The importance of 10 (and 20) year new highs in interest rates – by New Deal democrat As you may have already read elsewhere, interest rates on the 10 year US Treasury just made a new 10+ year high. Perhaps more importantly, 30 year mortgage rates made a new 20+ year high: Both rates are slightly above their previous highs from last October: Almost always in the past, interest rates peaked *before* the Fed finished hiking interest rates. Which suggests that the Fed is likely to make at least one more rate hike. Typically, these rates have also peaked *before* a recession ever hit. In fact, their failure to make new highs for 4 months has typically been the first long-term event enabling a recovery after that recession. So the new highs in

Topics:

NewDealdemocrat considers the following as important: 2023, Hot Topics, Interest rates, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

The importance of 10 (and 20) year new highs in interest rates

– by New Deal democrat

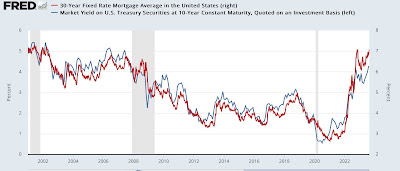

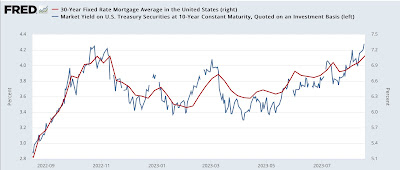

As you may have already read elsewhere, interest rates on the 10 year US Treasury just made a new 10+ year high. Perhaps more importantly, 30 year mortgage rates made a new 20+ year high:

Both rates are slightly above their previous highs from last October:

Almost always in the past, interest rates peaked *before* the Fed finished hiking interest rates. Which suggests that the Fed is likely to make at least one more rate hike. Typically, these rates have also peaked *before* a recession ever hit. In fact, their failure to make new highs for 4 months has typically been the first long-term event enabling a recovery after that recession. So the new highs in interest rates “re-set the clock” in terms of how far off in the distance a post-recession recovery might take place.

Secondly, as I wrote Monday, the “Big Story” of why it actually *is* different this time is the 10% decline in commodity prices occurring while the economy is still expanding. This has enabled, for example, home builders to lower the price of their new homes to offset the effects of Fed rate hikes.

So far this decline in commodity prices has been more important than interest rate increases. But once these declines are done, they’re done. In contrast, Fed rate hikes will affect future activity 1 and 2 years later. A contract for a new house that isn’t signed today will affect housing under construction a year from now, and the purchase of furnishings and landscaping items 2 years from now.

I expect housing’s recent recovery to reverse, probably to a level roughly equivalent to its lows 6 and 9 months ago. Will producers of consumer goods be able to lower their prices (even further in the case of home builders) to compensate for the increase in interest rates? We’ll soon see.

Interest rates, the yield curve, and the Fed chasing a “Phantom (lagging) Menace,” Angry Bear, New Deal democrat