In the last two weeks of March and the first week of April, 2020 16.5 million new claims for unemployment were filed in the U.S. After the novel coronavirus is successfully contained some but not all of those jobs will return. The post-pandemic economy will not be the same as the economy before and to assume a return to business-as-usual economic growth would be folly. There will need to be immediate share-the-work policies along with basic income guarantees. These must be viewed not as temporary measures to be abandoned as soon as “normality” returns but as transitional steps toward an entirely new regime of work, income and common wealth. Addressing climate change has momentarily taken a back seat to the urgent immediacy of the pandemic. But the

Topics:

Sandwichman considers the following as important: climate change, Featured Stories, Healthcare, history, Hot Topics, politics, Uncategorized, US/Global Economics, wage growth

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

In the last two weeks of March and the first week of April, 2020 16.5 million new claims for unemployment were filed in the U.S. After the novel coronavirus is successfully contained some but not all of those jobs will return. The post-pandemic economy will not be the same as the economy before and to assume a return to business-as-usual economic growth would be folly.

There will need to be immediate share-the-work policies along with basic income guarantees. These must be viewed not as temporary measures to be abandoned as soon as “normality” returns but as transitional steps toward an entirely new regime of work, income and common wealth. Addressing climate change has momentarily taken a back seat to the urgent immediacy of the pandemic. But the irreversible long-term consequences of failing to free ourselves from the fossil-fueled treadmill of growth will make Covid-19 seem like a flash in the pan.

In The Unsolved Riddle of Social Justice, published shortly after the end of World War I (and, incidentally, the flu epidemic of that time), Stephen Leacock observed that the surprising resilience of industry during the recent war had “thrown its lurid light upon the economics of peace.” The coronavirus pandemic has once again “thrown its lurid light upon the economics of peace.” What the lurid light of war revealed to Leacock was the immense superfluity of peacetime employment. “Not more than one adult worker in ten…” Leacock speculated, “is employed on necessary things.”

Leacock’s estimate of superfluous workers may seem high but, to be honest, we don’t really know how much of the work that is done is necessary to sustain a society. If even one-fifth or one-quarter of the work being done was unnecessary, that would be a compelling rationale for suspending the growth imperative. Why not phase out current waste before producing even more waste?

But what if the proportion of superfluous to necessary work is even larger than that? How would we know it isn’t? As commentators from Simon Kuznets and Robert F. Kennedy to Marilyn Waring and Joseph Stiglitz have pointed out, national income accounts do not distinguish between “good” and “bad” commodities. They do not differentiate between necessities, comforts, luxuries and ugly Christmas sweaters that go from the closet to the trash. Furthermore, they do not account at all for the prodigious production of waste by-products. Nobody buys the carbon dioxide emissions from burning fossil fuels – even though somebody, someday, will indeed pay for them – with their lives if not money.

The absence of authoritative metrics serves as a convenient alibi for keeping things as they are or for actively making them worse. Efforts to construct alternative indices to the national income accounts, such as the Genuine Prosperity Index, have provided glimmers of insight but have ended up abandoned orphans that national governments have disdained to adopt.

What I am proposing here as an alternative to these global metrics focusing on the average number of hours that individuals work annually and the hours per capita worked in the economy as a whole. How many of those hours are devoted to wasteful production – built-in obsolescence, excess productive capacity, propaganda, disposable fashion, and other forms of sheer waste? For the answer, we turn to Arthur Dahlberg’s analysis of the effect of long hours on labor’s share of income.

Although Dahlberg dismissed concerns that machines directly cause technological unemployment, he noted that the new jobs created in the wake of technological change would be different than the old ones. In Dahlberg’s view, many of those new jobs would differ from those they replaced in that the demand for their products or services would not be spontaneous but would need to be artificially induced by, for example, advertising, social pressure, non-essential model variation, etc.

Dahlberg argued that wages are determined by bargaining and the shift away from spontaneously-demanded goods and services undermines labor’s relative bargaining power, resulting in a smaller labor share of income. Recipients of capital income may spend their larger share either on personal consumption or investment but, if the latter, they eventually will want to “cash in” on their investment. Spending on new investment will decline faster than spending on consumption rises.

Dahlberg thus saw unemployment as the slow-moving consequence of the introduction of labor-saving technology if the hours of work are not reduced. He argued that it was necessary to maintain a shortage of labour hours to enforce efficiencies on capital investment. As a result of the suppression of labor’s bargaining leverage, capital would be forced to seek out ever more tenuous and wasteful “investment” opportunities. Over the last half century, mainstream economists have successfully promoted the policy perspective that it was necessary to maintain a surplus of unemployed workers to prevent inflation. The result has been a long-term decline in labor’s share of income and an increase in the hours worked per capita to prevent that share from declining even more steeply.

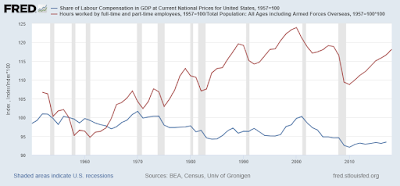

In the 60 years from 1957 to 2017, the labor share of U.S. GDP declined from 63.9% in 1957 to 59.7% in 2017 in spite of an 18% increase in the hours worked per capita. Working families were running faster on the treadmill to avoid falling even further behind. On an hourly basis, labor’s share of GDP fell to 54.6% in 2017.

In the course of a single business cycle, labor’s share of GDP increases as a function of the increase in hours worked. Over the course of several business cycles, however, the steady increase in hours worked at the peak of each successive cycle leads to a progressive decline in labor’s share following the subsequent recession. This is especially evident in the stepped peaks for hours per capita in years from 1969 to 2007 that precede the progressively declining valleys for labor share of GDP from 1970 to 2010.

Estimating how much of current economic activity is necessary and how much is superfluous may seem a hopelessly subjective task. There are, however, reference points that can ground the exercise in collective memory and historical experience. I have chosen 1957 as a reference point for both literary and statistical reasons.

In May of 1956, Business Week published the first of two installments on consumerism. “It is an age in which all the old admonitions [extolling frugality] appear to be outdated,” the author observed, “Just past the midmark of the 20th Century, it looks as though all of our business forces are bent on getting everyone to do just the reverse. Borrow. Spend. Buy. Waste. Want.” John Kenneth Galbraith’s The Affluent Society (1958) and Vance Packard’s The Waste Makers (1960), both best sellers, also took up the theme of wasteful consumerism. This is not to say that everyone was well off in 1957. Nearly a quarter of the population had incomes below the government poverty level and forty percent of housing units lacked such basic plumbing facilities as private flush toilets or hot running water.

At the start of the 1956 U.S. presidential election, Vice President Nixon speculated that a four-day, 32-hour workweek was feasible in the “not too distant future.” Nixon’s comments were not that unconventional for the times as the prospects for a four-day workweek were being examined by the editor of Fortune and the newsletter of the First National City Bank of New York. In its October 13, 1957 edition, nine days after the launch of Sputnik, Parade Magazine, the weekly newspaper supplement, ran a feature titled, “Do you really want a four-day week?”

A recession began in September, 1957 that lasted until May of 1958. This was followed just two years later by a second recession that lasted nearly a year. The timing and duration of these recessions eerily recalls a prediction made during World War II by John Maynard Keynes that an initial period of investment needed for reconstruction after the war would probably last for about 15 years, after which governments would need to turn to policies of income redistribution and shorter working time to maintain full employment. Instead, we got perpetual, exponential growth to meet the Soviet challenge (remember Sputnik?). “Borrow. Spend. Buy. Waste. Want.” went from being an improvident business slogan to a single-minded government creed.

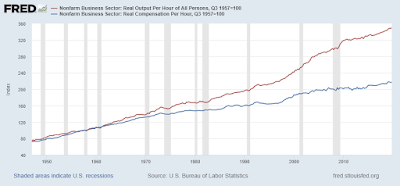

And grow the Gross Domestic Product did — from $17,482 per capita in 1957 to $58,056 at the start of 2019 an increase of 332%. And what do workers get for this three-fold plus increase in GDP? Although they work around 18% per capita more hours, their share of output has declined. For workers in the nonfarm business sector, the growing gap between output and compensation is particularly stark. Real output per hour increased by three and a half times between 1957 and 2019 (349%) but real compensation per hour only slightly more than doubled (217%).

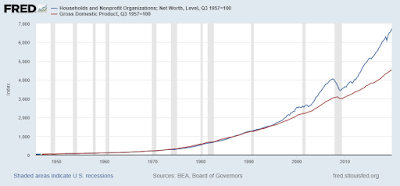

So where did that missing 132% go? Eventually, quite a bit of it went to bidding up the prices of assets. From the late 1940s to the mid-1990s, the net worth of households and non-profits expanding at about the same rate as GDP, although net worth was several times larger. But after around 1995, a series of “lumps” can be seen in the net worth data that correspond with the dot.com bubble, the housing bubble and the pre-coronavirus expansion.

These unprecedented increases in “net worth” from the mid-1990s on — otherwise known as “bubbles” — have an unfortunate proclivity to burst. And when those bubbles burst, governments rush in with bailouts to prop up the system and start the next expansionary bubble. …and the next. …and the one after that. It has to be done. There Is No Alternative!

But what if there was an alternative?

What if in 1957 we started taking annual productivity gains in shorter hours rather than more output? Over the period from 1957 to the end of 2018, the average annual productivity gain per capita was just under two percent. Starting with annual hours of 2065 in 1957, a two-percent reduction per year would have achieved a four-day, 32-hour workweek, with three weeks annual vacation and ten paid holidays by 1973. A 24-hour workweek, with seven weeks’ vacation could have been achieved by 1992. By 2005, weekly hours could have stabilized at around 18, with continually expanding vacation weeks going from six weeks in 2005 to 16 weeks in 2019.

Meanwhile, output would have increased a bit due to the direct effects of shorter working time on productivity. Thus, real GDP per capita could increase about 13% from the 1957 level to nearly $20,000. Since the reduction of working time would enforce full employment, greater bargaining leverage for workers and a higher labor share of national income, it follows that even a modest increase in output could result in the elimination of poverty and a massive reduction in income and wealth inequality. What’s not to like about that scenario (aside from the fact that it is only hypothetical)?

A conventional economist might argue that the productivity gains achieved through innovation over the last 60 years would not have occurred without the “incentives” provided by economic growth – that there is a “trade-off” between efficiency and equality. This is a Malthusian theological argument, not an analysis grounded in empirical evidence. The argument seems persuasive because we like to believe this is the “best of all possible worlds” and that “everything happens for a [good] reason.” Voltaire wrote a novel, Candide, satirizing such trite rationalizations of social evil. And let’s not forget that the economic growth – and increasing income and wealth inequality — of the past 60 years did not occur without repeated fiscal and monetary policy interventions from government to stimulate growth and sometimes admittedly intended to suppress wage growth presumed by the conventional economists to be inflationary.

To economists, inflation is a monetary phenomenon. Milton Friedman claimed it is “always and everywhere a monetary phenomenon.” But Walter Benjamin, writing in the 1920s about the German hyperinflation, offered a compellingly different interpretation. He viewed the monetary calamity as inseparable from the cultural and ethical degeneration in which it was embedded. “In the stock of phraseology that lays bare the amalgam of stupidity and cowardice constituting the mode of life of the German bourgeoisie,” he wrote, “the locution referring to impending catastrophe – that ‘things can’t go on like this’ — is particularly noteworthy.”

In his “Tour of German Inflation,” Benjamin scorned the incapacity of well-to-do citizens to comprehend that dispossession could be every bit as enduring as prosperity had previously been for them, noting that for many, “even before the war,” wretched conditions had been a stable fact of life. He likened the conditions in Germany to a siege — “a case in which surrender, perhaps unconditional, should be most seriously considered. But the silent, invisible power opposite does not negotiate.” For 13 paragraphs, Benjamin enumerated the ways in which people have become estranged from each other and from things. In the, final, 14th he shifted abruptly from contemporary diagnosis to ancient prescription: “The earliest customs of peoples seem to send us a warning that in accepting what we receive so abundantly from nature we should guard against a gesture of avarice. For we are able to make Mother Earth no gift of our own.”

“If society has so degenerated through necessity and greed that it can now receive the gifts of nature only rapaciously,” Benjamin concluded, “that it snatches the fruit unripe from the trees in order to sell it most profitably, and is compelled to empty each dish in its determination to have enough, the earth will be impoverished and the land yield bad harvest.” Or a pandemic, he might have added.