AB: This particular article had warnings about use, changing any of the content, and proper recognition. Fair use is an issue as if giving credit to the authors and proper authorities. Liking this piece which explores the makeup of the batteries, etc. which energize the EVs being touted today. It explores the detail of what elements and compounds will go into the new energy efficient, less polluting vehicles. There is only so much easily available material to be had for the wasters of resources and then prices will most definitely increase. Think about it, an almost 2,000 lb. battery to drive a gross 10,000 lb. vehicle to which in many cases will never get dirty hauling the materials of labor? “Vanity… Definitely, my favorite sin.” It can poison

Topics:

Angry Bear considers the following as important: climate change, Education, Hot Topics, IEA, International Energy Agency, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Joel Eissenberg writes How Tesla makes money

NewDealdemocrat writes January JOLTS report: monthly increases, but significant downward revisions to 2024

AB: This particular article had warnings about use, changing any of the content, and proper recognition. Fair use is an issue as if giving credit to the authors and proper authorities. Liking this piece which explores the makeup of the batteries, etc. which energize the EVs being touted today. It explores the detail of what elements and compounds will go into the new energy efficient, less polluting vehicles. There is only so much easily available material to be had for the wasters of resources and then prices will most definitely increase. Think about it, an almost 2,000 lb. battery to drive a gross 10,000 lb. vehicle to which in many cases will never get dirty hauling the materials of labor?

“Vanity… Definitely, my favorite sin.” It can poison and derail even the most potentially beneficial of feats.

Credit to Al Pacino’s acting in representing the devil in “The Devil’s Advocate.”

Executive Report: The Role of Critical Minerals in Clean Energy Transitions, Analysis – IEA,

IEA (2021), The Role of Critical Minerals in Clean Energy Transitions, IEA, Paris, License: CC BY 4.0

In the transition to clean energy, critical minerals bring new challenges to energy security

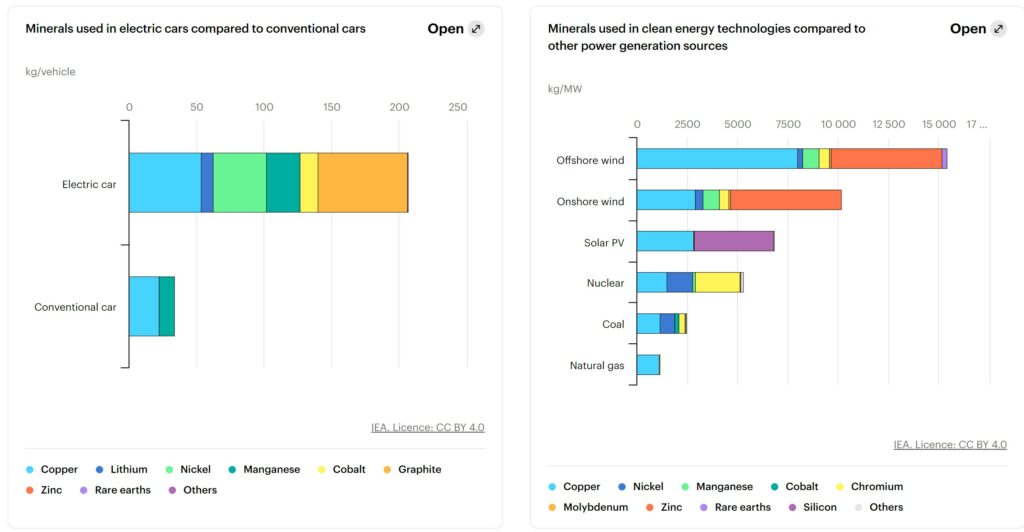

An energy system powered by clean energy technologies differs profoundly from one fueled by traditional hydrocarbon resources. Solar photovoltaic (PV) plants, wind farms and electric vehicles (EVs) generally require more minerals to build than their fossil fuel-based counterparts.

A typical electric car requires six times the mineral inputs of a conventional car and an onshore wind plant requires nine times more mineral resources than a gas-fired plant. Since 2010 the average amount of minerals needed for a new unit of power generation capacity has increased by 50% as the share of renewables in new investment has risen.

The types of mineral resources used vary by technology. Lithium, nickel, cobalt, manganese and graphite are crucial to battery performance, longevity and energy density. Rare earth elements are essential for permanent magnets that are vital for wind turbines and EV motors. Electricity networks need a huge amount of copper and aluminum, with copper being a cornerstone for all electricity-related technologies.

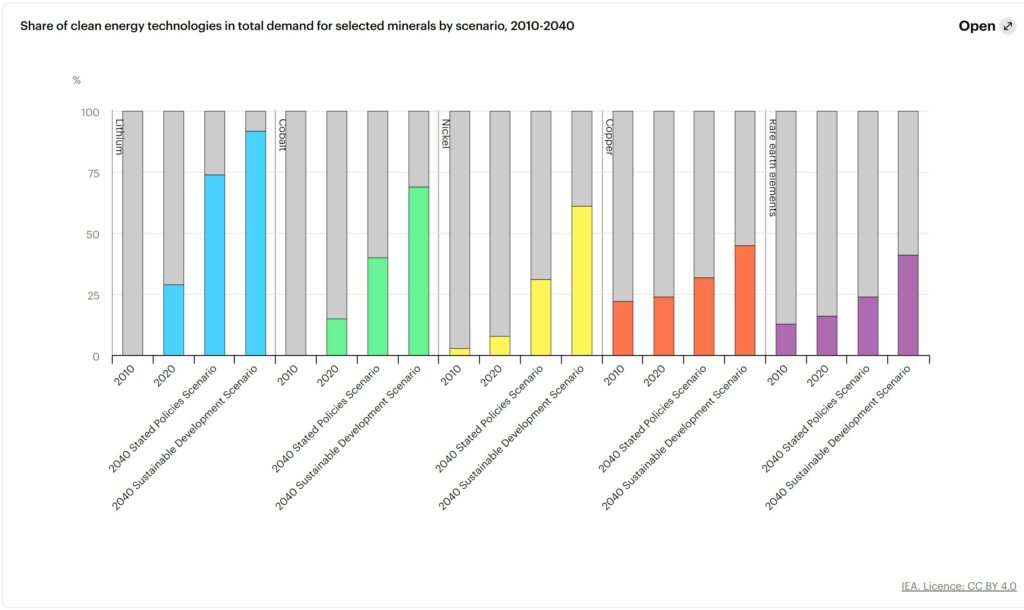

The shift to a clean energy system is set to drive a huge increase in the requirements for these minerals, meaning the energy sector is emerging as a major force in mineral markets. Until the mid-2010s, for most minerals, the energy sector represented a small part of total demand. However, as energy transitions gather pace, clean energy technologies are becoming the fastest-growing segment of demand. In a scenario that meets the Paris Agreement goals (as in the IEA Sustainable Development Scenario [SDS]), their share of total demand rises significantly over the next two decades to over 40% for copper and rare earth elements, 60-70% for nickel and cobalt, and almost 90% for lithium. EVs and battery storage have already displaced consumer electronics to become the largest consumer of lithium and are set to take over from stainless steel as the largest end user of nickel by 2040.

The rapid deployment of clean energy technologies as part of energy transitions implies a significant increase in demand for minerals

As countries accelerate their efforts to reduce emissions, they also need to make sure energy systems remain resilient and secure. Today’s international energy security mechanisms are designed to provide insurance against the risks of disruptions or price spikes in hydrocarbons supply, oil in particular. Minerals offer a different and distinct set of challenges, but their rising importance in a decarbonizing energy system requires energy policy makers to expand their horizons and consider potential new vulnerabilities. Concerns about price volatility and security of supply do not disappear in an electrified, renewables-rich energy system.

This is why the IEA is paying close attention to the issue of critical minerals and their role in energy transitions. This report reflects the IEA’s determination to stay ahead of the curve on all aspects of energy security in a fast-evolving energy world.

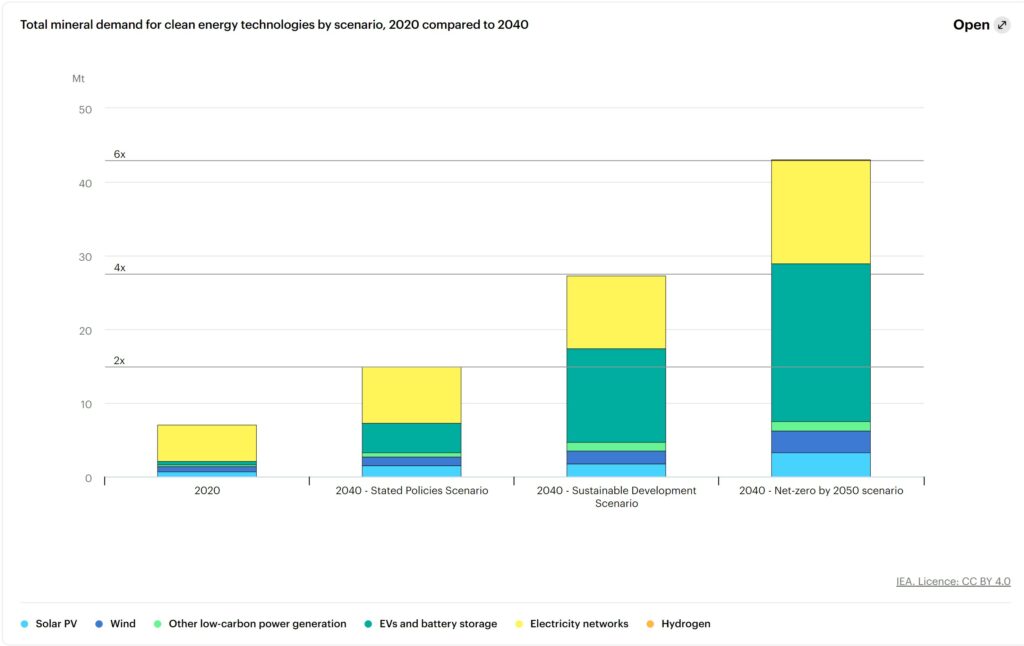

Our bottom-up assessment of energy policies in place or announced suggests the world is currently on track for a doubling of overall mineral requirements for clean energy technologies by 2040 (in the IEA Stated Policies Scenario, STEPS).

However, a concerted effort to reach the goals of the Paris Agreement (climate stabilization at “well below 2°C global temperature rise”, as in the SDS) would mean a quadrupling of mineral requirements for clean energy technologies by 2040. An even faster transition, to hit net-zero globally by 2050, would require six times more mineral inputs in 2040 than today.

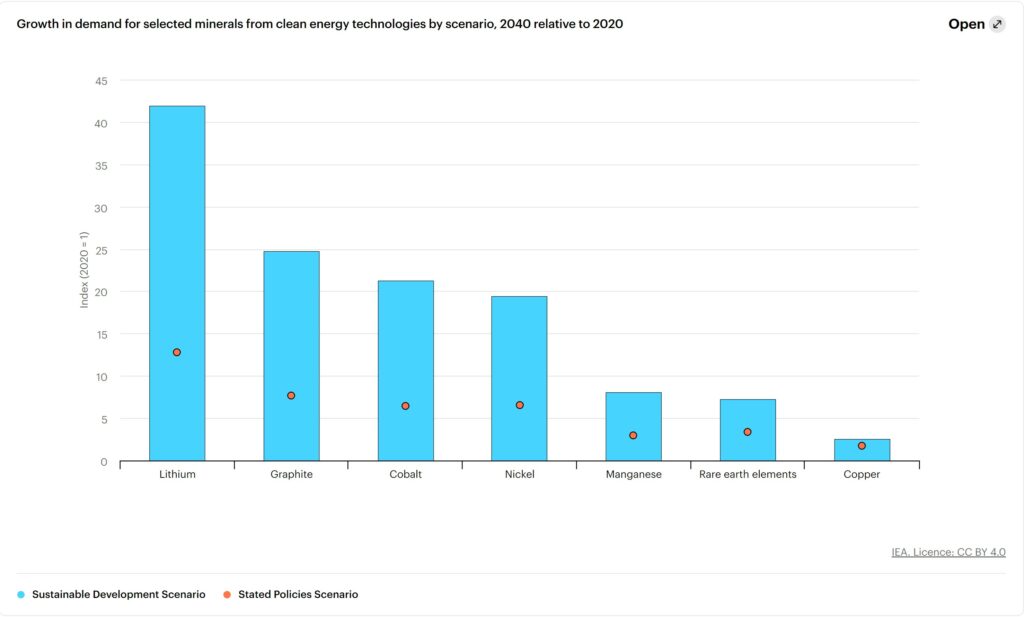

Which sectors do these increases come from? In climate-driven scenarios, mineral demand for use in EVs and battery storage is a major force, growing at least thirty times to 2040. Lithium sees the fastest growth, with demand growing by over 40 times in the SDS by 2040, followed by graphite, cobalt and nickel (around 20-25 times). The expansion of electricity networks means copper demand for grid lines more than doubles over the same period.

The rise of low-carbon power generation to meet climate goals also means a tripling of mineral demand from this sector by 2040. Wind takes the lead, bolstered by material-intensive offshore wind. Solar PV follows closely, due to the sheer volume of capacity that is added. Hydropower, biomass and nuclear make only minor contributions given their comparatively low mineral requirements. In other sectors, the rapid growth of hydrogen as an energy carrier underpins major growth in demand for nickel and zirconium for electrolysers, and for platinum-group metals for fuel cells.

Changing fortunes: Coal vs energy transition minerals

Demand trajectories are subject to large technology and policy uncertainties. We analyzed 11 alternative cases to understand the impacts. For example, cobalt demand could be anything from 6 to 30 times higher than today’s levels depending on assumptions about the evolution of battery chemistry and climate policies. Likewise rare earth elements may see three to seven times higher demand in 2040 than today, depending on the choice of wind turbines and the strength of policy support. The largest source of demand variance comes from uncertainty around the stringency of climate policies. The big question for suppliers is whether the world is really heading for a scenario consistent with the Paris Agreement. Policy makers have a crucial role in narrowing this uncertainty by making clear their ambitions and turning targets into actions. This will be vital to reduce investment risks and ensure adequate flow of capital to new projects.

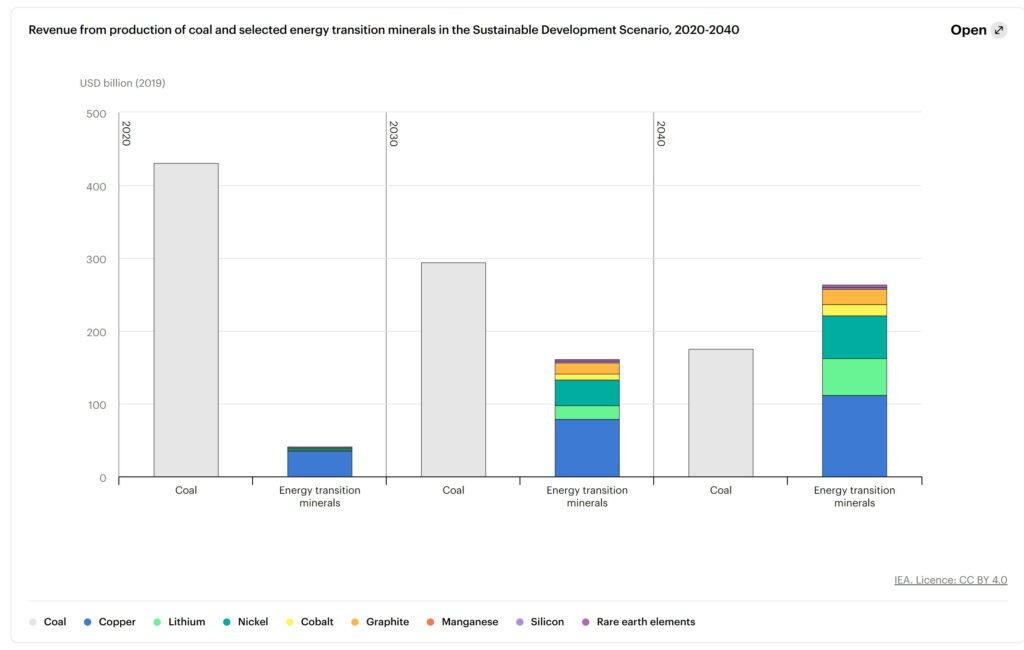

Clean energy transitions offer opportunities and challenges for companies that produce minerals. Coal is currently the largest source of revenue for mining companies by a wide margin. Today’s revenues from coal production are ten times larger than those from energy transition minerals.

However, accelerating clean energy transitions are set to change this picture. There is a rapid reversal of fortunes in a climate-driven scenario, as the combined revenues from energy transition minerals overtake those from coal well before 2040.

Today’s mineral supply and investment plans fall short of what is needed to transform the energy sector, raising the risk of delayed or more expensive energy transitions

The prospect of a rapid rise in demand for critical minerals (in most cases well above anything seen previously) poses huge questions about the availability and reliability of supply. In the past, strains on the supply-demand balance for different minerals have prompted additional investment as well as measures to moderate or substitute demand, but these responses have come with time lags and have been accompanied by considerable price volatility. Similar episodes in the future could delay clean energy transitions and push up their cost. Given the urgency of reducing emissions, this is a possibility the world can ill afford.

Raw materials are a significant element in the cost structure of many technologies requiring energy transitions. In the case of lithium-ion batteries, technology learning and economies of scale have pushed down overall costs by 90% over the past decade. However, this also means raw material costs now loom larger, accounting for some 50-70% of total battery costs, and up from 40-50% five years ago.

Higher mineral prices could therefore have a significant effect: a doubling of lithium or nickel prices would induce a 6% increase in battery costs. If both lithium and nickel prices were to double at the same time, this would offset all the anticipated unit cost reductions associated with a doubling of battery production capacity. In the case of electricity networks, copper and aluminum currently represent around 20% of total grid investment costs; higher prices as a result of tight supply could have a major impact on the level of grid investment.

Our analysis of the near-term outlook for supply presents a mixed picture. Some minerals such as lithium raw material and cobalt are expected to be in surplus in the near term, while lithium chemical, battery-grade nickel and key rare earth elements (e.g., neodymium, dysprosium) might face tight supply in the years ahead. However and looking further ahead in a scenario consistent with climate goals, expected supply from existing mines and projects under construction is estimated to meet only half of projected lithium and cobalt requirements and 80% of copper needs by 2030.

Today’s supply and investment plan are gearing to a world of more gradual, insufficient action on climate change (the STEPS trajectory). They are not ready to support accelerated energy transitions. While there are a host of projects at varying stages of development, there are many vulnerabilities that may increase the possibility of market tightness and greater price volatility:

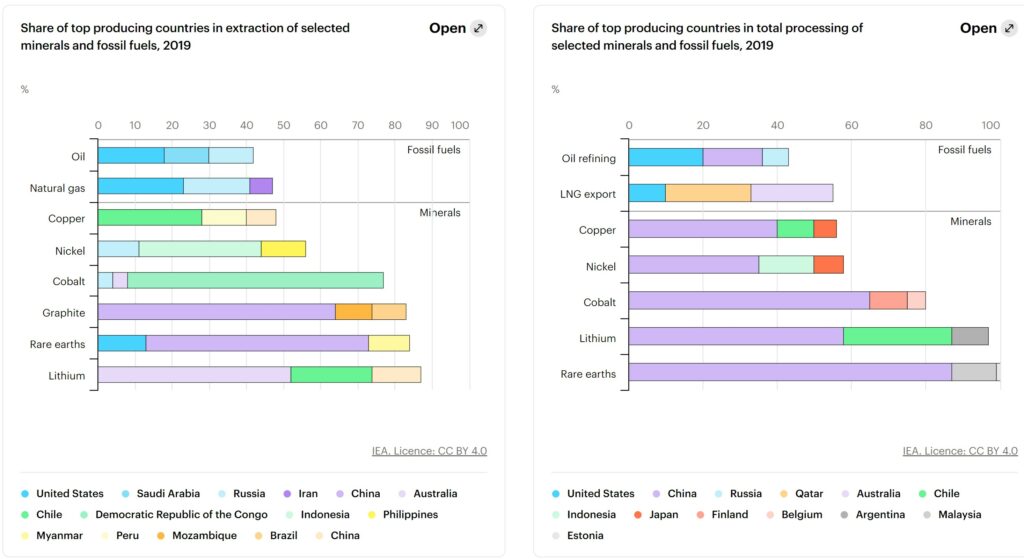

- High geographical concentration of production: Production of many energy transition minerals is more concentrated than that of oil or natural gas. For lithium, cobalt and rare earth elements, the world’s top three producing nations control well over three-quarters of global output. In some cases, a single country is responsible for around half of worldwide production. The Democratic Republic of the Congo (DRC) and People’s Republic of China (China) were responsible for some 70% and 60% of global production of cobalt and rare earth elements respectively in 2019. The level of concentration is even higher for processing operations, where China has a strong presence across the board. China’s share of refining is around 35% for nickel, 50-70% for lithium and cobalt, and nearly 90% for rare earth elements. Chinese companies have also made substantial investment in overseas assets in Australia, Chile, the DRC and Indonesia. High levels of concentration, compounded by complex supply chains, increase the risks that could arise from physical disruption, trade restrictions or other developments in major producing countries.

- Long project development lead times: Our analysis suggests that it has taken 16.5 years on average to move mining projects from discovery to first production. These long lead times raise questions about the ability of supply to ramp up output if demand were to pick up rapidly. If companies wait for deficits to emerge before committing to new projects, this could lead to a prolonged period of market tightness and price volatility.

- Declining resource quality: Concerns about resources relate to quality rather than quantity. In recent years ore quality has continued to fall across a range of commodities. For example, the average copper ore grade in Chile declined by 30% over the past 15 years. Extracting metal content from lower-grade ores requires more energy, exerting upward pressure on production costs, greenhouse gas emissions and waste volumes.

- Growing scrutiny of environmental and social performance: Production and processing of mineral resources gives rise to a variety of environmental and social issues that, if poorly managed, can harm local communities and disrupt supply. Consumers and investors are increasingly calling for companies to source minerals that are sustainably and responsibly produced. Without efforts to improve environmental and social performance, it may be challenging for consumers to exclude poor-performing minerals as there may not be sufficient quantities of high-performing minerals to meet demand.

- Higher exposure to climate risks: Mining assets are exposed to growing climate risks. Copper and lithium are particularly vulnerable to water stress given their high-water requirements. Over 50% of today’s lithium and copper production is concentrated in areas with high water stress levels. Several major producing regions such as Australia, China, and Africa are also subject to extreme heat or flooding, which pose greater challenges in ensuring reliable and sustainable supplies.

These risks to the reliability, affordability and sustainability of mineral supply are manageable, but they are real. How policy makers and companies respond will determine whether critical minerals are a vital enabler for clean energy transitions, or a bottleneck in the process.

New and more diversified supply sources will be vital to pave the way to a clean energy future

As energy transitions gather pace, security of mineral supply is gaining prominence in the energy security debate, a realm where oil has traditionally occupied a central role.

There are significant differences between oil security and mineral security, notably in the impacts that any disruption may have. In the event of an oil supply crisis, all consumers driving gasoline cars or diesel trucks are affected by higher prices. By contrast, a shortage or spike in the price of a mineral affects only the supply of new EVs or solar plants. Consumers driving existing EVs or using solar-powered electricity are not affected. In addition, the combustion of oil means new supply is essential to the continuous operation of oil-using assets. However, minerals are a component of infrastructure, with the potential to be recovered and recycled.

Nonetheless, experience from oil markets may offer some valuable lessons for an approach to mineral security, in particular to underscore supply-side measures need to be accompanied by wide-ranging efforts encompassing demand, technology, supply chain resilience and sustainability.

Rapid, orderly energy transitions require strong growth in investment in mineral supply to keep up with the rapid pace of demand growth. Policy makers can take a variety of actions to encourage new supply projects: the most important is to provide clear and strong signals about energy transitions. If companies do not have confidence in countries’ climate policies, they are likely to make investment decisions based on much more conservative expectations. Given the long lead times for new project development, this could create a bottleneck when deployment of clean energy technologies starts to grow rapidly. Diversification of supply is also crucial Resource-owning governments can support new project development by reinforcing national geological surveys, streamlining permitting procedures to shorten lead times, providing financing support to de-risk projects, and raising public awareness of the contribution such projects play to the transformation of the energy sector.

Reducing material intensity and encouraging material substitution via technology innovation can also play major roles in alleviating strains on supply, while also reducing costs. For example, 40-50% reductions in the use of silver and silicon in solar cells over the past decade have enabled a spectacular rise in solar PV deployment. Innovation in production technologies can also unlock sizeable new supplies. Emerging technologies, such as direct lithium extraction or enhanced metal recovery from waste streams or low-grade ores, offer the potential for a step change in future supply volumes.

A strong focus on recycling, supply chain resilience and sustainability will be essential

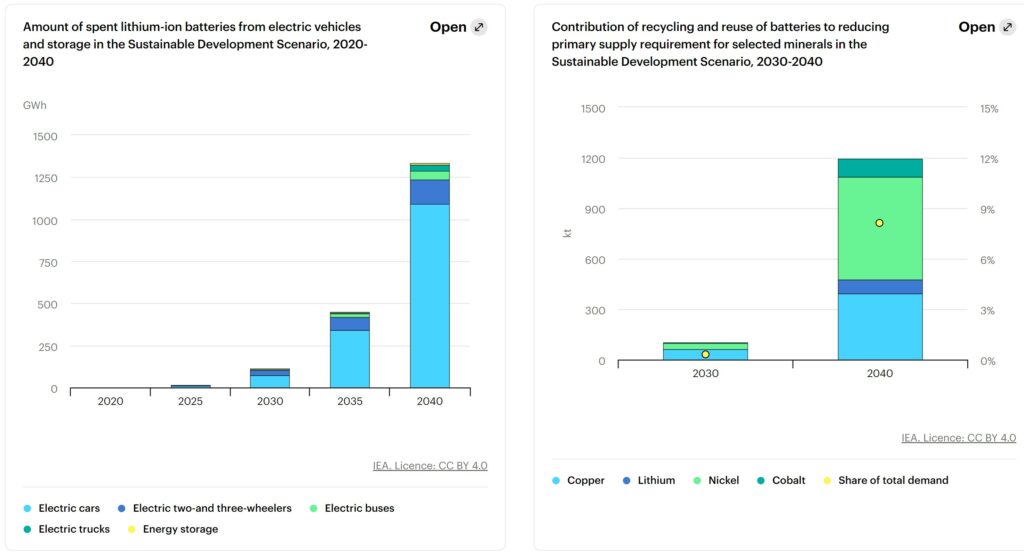

Recycling relieves the pressure on primary supply. For bulk metals, recycling practices are well established, but this is not yet the case for many energy transition metals such as lithium and rare earth elements. Emerging waste streams from clean energy technologies (e.g. batteries, wind turbines) can change this picture. The amount of spent EV batteries reaching the end of their first life is expected to surge after 2030, at a moment of continued rapid growth in mineral demand. Recycling would not eliminate the need for continued investment in new supply to meet climate goals, but we estimate, by 2040, recycled quantities of copper, lithium, nickel and cobalt from spent batteries could reduce combined primary supply requirements for these minerals by around 10%. The security benefits of recycling can be far greater for regions with wider deployment of clean energy technologies due to greater economies of scale.

Stronger actions are required to counter the upward pressure on emissions from mineral production, but the climate advantages of clean energy technologies remain clear

Regular market assessments and periodic stress-tests, coupled with emergency response exercises (as with the IEA’s existing emergency response programs), can help policy makers identify points of potential weakness, evaluate potential impacts and devise necessary actions. Strategic stockpiling can in some cases also help countries weather short-term supply disruptions. Such programs need to be carefully designed, based on a detailed review of potential vulnerabilities. Some energy transition minerals with smaller markets have low pricing transparency and liquidity, making it difficult to manage price risks and affecting investment decisions. Establishing reliable price benchmarks will be a crucial step towards enhancing transparency and supporting market development.

Tackling the environmental and social impacts of mineral developments will be essential, including the emissions associated with mining and processing, risks arising from inadequate waste and water management, and impacts from inadequate worker safety, human rights abuses (such as child labor) and corruption. Ensuring that mineral wealth brings real gains to local communities is a broad and multi-faceted challenge, particularly in countries where artisanal and small-scale mines are common. Supply chain due diligence, with effective regulatory enforcement, can be a critical tool to identify, assess and mitigate risks, increasing traceability and transparency.

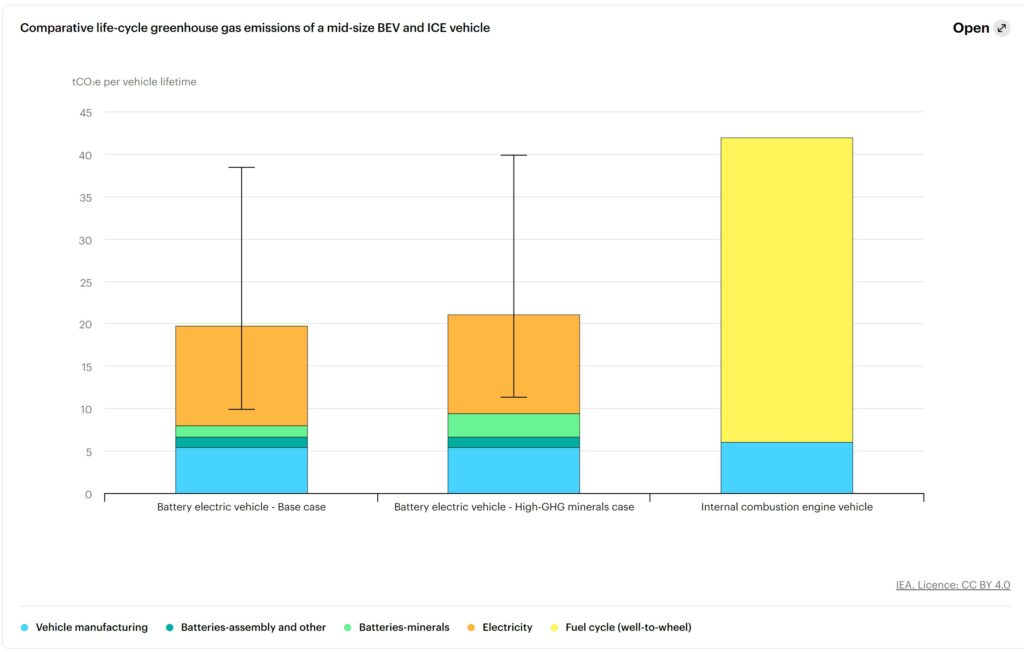

Emissions along the mineral supply chain do not negate the clear climate advantages of clean energy technologies. Total lifecycle greenhouse gas emissions of EVs are around half those of internal combustion engine cars on average, with the potential for a further 25% reduction with low-carbon electricity. While energy transition minerals have relatively high emission intensities, a large variation in the emissions footprint of players suggests there are ways to minimize these emissions through fuel switching, low-carbon electricity and efficiency improvements. Integrating environmental concerns in the early stages of project planning can help ensure sustainable practices throughout the project life cycle.

IEA’s six key recommendations for a new, comprehensive approach to mineral security

1. Ensure adequate investment in diversified sources of new supply. Strong signals from policy makers about the speed of energy transitions and the growth trajectories of key clean energy technologies are critical to bring forward timely investment in new supply. Governments can play a major role in creating conditions conducive to diversified investment in the mineral supply chain.

2. Promote technology innovation at all points along the value chain. Stepping up R&D efforts for technology innovation on both the demand and production sides can enable more efficient use of materials, allow material substitution and unlock sizeable new supplies, thereby bringing substantial environmental and security benefits.

3. Scale up recycling. Policies can play a pivotal role in preparing for rapid growth of waste volumes by incentivizing recycling for products reaching the end of their operating lives, supporting efficient collection and sorting activities and funding R&D into new recycling technologies.

4. Enhance supply chain resilience and market transparency. Policy makers need to explore a range of measures to improve the resilience of supply chains for different minerals, develop response capabilities to potential supply disruptions and enhance market transparency. Measures can include regular market assessments and stress-tests, as well as strategic stockpiles in some instances.

5. Mainstream higher environmental, social and governance standards. Efforts to incentivize higher environmental and social performance can increase sustainably and responsibly produced volumes and lower the cost of sourcing them. If players with strong environmental and social performance are rewarded in the marketplace, it can lead to greater diversification among supply.

6. Strengthen international collaboration between producers and consumers. An overarching international framework for dialogue and policy co-ordination among producers and consumers can play a vital role, an area where the IEA’s energy security framework could usefully be leveraged. Such an initiative could include actions to (i) provide reliable and transparent data; (ii) conduct regular assessments of potential vulnerabilities across supply chains and potential collective responses; (iii) promote knowledge transfer and capacity building to spread sustainable and responsible development practices; and (iv) strengthen environmental and social performance standards to ensure a level playing field.