8 Blocks Capital". But there's no mention of the rest of the lenders. In particular, there is no mention of Genesis Global Trading, by far 3AC's biggest creditor. It seems 3AC's game of blind man's buff with its creditors was all too successful.

Deribit complained that 3AC was ghosting it. And it expressed concern that the company appeared to be selling crypto to pay off other loans, transferring crypto to unknown addresses, and continuing to trade crypto. One transfer it identified, for $31.6m, was to a Cayman Islands company controlled by Su Zhu and Kelly Chen, though the funds were subsequently moved out of that company and Deribit was unable to find where they had gone.

On 27th June Voyager Digital, which had lent over a quarter of its entire asset base to 3AC, filed a notice of default. As a direct consequence of 3AC's default, Voyager itself filed for Chapter 11 bankruptcy just over a week later.

Also on 27th June, 3AC applied to the High Court of the BVI to place itself into liquidation, saying that because of cryptocurrency price fluctuations it was in default of its loan obligations and had received notices of default from a number of (unspecified) lenders, and had received a statutory demand for $10m from Bitget Singapore Pte Ltd. which it was unable to meet. But an affidavit filed by Kyle Davies revealed the true scale of its indebtedness. It said the company had 32 lenders, for whom the loan repayments outstanding totalled US$2.622bn, BTC 2,285.283 (worth approx US$ 46m at the time of filing) and ETH 17,231.77 (about $20.5m at the time of filing). Of this, approximately $2.3bn was owed to Genesis Global Trading. There was unpaid interest on these borrowings too.

The amount owing was partly offset by liquidated collateral of various kinds, including cash, BTC, ETH and, for Genesis Global Trading, shares in Grayscale Bitcoin and Ethereum Trusts. However, much of the borrowing was unsecured, and for the rest, the collateral was clearly insufficient. So it would appear that at the time that it went into liquidation, 3AC admitted to debts of over $2bn. Its real indebtedness was even higher.

Regulators come in for a lot of criticism, but where 3AC was concerned, one regulator appears to have been very much on the ball. On 30th June, the formidable Monetary Authority of Singapore (MAS) reprimanded 3AC for providing false information and exceeding its S$250m assets under management threshold. 3AC had transferred its investment management to the British Virgin Islands in 2021, but as far as MAS was concerned it was still under Singapore jurisdiction, because the Singapore-based 3AC and its BVI investment manager shared a director (Su Zhu).

The alleged breaches of the regulations had occurred in 2020 and 2021. But at the end of the reprimand, MAS added that "in light of recent developments that call into question the solvency of the fund managed by 3AC", it was investigating whether there had been further breaches of its regulations.

The co-founders knew the game was up. MAS was on to them. There was nothing more they could do but flee. And that's exactly what they did. On 1st July, 3AC filed for U.S. Chapter 15 bankruptcy protection. In an affidavit signed that day, the BVI liquidator Russell Crumpler observed that the co-founders appeared to be no longer in Singapore.

But although they were no longer in Singapore, the co-founders still had control of the funds. And Deribit's concerns proved well-founded. After declaring itself bankrupt, 3AC moved stablecoins and NFTs to unknown wallets via the KuCoin exchange. Blockchains reveal the address to which an asset has been moved, but they don't tell you who owns that address. Exchanges often do know who owns hot wallets, but KuCoin did not know these ones. And the trail can literally go cold if the assets are sent to an offline wallet. These assets may never be recovered.

To prevent 3AC's remaining assets being squirrelled away, the BVI liquidators appealed to courts in the U.S. and Singapore to freeze them with immediate effect, telling a New York Court that "there is an actual and imminent risk that the Debtor’s assets may be transferred or otherwise disposed of by parties other than the court-appointed Foreign Representatives to the detriment of the Debtor, its creditors, and all other interested parties." 3AC's assets are now frozen in both the U.S. and Singapore.

But it may be too late. Over two weeks elapsed between 3AC being ordered into liquidation by a BVI court and its assets being frozen. And 3AC's co-founders have not exactly been cooperative. At the time of the U.S. emergency motion, their whereabouts was unknown, though Bloomberg now reports that they are planning to relocate to Dubai. Emails attached to the Singapore petition show that they ghosted the liquidators, just as they had the lenders. It's not difficult to imagine what they were doing while the liquidators were trying to contact them.

I suspect that whatever assets 3AC still possesses are long gone. Where they have gone is a matter of conjecture. But there are plenty of countries in the world that will provide a safe haven for stolen assets and people on the run from U.S. authorities. A finer example of shutting the stable door after the horse has bolted is hard to imagine.

And this, I'm afraid, means that unsecured creditors are unlikely to get much of their money back.There is a massive and widening gap between the amount liquidators can recover and the amount 3AC is known to owe. A recent short affidavit from Russell Crumpler says that so far, $40m has been recovered. But known unsecured claims against 3AC's assets already total $2.8bn and Crumpler says he expects this figure to rise considerably.

The creditors have now formed a Committee to help the liquidators decide how to apportion the tiny pile of recoverable assets - or, if you prefer, to help them decide who should lose what. The Committee is made up of 3AC's largest creditors: Voyager Digital LLC (which is itself in Chapter 11 insolvency), Digital Currency Group Inc., Coinlist Lend LLC, Blockchain Access UK Ltd, and Matrix Port Technology (Hong Kong) Ltd.

Creditor committees (or Ad Hoc Groups, as they are often known) are a familiar sight in corporate insolvencies and sovereign defaults (for example, Argentina's holdouts, and Peru's Land Bonds holders). They serve a useful purpose, esepcially when there are disputes about the best way of resolving a failed institution and distributing its assets fairly. An Ad Hoc Group of creditors successfully challenged the Austrian government's proposals to resolve the bankrupt Hypo-Alpe-Adria Bank (HETA), eventually achieving 86.32% recovery.

In this case, a creditor committee is needed to force creditors to cooperate with each other. When a company is being liquidated and its remaining assets distributed to its creditors, claims ranked equal in seniority ("pari passu") must be treated equally. But several creditors, most notably Blockchain Access (now a committee member), publicly complained that 3AC was doing deals with other creditors while refusing even to talk to them, effectively subordinating their own claims.

The creditor committee can be relied upon to ensure that large creditors are treated equitably. But I'm not so sure it will necessarily act in the best interests of smaller ones. The crypto world has a tendency to decide that established rules and practices in traditional finance, such as creditor ranking and "pari passu", don't apply to them. So it's not difficult to imagine that the large creditors that make up this committee might try to cook up a deal that effectively subordinates smaller ones. It is to be hoped that the liquidators will prevent this from happening.

It is also to be hoped that liquidators will be able to argue that the assets of the co-founders (and in Kyle Davies's case, those of his partner) should be up for grabs. 3AC's organisation chart shows that the co-founders effectively controlled all the company's assets, including customer assets that were supposedly "under management". And documentation in the Singapore bundle reveals that they bought themselves valuable properties and made a down payment on a yacht. All of these assets arguably belong to their creditors. I also think that since Su Zhu and Kelly Chen are controlling shareholders, the courts might look sympathetically on an argument that their claims as creditors should be subordinated to those of other unsecured creditors. And they, along with Kyle Davies and possibly some of 3AC's senior management, may also face legal action for fraud.

But if the company's remaining assets and those of its co-founders have gone to safe havens beyond the reach of liquidators, and the co-founders have fled to a country with no extradition treaties, then creditors will receive little or nothing and legal action will be toothless. And since the failure of companies like Voyager and Celsius was at least partly caused by 3AC's collapse, it is their retail customers who will ultimately pay for Su Zhu and Kyle Davies's recklessness and extravagance.

Related reading:

Putting the Terra stablecoin debacle into Tradfi context - The Blind Spot