September real retail sales lay another egg – by New Deal democrat One of my favorite indicators, retail sales, was reported for September this morning, and it came in unchanged. Which means that after factoring in +0.4% inflation in September, real retail sales were down -0.4%. Which is not good, because real retail sales have gone nowhere in 18 months, and have been down every single month since April with the exception of August, and are now down -1.4% since then: Furthermore, real retail sales being negative YoY for more than a couple of months has for the past 75 years been an excellent coincident to short leading indicator for an oncoming recession: The only false positives are 1951 and 1966. In September, the YoY change was

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, Retail sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

September real retail sales lay another egg

– by New Deal democrat

One of my favorite indicators, retail sales, was reported for September this morning, and it came in unchanged. Which means that after factoring in +0.4% inflation in September, real retail sales were down -0.4%.

Which is not good, because real retail sales have gone nowhere in 18 months, and have been down every single month since April with the exception of August, and are now down -1.4% since then:

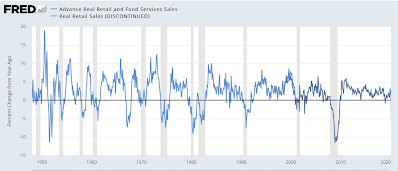

Furthermore, real retail sales being negative YoY for more than a couple of months has for the past 75 years been an excellent coincident to short leading indicator for an oncoming recession:

The only false positives are 1951 and 1966. In September, the YoY change was exactly *0*. Our current situation – of half a year of monthly readings just above or below zero – is very similar to the first half of 2007, and we know how that wound up!

Next, As I note almost every month, real retail sales (/2) are a good short leading indicator for employment. Here’s the long term view from 1993-2019:

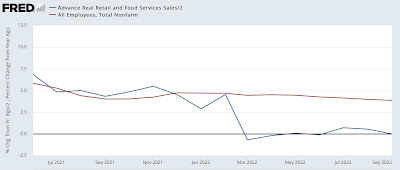

To avoid issues with scale, I am skipping the data from 2020 and early 2021. Here is the updated comparison with payrolls since June 2021:

Retail sales continue to forecast a deceleration in monthly payroll gains. Last autumn’s Booming payroll gains are a thing of the past. While there will always be monthly outliers, payroll gains averaging under 0.2% (about 300,000) – and gradually decelerating more – are what we should expect for the rest of this year.

“July real retail sales show more stagnation, but slightly positive YoY,” Angry Bear (angrybearblog.com)