September JOLTS report: despite the increase in openings, the decelerating trend in the game of reverse musical chairs remains intact – by New Deal democrat In 2021 and earlier this year, the jobs market was typified by a game of reverse musical chairs in which there were more chairs (available jobs) than players (job seekers). As a result, employers had to increase wages in order to attract workers to their openings. But since this left other jobs vacant, those employers had to increase wages as well, to keep pace. I have been watching this year for the end of the game of reverse musical chairs. Last month I wrote that the August report was evidence that “the game is entering its closing phases, at least for this cycle.” I will go into

Topics:

NewDealdemocrat considers the following as important: Hot Topics, musical chairs, NDd, Recession soon?, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Joel Eissenberg writes How Tesla makes money

NewDealdemocrat writes January JOLTS report: monthly increases, but significant downward revisions to 2024

September JOLTS report: despite the increase in openings, the decelerating trend in the game of reverse musical chairs remains intact

– by New Deal democrat

In 2021 and earlier this year, the jobs market was typified by a game of reverse musical chairs in which there were more chairs (available jobs) than players (job seekers). As a result, employers had to increase wages in order to attract workers to their openings. But since this left other jobs vacant, those employers had to increase wages as well, to keep pace. I have been watching this year for the end of the game of reverse musical chairs.

Last month I wrote that the August report was evidence that “the game is entering its closing phases, at least for this cycle.”

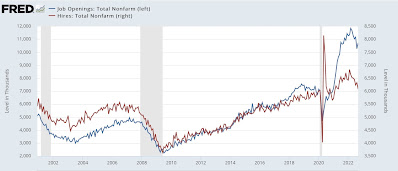

I will go into further detail below, but to summarize, in the current expansion:

- Hires peaked third, in February 2022

- Quits peaked first, in November 2021

- Layoffs and Discharges made a trough second, in December 2021

- Openings peaked last, in March 2022

The commentary I have read about yesterday’s report focused on the fact that job openings rose again, bemoaning that this would give the Fed more ammunition to raise rates. We’ll find out what the Fed does later today, but as I wrote yesterday the trend in job openings remains downward (blue in the graph below). So does the trend in monthly hires (red). Note the pre-pandemic trend of openings peaking about a year before both of the last recessions, and hires peaking well in advance of the Great Recession:

Since March, openings have averaged a decline of roughly 200,000 per month. I suspect the last two months, which averaged a decline of 300,000 per month, are indicative of acceleration of that trend. Last month I wrote that, at their average decline since March openings “will return to their pre-pandemic level by next April.” The increase this month makes that less likely, but still not out of the question.

In fact, while openings increased, actual hires declined further, in line with their trend.

Voluntary quits, which are an important measure of employee confidence in finding another job, also declined by -2.9% for the month, and were virtually unchanged compared with their recent low two months ago. In other words, the declining trend is intact there as well:

Note quits also peaked well in advance of the Great Recession and had turned flat for over a year before the pandemic hit.

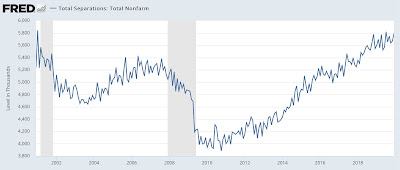

The story is the same for total separations, which declined to a 16 month low:

Like quits, total layoffs and separations had already turned down before the Great Recession, and were flat before the pandemic hit:

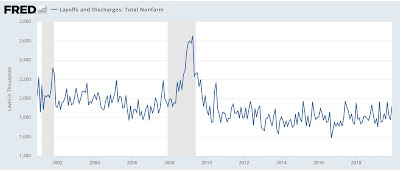

Finally, layoffs and discharges did decrease to a 5-month low, but remain significantly above their December 2021:

Layoffs and discharges troughed well before both of the last two recessions as well:

To summarize their 20+ year history, with the exception of hires, which peaked early – in December 2004 through September 2005 – prior to the Great Recession, but continued to increase right up until the pandemic hit in February 2020; all the other series peaked (or in the case of layoffs and discharges, made a trough) well in advance of the next downturns.

Despite the increase in openings, the September JOLTS report is entirely consistent with pre-recession decelerating trends being firmly intact. The game of reverse musical chairs is slowing down. The question is, how quickly it will actually end, and reverse.